On this page, we explain what stablecoins are and shed some light on which stablecoins you may want to avoid since regulators are becoming increasingly nervous about certain types of stablecoins.

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Why are regulators concerned about stablecoins?

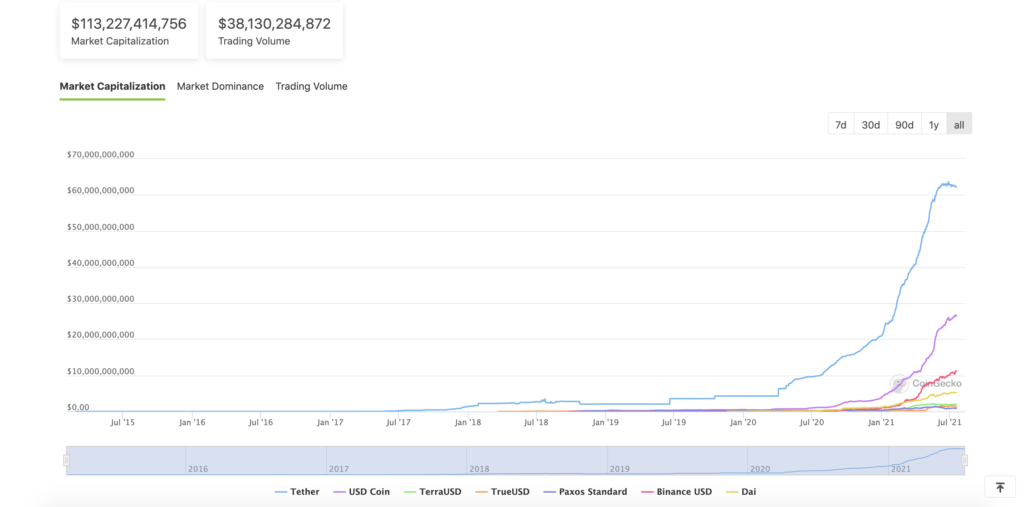

From a regulatory perspective, the concern is not without merit. As you may see from the chart below stablecoin adoption has exploded 2560% to more than $133 billion over a two-year span!

The rapid rise of stablecoin dominance has sparked concerns about how these tokens could sow instability across wider financial markets.

Why?

Certain regulators are concerned that stablecoins could interfere with monetary policy transmission (in other words dilute the intended effect of monetary policy over markets) whilst others fear that stablecoins could be susceptible to a ‘run’ that risks spilling over to the wider financial system.

In the case of a fiat-collateralized stablecoin, a potential run would result in a custodian having to sell fiat-based assets in a forced sale to honour its obligation towards the sellers of a stablecoin. That type of scenario would of course have an impact on the wider financial system.

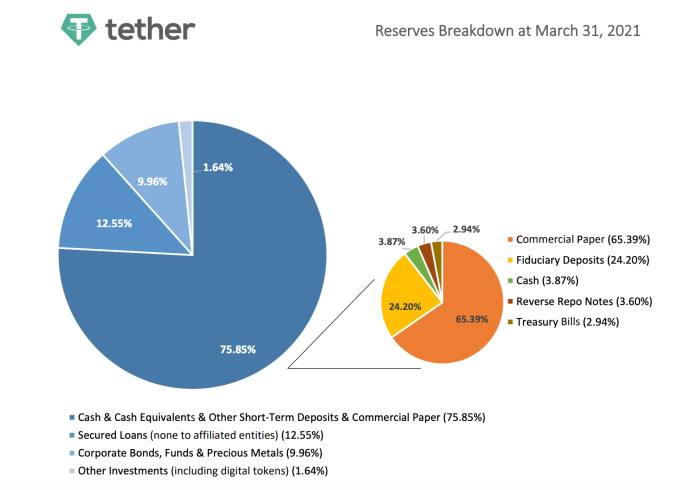

Tether, for instance, is the most popular fiat-collateralized stablecoin. As of 31st March 2021, 75.85% of Tether’s reserves were backed by Cash & Cash Equivalents & Other Short-Term Deposits & Commercial Paper while the majority of the remaining 24.15% consisted of secured loans, corporate bonds, funds and precious metals.

We have ascertained that regulators are concerned about the potential spillover risks that stablecoins pose to the wider financial system.

The next questions that come to mind are:

1. Which stablecoins are least at risk of a regulatory crackdown?

2. What might a regulatory crackdown look like?

3. In view of a potential regulatory crackdown, should you even bother holding stablecoins?

Before we answer these questions, let’s take a few steps back and touch upon the basics of stablecoins to be completely thorough.

What is a Stablecoin?

Stablecoins are cryptocurrencies that are designed to reliably track the value of legal tender (fiat currencies or real-world assets such as the US dollar, Euro, Japanese Yen, gold, etc…) usually on a 1-for-1 basis.

Properties of Stablecoins:

Few tracking errors

Stablecoins aim to track real-world assets accurately with the primary objective of having no divergence between the values of the cryptocurrency and its corresponding fiat asset. The actual tracking must be consistently reliable and therefore stable.

Arbitrage opportunities may arise whenever there is a divergence between the value of a stablecoin and the value of the real-world asset that it is tracking. When this happens, market makers and traders buy or sell the stablecoin to bring its value back into alignment.

Store of value

Stablecoins are primarily used for trading purposes, giving crypto traders the ability to switch their volatile crypto into more stable assets that mimic their home fiat currencies.

So if you’re a trader from the UK, you may prefer to switch your Bitcoin holdings to BGBP as opposed to USDT in order to avoid being exposed to foreign currency risk.

Payments

Stablecoins may also be used to conduct low-cost international remittances as well as to pay for goods and services.

Types of Stablecoins

We may broadly categorize stablecoins as centralized and decentralized. The categorization depends on whether there is a need to trust a centralized third party.

1. Centralized Stablecoins

Centralized stablecoins are also known as fiat-collateralized stablecoins or custodian stablecoins. Centralized stablecoins are the first type of stablecoin category to hit the market, and to some extent explains why they are the most dominant type of stablecoin in the market.

Centralized stablecoins are essentially a tokenized IOU because the tokens that are minted are asset-backed or collateralized against legal tender (fiat currencies or hard assets such as gold) through a third-party custodian such as a bank.

A 1:1 peg between the value of the stablecoin and the corresponding fiat asset is maintained through a stabilization mechanism that involves minting new stablecoins tokens whenever someone deposits the equivalent fiat to the custodian reserve and redeeming or burning the stablecoins whenever someone sells them.

The minting and redemption of tokens acts as a stabilization mechanism because it helps to balance supply and demand of stablecoins and thus maintain a peg with the corresponding fiat asset.

Tether (USDT), USD Coin (USDC), Pax Standard (PAX), True USD (TUSD), Binance USD (BUSD), and Gemini Dollar (GUSD) are examples of fiat-collateralized stablecoins that are pegged to the US dollar. Further information may be found below.

| Popular Centralized Stablecoins | White Paper | Brief description |

|---|---|---|

| Tether (USDT) |  | Tether is a controversial US dollar-pegged stablecoin that has its tokens issued by Hong Kong-based Tether Limited, an entity that is ultimately controlled by the owners of Bitfinex. Tether tokens exist as digital tokens built on bitcoin (Omni and Liquid Protocol), Ethereum, EOS, Tron, Algorand, SLP and OMG blockchains. Each Tether issued into circulation is said to be backed by a one-to-one ratio with the equivalent amount of fiat currency held in a custodial account by Hong Kong-based Tether Limited. |

| USD Coin (USDC) |  | Launched in September 2018, USD Coin (USDC) is a US dollar-pegged stablecoin that runs on the Ethereum, Stellar, Algorand, Hedera Hashgraph and Solana blockchains. It is governed by CENTRE, a joint venture company by Circle and Coinbase. USDC operates within US money transmission laws. The project uses established banks reserves that are regularly attested (but not audited) by Grant Thornton. Attestation reports may be found here. |

| Paxos Standard (PAX) | Founded in 2012 with an HQ in New York City, and offices in London and Singapore, Paxos Standard is backed one-to-one by USD deposits. Paxos stablecoins follow the ERC-20 protocol, which is a standard for smart contracts on the Ethereum blockchain. Paxos Standard tokens are issued by Paxos Trust Company, which is a New York State-chartered trust company that is regulated by the New York State Department of Financial Services (NYDFS). As a trust company, Paxos is subject to a high level of regulatory oversight. | |

| TrueUSD (TUSD) | Launched in March 2018 by San Francisco startup TrustToken, TrueUSD (TUSD) is a US dollar-backed ERC20 stablecoin that is fully collateralized, legally protected, and transparently verified by third-party attestations. TrueUSD uses multiple escrow accounts to reduce counterparty risk and to provide token-holders with legal protections against misappropriation. | |

| Binance USD (BUSD) | Launched in September 2019, Binance USD (BUSD) is a 1:1 USD-backed stablecoin approved by the New York State Department of Financial Services (NYDFS) and issued in partnership with Paxos. BUSD runs on both, Ethereum, as an ERC-20 token, and on Binance Chain as a BEP-2 token. | |

| Gemini Dollar (GUSD) |  | Launched in September 2018, Gemini Dollar (GUSD) is Gemini’s native stablecoin which is issued on the Ethereum blockchain as an ERC-20 token. 1 GUSD is a 1:1 USD-backed stablecoin that is regulated by the New York Department of Financial Services. GUSD reserves are eligible for FDIC insurance up to $250,000 per user while custodied with State Street Bank and Trust USD reserve audits are published monthly by an independent registered accounting firm, BPM LLP, and the Ethereum smart contract has been audited by Trail of Bits, a leading information security research & development firm. |

A few of the companies behind the US-dollar backed stablecoins mentioned in the table above have also launched stablecoins pegged to the Euro, British Pound, Hong Dollar, Russian Ruble, gold and more.

2. Decentralized Stablecoins

Decentralized stablecoins (or non-custodial stablecoins) can be further subdivided into algorithmic stablecoins, direct incentive stablecoins, and crypto-collateralized stablecoins.

Algorithmic Stablecoins

Without going into too much detail, algorithmic stablecoins are a type of smart currency that utilises complex algorithms to attain price stability and pegging to a corresponding fiat currency without the need for asset collateralization. In other words, this type of stablecoin doesn’t require asset backing or a custodian, and the protocol is programmed in such a way that it never deviates away from its peg!

TerraUSD (UST), Frax (FRAX) and Neutrino dollar (USDN) are popular algorithmic stablecoins.

| Popular Algorithmic Stablecoins | White Paper | Brief description |

|---|---|---|

| TerraUSD (UST) | Launched in September 2020 (in collaboration with Bittrex Global), TerraUSD (UST) is a decentralized and algorithmic stablecoin that is pegged to the US dollar through an algorithm developed by Terraform Labs. TerraUSD was created to offer a scalable solution for DeFi amid severe scalability problems faced by other stablecoins. Thus, TerraUSD aims to achieve a higher level of scalability, interest rate accuracy, and interchain usage. | |

| Frax (FRAX) |  | Launched in December 2020, FRAX is a decentralized, fractional-reserve stablecoin launched on the Ethereum network and pegged 1:1 to the US dollar. Initially fully collateralized, its aim is to gradually transition to a fully algorithmic protocol. |

| Neutrino Dollar (USDN) | Neutrino USD (USDN) is an algorithmic stablecoin that is pegged 1:1 to the US dollar. The token’s price stability is regulated by the Neutrino Protocol algorithm and backed by WAVES held in the smart contract. |

Direct Incentive Stablecoins

A direct incentive stablecoin is a completely decentralized stablecoin that maintains a peg through an incentive mechanism that governs both the trading activity and usage of the stablecoin. In other words, rewards (incentives) and penalties (disincentives) drive the price of the stablecoin towards the peg. This form of stablecoin is very new, with Fei Protocol a leader.

| Popular Direct Incentive Stablecoins | White Paper | Brief description |

|---|---|---|

| Fei Protocol (FEI) | Launched in April 2021, Fei Protocol (FEI) is an undercollateralized stablecoin that is fully decentralized. FEI is based on a novel kind of stablecoin mechanism called direct incentives, which aims to be more capital efficient. |

Crypto-collateralized stablecoins

As the name implies, crypto-collateralized stablecoins are not backed by any legal tender but rather by other cryptocurrencies such as Ethereum. In doing so, users have the ability to mint and burn tokens without needing to utilize the services of a centralized third party trust company.

Whereas fiat-backed stablecoins only need to hold 1:1 reserves in legal tender, this type of stablecoin often requires over-collateralization to account for price volatility.

The most popular crypto-collateralized stablecoin are Maker Dai (DAI) and Synthetix (sUSD).

| Popular Crypto-collateralized stablecoins | White Paper | Brief description |

|---|---|---|

| Maker Dai (DAI) | Dai is a crypto-collateralized ERC20 token backed by an excess amount of digital asset collateral (most commonly $ETH) through Maker Vaults. Dai utilizes smart contracts and a governance token, $MKR, to monitor price stability. | |

| Synthetix (sUSD) | Previously known as Havven, Synthetix is a crypto-collateralized network enabling the creation of on-chain synthetic assets on the Ethereum blockchain. These assets are over-collateralized to provide sufficient liquidity for users to redeem collateral at face value. Beyond $sUSD, Synthetix plans to offer stablecoins for other legal tenders such as the euro, yen, and the Korean won. |

Now that we have a better understanding of stablecoins and the different types, let’s attempt to answer the questions put forward at the beginning of this page.

1. Which stablecoins are least at risk of a regulatory crackdown?

From a category perspective, centralized stablecoins are a higher risk category since they fiat-collateralized. However, this does not mean that decentralized stablecoins will be completely immune to any regulation impacting centralized stablecoins either.

In the centralized stablecoin category, Tether (USDT) remains the most dominant stablecoin by usage despite attracting negative press for not being sufficiently transparent with its reserves. However, the breakdown as of 31st March 2021 (shown at the top of this page) raises many questions regarding reserve quality. As a matter of fact, New York also banned Tether trading after an investigation found it had overstated its US dollar backing.

Within the centralised stablecoin category we prefer USDC, Paxos and BUSD stablecoins, which are also growing in terms of usage and dominance.

2. What might a regulatory crackdown look like?

It is difficult to say at this juncture although a lack of regulation means investors have almost no protection if their stablecoin suddenly collapses.

Broadly speaking it is only a matter of time until this space is regulated. We may see regulations that impose limits on the level of fiat-collateralization as well as more stringent risk disclosures, greater transparency, and of course formal auditing requirements.

Any limits on the level of fiat-collateralization could see this category move to a hybrid model.

3. In view of a potential regulatory crackdown, should you even bother holding stablecoins?

Let’s get straight to the point. Central Bank Digital Currencies (CBDCs) are the next big thing that could threaten the growth of stablecoins. CBDCs are digital versions of banknotes and coins, issued with the full backing of central banks. One of the major drawbacks talked about in the media is the loss of privacy nonetheless.

The lack of privacy may not bother everyone especially if CBDCs provide DeFi incentives (higher interest rates) for users who aren’t bothered with relinquishing their privacy. Having such an incentive system in place would of course disrupt traditional central bank monetary policy – but then again hasn’t the world already acknowledged (for some time now) that traditional monetary policy is broken?

At this juncture, we believe stablecoins can co-exist alongside CBDCs. It is entirely possible that the emergence of CBDCs could actually see the emergence of a new class of CBDC-collateralised stablecoins. Such an asset class stands to derisk the stablecoin space significantly and lower the DeFi yields that are currently available.

Currently, it is possible to attain yields of 10.50% – 22.00% on dollar-pegged stablecoin assets. You may visit our stablecoin savings page to compare the latest annualized interest rates that are paid out to “hodlers”.