Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk.

Daily Market Commentary

- Bitcoin Price Analysis – October 27, 2025All of my commentaries begin by framing the broader macroeconomic landscape, since global liquidity, market sentiment, and risk appetite directly shape crypto market behaviour. This week is no exception —… Read more: Bitcoin Price Analysis – October 27, 2025

Bitcoin Fear & Greed Index

L

Bitcoin & Crypto Market Sentiment (real time)

Trending Coins on Reddit

Which coins are heating up on Reddit (real time | last 24 hrs)

Trending Crypto Stocks on Reddit

Which Crypto Stocks are heating up on Reddit (real time | last 24 hrs)

Trending Meme Stocks on Reddit

Which Meme Stocks are heating up on Reddit (real time | last 24 hrs)

Reddit Sentiment Shifts (Last 24 Hours – as of 2025-11-04 10:07 UTC)

• As the broader crypto market experiences sharp declines, Bitcoin (BTC) remains the most discussed coin on Reddit with 100% of tracked mentions, followed by Ethereum (ETH) at 27%, Binance Coin (BNB) at 3%.

• On the crypto stock side, nothing appears to be particularly trending on Reddit so far today.

• Meanwhile, in Meme land, GameStop (GME) remains the most popular stock discussed on Reddit followed by Opendoor Technologies (OPEN) and Blackberry (BB).

Strategic Implication:

These shifts in community mentions can often signal the early stages of meaningful price movement, whether upward or downward. I will continue to monitor these sentiment dynamics in parallel with on-chain and market-flow data to determine whether online discussion is translating into real trading activity—and what that might imply for altcoin market rotations.

Corporate Crypto Treasuries | Latest Holdings [Real-time data]

A list of publicly traded companies (crypto stocks) buying Bitcoin, Ethereum and Solana

| Company | Ticker | % Crypto / Mkt Cap | Premium / Discount | Market Cap (USD) | Total Crypto Value (USD) | BTC | ETH | SOL | Source |

|---|---|---|---|---|---|---|---|---|---|

| Bit Digital | BTBT | 65.46% | -34.54% | $708.10 M | $463.55 M | 0 | 150,244 | 0 | PR - 8/Oct/2025 |

| BitMine Immersion | BMNR | 133.42% | 33.42% | $8.41 B | $11.22 B | 192 | 3,629,701 | 0 | PR- 24/Nov/2025 |

| Coinbase | COIN | 2.41% | -97.59% | $61.67 B | $1.49 B | 11,776 | 136,782 | 0 | SEC - 30/June/2025 |

| Microstrategy | MSTR | 129.65% | 29.65% | $45.32 B | $58.76 B | 649,870 | 0 | 0 | SEC - 17/Nov/2025 |

| SharpLink Gaming | SBET | 137.98% | 37.98% | $1.93 B | $2.66 B | 0 | 861,251 | 0 | PR - 12/Nov/2025 |

Crypto Price Predictions

Latest Price Predictions for BTC, ETH, SOL

Best Staking APYs

Find the Highest Staking APYs

| Project Ticker | APY |

| SOL | 338.86% |

| ETH | 267.87% |

| BTC | 106.66% |

Latest Coin Listings

Devise Long/Short Strategies

| Project Ticker | Exchange |

| ENSO | Binance |

| RYO | Bitrue |

| MOON | AscendEX |

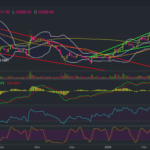

Altcoin Beta, Relative Volatility and Standard Deviation Matrix [Real-time data]

Identify the best crypto for your portfolio

Crypto Beta Metrics

TABLE USE CASE

- If you wanted to hedge against a benchmark (e.g. BTC) then you would need to find an altcoin that has a Beta close to 0 or preferably below 0 that would mean the altcoin is uncorrelated or negatively correlated with the benchmark (e.g. BTC). The RV would need to be below 1 , indicating the altcoin is less volatile than the benchmark (e.g. BTC) and it would need to have a low SD, suggesting that price fluctuations of the altcoin on its own are low and stable. Together, these traits suggest an altcoin could act as an effective hedge against a benchmark (e.g. BTC) and potentially an ideal addition in a long-term portfolio.

- If the goal is to outpace BTC (rather than hedge it), you would flip the logic and look for altcoins with a Beta greater than 1, an RV greater than 1, and a high SD. These traits indicate the asset tends to move more aggressively than BTC, making it suitable for a short-term portfolio aimed at amplifying short-term gains (though with higher downside risk as well should the market turn bearish!).

METHDOLOGY AND DEFINITIONS

- The data in the table above is automatically refreshed daily.

- The computations are based on the daily closing prices for each coin and each benchmark.

- Computations are made using daily log returns (previous 90 days to keep the figures recent and more relevant).

- Dates are aligned so altcoin assets and benchmark use the same overlapping days only.

- Beta describes how much the asset tends to move when the benchmark moves in a certain direction. Let’s say you’re measuring the beta of Cardano (ADA) against Bitcoin (BTC) (benchmark). If ETH has a beta of 1.75 relative to BTC then when BTC rises 1% ETH would be expected (on average) to rise 1.75% and when BTC falls 1% ETH would be expected to fall 1.75%.

- RV ( Relative Volatility) reflects how volatile an altcoin is relative to its respective benchmark (BTC, ETH, SOL) but unlike Beta is it not measuring a directional relationship. RV compares magnitude of volatility versus a benchmark. For example, if ADA’s RV of 2 vs BTC, it means ADA is twice as volatile as Bitcoin. If BTC moves sharply, you could generally expect ADA to swing twice as wildly (though not necessarily in the same direction because that is what beta is capturing). If instead an altcoin has an RV of 0.7, it would mean it’s 30% less volatile than BTC.

- Standard Deviation (SD) ignores benchmarks. It shows how much an asset’s price tends to move on its own, scaled to a yearly timeframe. Unlike Relative Volatility (RV), which compares an asset’s swings to a benchmark, SD is standalone — it looks only at the asset’s own variability. For example, if ADA has an annualised volatility (SD) of 0.90 (90%), it means ADA’s returns typically fluctuate by about 90% up or down over a year, regardless of what Bitcoin or any other benchmark does.

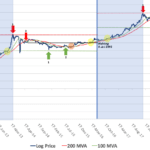

Bitcoin Price Analysis

Understand what’s happening across different markets

- Bitcoin Price Analysis: BTC is at risk of another major sell-off!

- Bitcoin Price Analysis: BTC fails to attract fresh buyers to support the price above the $7000 level

- Bitcoin Price Analysis: BTC could be gearing up for a stratospheric rally!

- Bitcoin Price Analysis: BTC bullish trajectory intact despite ongoing shakeout

- Bitcoin Price Analysis: BTC whipsaws as Golden Cross approaches!

Research

Insights that improve your investment decisions

- Bitcoin Supercycle [2024-2025]: Observations, possible outcomes, and lessons from previous cycles!

- Bitcoin Price Analysis: where is BTC heading to next?

- Top 5 Cryptocurrencies for 2020: ETH, ETC, DASH, LINK, XRP

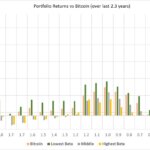

- How we developed a cryptocurrency portfolio that beats Bitcoin

- Bitcoin Log Price Chart Analysis: A thorough investigation

CoinMarketExpert

Dragonara Business Centre,

Dragonara Road – STJ 06 – St Julians

Malta

Pages

Social