Bitcoin Strategy: How stablecoin savings can be used to offset potential BTC losses

The objective of this article is to show you that it is possible to participate in the potential upside of bitcoin (or any crypto-asset actually) whilst mitigating your downside through the use of high-yield stablecoin savings rates.

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Bitcoin’s price performance so far is on par or better than the second halving

As of the time of writing today, on 9th June 2021, BTC/USDT was trading at approximately $35,000. That represents a 294% price increase from the close seen on 11th May 2020 (the halving date).

The halving that occurred on 11th May was the third of its kind. On that day, bitcoin’s block reward fell from 12.5 BTC to 6.25 BTC, which means that over the next four years, the supply of freshly minted bitcoins entering into circulation on a daily basis will be halved from roughly 1,800 to 900 BTC per day. Basic economics prescribes that a lower supply, coupled with a constant or rising level of demand leads to upward price pressures – and of course, that’s what eventually happened. Around mid-April 2021, the price of BTC/USDT peaked above $60,000!

Currently, there is a lot of noise in the market with plenty of mixed views in the media regarding the price of bitcoin. However, that’s beside the point here because this article has not been written to speculate on the future price of bitcoin. Nobody can tell you precisely where the price of bitcoin is heading in future with a high degree of certainty.

Instead, this article is written to help you understand that it is possible to structure a crypto portfolio so that the interest earned on stablecoins helps to mitigate future potential losses in the price of bitcoin (or any other cryptocurrency for that matter).

Think like a proper investor or hedge fund manager

So, with the above said, why not consider thinking more like a hedge fund manager?

Why not consider options that can help mitigate and/or hedge some (or most) of the risk whilst also giving you exposure to any potential upside gains that bitcoin may have in store?

Financial derivatives such as options contracts are a great way to hedge a portfolio although they are quite complex and therefore not everyone’s cup of tea. As an alternative, we could also make use of the high level of “crypto interest” that can be earned by parking funds into stablecoin savings accounts.

Let’s take an example with Youhodler, where the APR (‘Annual Percentage Rate’) on stablcoins is as high as 12.70%.

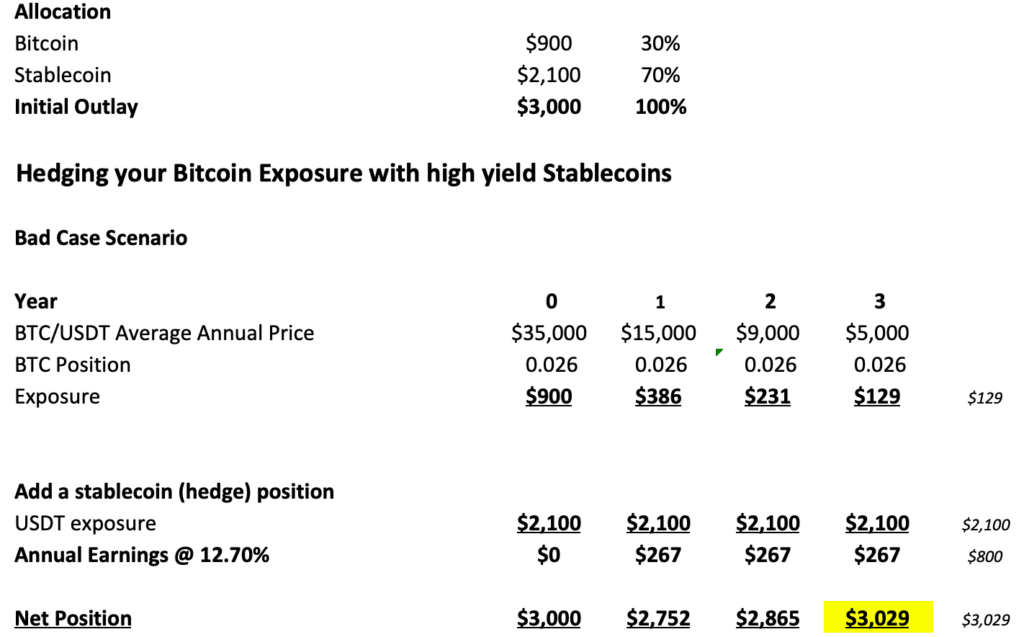

In the example provided below, we allocated an exposure of $900 (30%) to bitcoin and $2,100 (70%) to stablecoins, so in total, our investment is $3,000.

Stablecoins are pegged to fiat currencies and therefore there is hardly any price volatility.

Furthermore, we assume a “bad case” scenario in which the price of bitcoin falls from $35,000 to an average of $15,000 one year later and then drops to $9,000 in the second year before falling even further to $5,000 in year three. Of course, this may sound like an exaggeration although I am sure many of you will agree that bitcoin is highly volatile!

In our “bad case”, you can see that the high rate of ‘crypto interest’ from USDT offsets the losses incurred in bitcoin.

Of course the above is a simplified example. However, the concept is explained clearly and we hope it gets you thinking about different ways other crypto products can be combined with stablecoins as a way to shield your downside exposure whilst at the same time also allowing you to participate in any potential upside swings.

This strategy is not entirely risk-free nonetheless. In addition to counterparty risk, we note the APR that is earned on stablecoin savings accounts may be adjusted lower over time so this is a factor to consider when applying this particular strategy.

Visit the stablecoin savings accounts page that our team has put together using the latest data from trusted platforms.

Multi HODL: Barbell Strategy

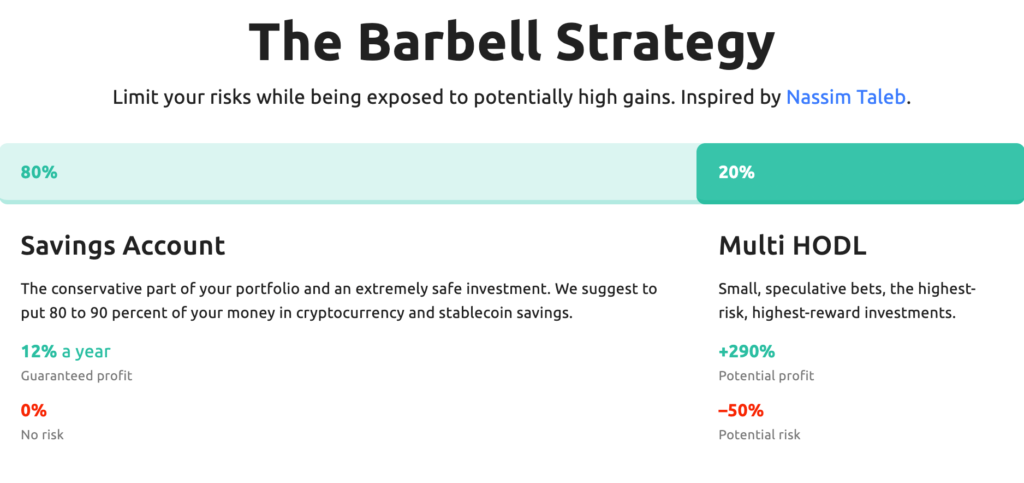

We came across the barbell strategy on the website of Youhodler, which ironically resembles the strategy described above except with a more conservative weighting. After all, Nassim Taleb had also run a hedge fund at one point in his career!

Youhodler has the perfect platform for this type of strategy since it has excellent interest rates on stablecoins as well as a unique Multi HODL function.

On its website, Youhodler describes the barbell strategy as follows:

Using the Barbell Strategy, crypto traders can keep 90% of their crypto assets in safe, stablecoin savings accounts and earn interest on crypto risk-free. The other 10% is then put in a risker, “Multi HODL” tool where YouHodler takes the crypto as collateral to start a chain of loans, multiplying the original crypto in the process.

If the value of the crypto goes up after the process, then the user covers the interest fee with the high multiplicated profit. If the market goes down, then the crypto trader can take comfort in the fact that 90% (plus high interest on deposit) of their assets are still secure in the Savings Account or wallet. Hence, The Barbell Strategy is a smart way to manage risk while also giving yourself the opportunity to encounter luck on a daily basis.

And unlike other platforms, you can continue to earn interest on traded crypto.

How to Multi HODL

Full video tutorial with 5 basic steps on how to use Multi HODL below.

Step 1: Click the “Multi HODL” button on the left side of your dashboard and click “start new Multi HODL.”

Step 2: Select the crypto you want to multiply and then choose a direction (up and/or down).

Step 3: Select the source of funds, the amount you desire to multiply, and the multiplier amount (x2 – x30 in this particular case).

Step 4: Set your “Take Profit” and “Margin Call” levels

Step 5: Click “Start” and watch your Multi HODL go!