This post observes Bitcoin’s historical pre-and-post halving price performance, as many references are being made about it in the media, and we want to get the facts straight.

| Key Points: | Buy Bitcoin: | |

|---|---|---|

| ⭐ One of the best crypto exchanges in the market right now! ⭐ High on security and safety (SAFU, 2FA, etc..). ⭐ Largest selection of cryptos to trade. ⭐ Ability to buy crypto with fiat. | |

| | ⭐ leading social trading platform, trusted by millions of users from more than 140 countries. ⭐ Wide variety of trading options (crypto, stocks, ETFs, forex, commodities, etc...) ⭐ Copy the trades of top performing traders and portfolios! ⭐ 0% commissions on all stocks! | |

| ⭐ Legitimate crypto exchange and trading platform. ⭐ Low trading and exchange fees. ⭐ Free practice demo account with 50,000 USDT. ⭐ Make your first deposit and receive a 25 USDT Welcome Bonus. | |

| Disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not an indication of future results. Cryptoassets are volatile instruments that can fluctuate widely and therefore are not appropriate for all investors. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework. eToro USA LLC does not offer CFDs. eToro USA LLC makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. This publication has been prepared by our partner utilizing publicly available non-entity specific information about eToro. | ||

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Why are we doing this?

Some time ago we had conducted a similar analysis, observing Litecoin’s pre-and-post halving price-performance. At the time of writing that report, we had come across many articles claiming it was a great opportunity to buy Litecoin, although we cautioned our readers to be extremely careful.

We had noted at the time that Litecoin could be experiencing a classical pump and dump, and therefore anyone buying Litecoin so close to the halving date ought to think twice. As a matter of fact, between the halving date from 5th August to September 2019, the price of Litecoin had fallen by approximately 30%!

This post is purely focused on Bitcoin and we are writing it to make sure our readers do not get too carried away with mainstream predictions claiming the Bitcoin may reach $100,000 – $1,000,000 per BTC after the halving in May 2020.

This post will be broken down as follows:

– Bitcoin halving dates history

– How often does Bitcoin halve?

– What is the Bitcoin inflation rate?

– Observations: Bitcoin halving price performance

Bitcoin halving dates history

The first halving of the Bitcoin block reward occurred on November 28th, 2012 while the second halving occurred on July 9th, 2016. The next Bitcoin halving is expected to take place on May 11th, 2020.

How often does Bitcoin halve?

Bitcoin’s block rewards halve as soon as 210,000 blocks are mined and successfully added to the Bitcoin blockchain. That implies the halving occurs approximately every 4 years since it takes approximately 10 minutes to mine each Bitcoin block.

The math is as follows:

Bitcoin halving period: 210,000 blocks x 10 minutes per block / 60 minutes per hour / 24 hours per day / 365 days per year = 4 years.

What is the Bitcoin inflation rate?

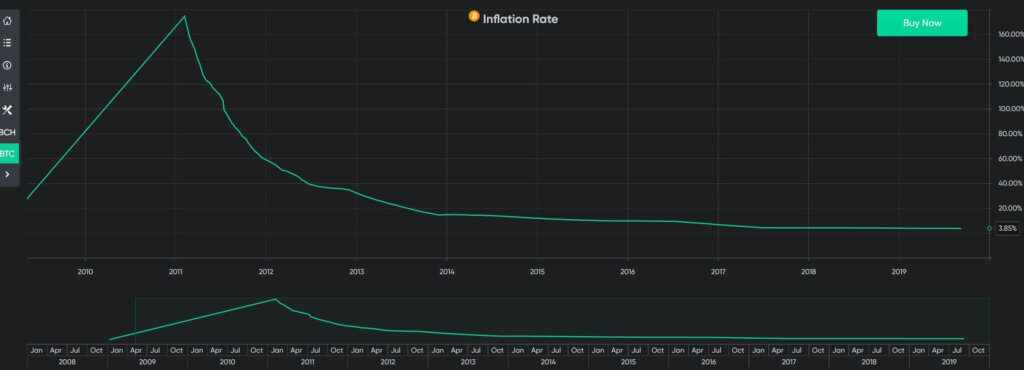

The Bitcoin inflation rate basically refers to the new supply of Bitcoins entering the market every 10 minutes. We may observe from the chart below that the Bitcoin inflation rate (i.e. supply of Bitcoins flooding the market) is diminishing over time.

How is this possible? It all has to do with the block reward. Before the first halving occurred, miners were receiving 50 BTC approximately every 10 minutes, then after the first halving, miners received 25 BTC every 10 minutes. On the halving that took place on 9th July 2016, the block rewards fell to 12.5 BTC and in May 2020 it will halve again to 6.25 BTC.

How is the Bitcoin inflation rate calculated?

When the initial block rewards for miners was 50 BTC there were 7,200 new coins created daily. This fell to 3,600 new coins daily when the block reward fell to 25 BTC, and currently it is 1,800 new coins daily (based on 12.5 BTC).

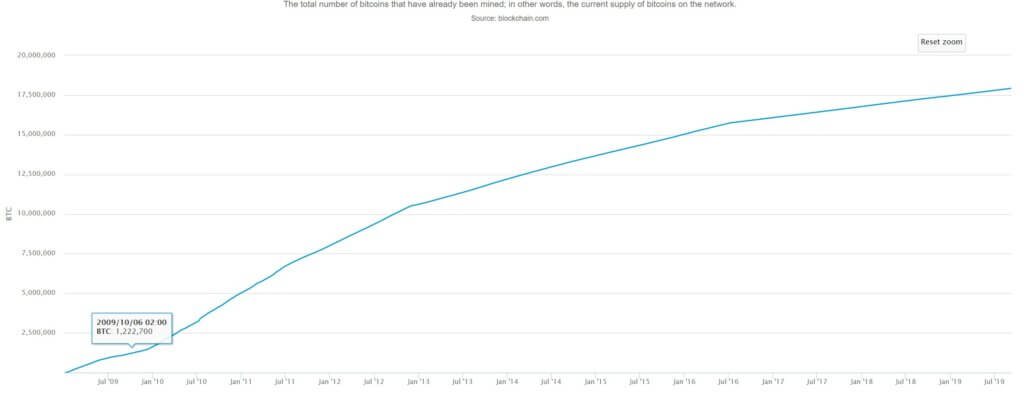

When summing all of the coins minted over the last 10 years, we get approximately 17,925,888 Bitcoins in circulation (circulation supply) today (at the time of writing).

And from today until 11th May 2020 there will be approximately 450,000 new Bitcoins created and added to the circulation supply.

On 11th May 2020, the block reward halves to 6.25, so that means there will be a further 105,000 Bitcoins created from the halving date to 10th September 2020 (one year from today).

That means that from 10th September 2019 (today) until 10th September 2020 there will be approximately 555,000 (450k+ 105K) new Bitcoins created.

The math is as follows:

Bitcoin inflation rate calculation: 555,000 new Bitcoins created over a year /17,925,888 today’s total circulation supply of Bitcoin =3.1% Bitcoin inflation rate.

We can see from the chart above the Bitcoin inflation rate declining from around 35% on 28th November 2012 (first halving) to 9.4% on 9th July 2016 (second halving). Currently the Bitcoin inflation rate is around 3%-4%.

Observations: Bitcoin halving price performance

Will another decline in the Bitcoin inflation rate help the price of Bitcoin explode, as the media seems to suggest?

We honestly don’t know. Anything is possible. We do not have a crystal ball, and nor does anyone else we know for that matter have one – so be cautious!

(1) Bitcoin inflation rate fallacy

Many claim the price of Bitcoin will rise at a faster pace after May 2020, taking the price of Bitcoin north of $100,000 or potentially $1,000,000 as the supply of new Bitcoins paid out to miners (and entering circulation) diminishes whilst on the other hand demand rises due to increased Bitcoin adoption.

Whilst we do not dispute the laws of supply and demand, we believe the use of facts in conjunction with forecasts should be treated with the utmost level of skepticism.

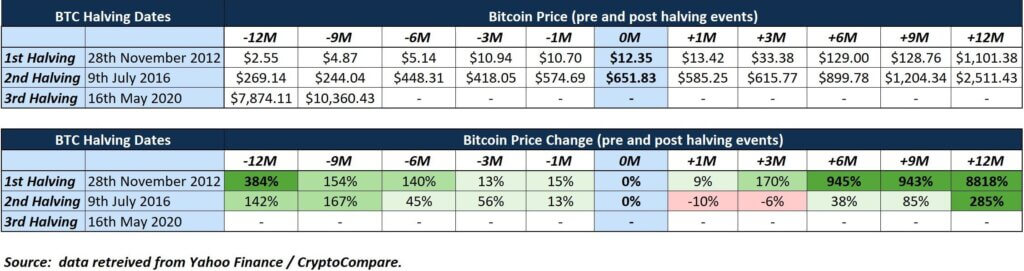

This “Bitcoin inflation rate fallacy” may be proven by simply looking at the post-halving price performance of Bitcoin in 2012 and 2016, as may be seen in the table below.

Looking at the data, it is possible to see that the falling bitcoin supply argument has not worked too well. The table above shows the price of Bitcoin rising by approximately 285% 12-months after the halving in 2016. That compares with a stratospheric price gain of 8,818% after the 12-month period following the first halving period. How is that possible?

Whilst it is true that the supply of Bitcoins entering circulating is diminishing over time, as the chart below illustrates, the fact remains that the overall supply of Bitcoins entering circulation is still increasing. This phenomenon together with many other factors helps to explain why post-halving gains may be gradually declining in terms of magnitude.

(2) The Law of Diminishing Returns

This law describes how adding an additional factor results in smaller increases at some point in time. It is possible that the law of diminishing returns may be creeping into the Bitcoin market as the industry enters a pre-maturation phase.

This implies that future post-halving periods may exhibit relatively less pronounced gains when compared to historical halvings. We have already witnessed this phenomenon during the second post-halving period after all.

(3) Possible pre-and-post halving entry points worthwhile to consider

From a historical context, we observe the price performance of Bitcoin seemingly becoming more dovish in the run-up to the halving day, especially 1-to-3 months before historical halvings. Similarly, price gains seem to be relatively weak around 1-month after historical halvings dates.

It is impossible to make any statistically significant observations based on data from only two previous halving events. However, if we had to assume that history will repeat itself again, the data could imply that the best time to be considering an exposure to Bitcoin might be around 1 year before the halving date and possibly 1 month after the halving date.

(4) Be open to a “buy on the rumour, sell on the fact” reaction

It is not uncommon for prices of traditional securities to be pumped higher before an earnings report only to be sold as soon as the report is released to the public (even though the data may be in line with expectations).

Similarly, there is no reason why Bitcoin cannot be hit with a ‘buy on the rumor, sell on the fact’ reaction on or around the 11th May halving date. There is always a first time!

The media is full of fortune-tellers although, in reality, nobody knows what is going to happen to the price of Bitcoin after the halving in May 2020.

As much as we love Bitcoin, we hope this report provides our readers with a healthy dose of skepticism. We hope you take a sensible approach to your trading and investing strategies in general. That means thinking more carefully about risk management and time horizons.

Where to Buy Bitcoin?

| Key Points: | Buy Bitcoin: | |

|---|---|---|

| ⭐ One of the best crypto exchanges in the market right now! ⭐ High on security and safety (SAFU, 2FA, etc..). ⭐ Largest selection of cryptos to trade. ⭐ Ability to buy crypto with fiat. | |

| | ⭐ leading social trading platform, trusted by millions of users from more than 140 countries. ⭐ Wide variety of trading options (crypto, stocks, ETFs, forex, commodities, etc...) ⭐ Copy the trades of top performing traders and portfolios! ⭐ 0% commissions on all stocks! | |

| ⭐ Legitimate crypto exchange and trading platform. ⭐ Low trading and exchange fees. ⭐ Free practice demo account with 50,000 USDT. ⭐ Make your first deposit and receive a 25 USDT Welcome Bonus. | |

| Disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not an indication of future results. Cryptoassets are volatile instruments that can fluctuate widely and therefore are not appropriate for all investors. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework. eToro USA LLC does not offer CFDs. eToro USA LLC makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. This publication has been prepared by our partner utilizing publicly available non-entity specific information about eToro. | ||

In the meantime, you may read our previous post concerning the pre-and-post price performance of Litecoin’s halving here.

If you enjoy reading our updates and analysis then start following us on Twitter now join our new Reddit Community.

If you are new to trading, you must learn to develop a mindset for it and understand how to mitigate risks. Our free educational guide on the five rules you need to master before trading crypto will surely be a valuable starting point for you.