Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Bitcoin Price Analysis: Monday 25th May 2020

What happened after our Bitcoin update on 18th May?

At the time of writing today, the price of BTCUSDT was trading at approximately $8,800, down from an earlier high of $8,918.

Since our previous commentary, the price of BTCUSDT is down by circa 8.6% and since then the price of Bitcoin has been on a gradual and steady descent.

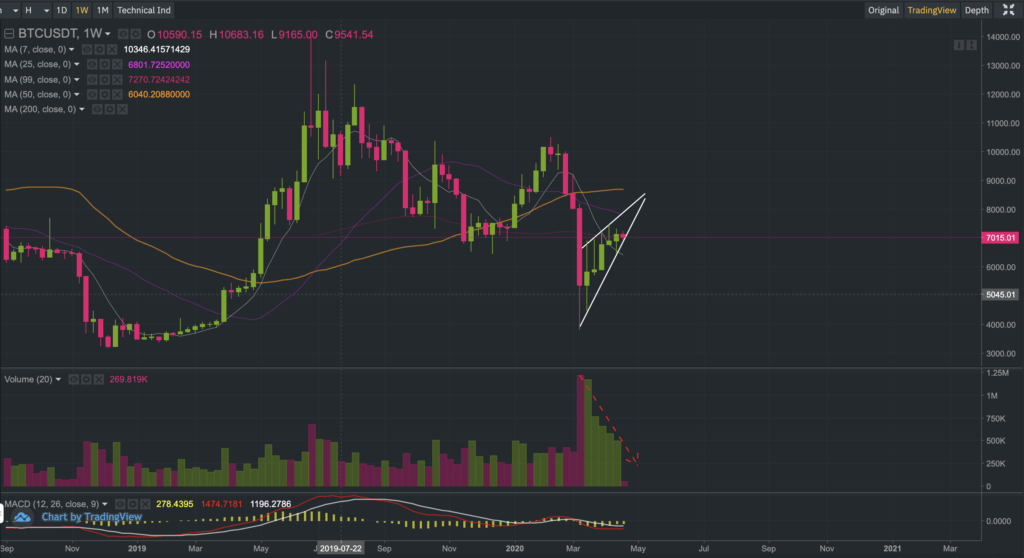

In our previous commentary, we noted that the trend had been on a bullish trajectory at the time with the 50-day and 200-day simple moving average very close to forming a golden cross.

We also noted that $10,000 has historically been a level that has attracted sellers and pointed out that relative strength indicators were looking overbought. Furthermore, we noted that the hash rate had been falling and that it would be definitely worth keeping an eye on to understand whether a reversal or steeper pullback may be forthcoming.

So where do we stand from here?

The trend ‘may’ still be your friend

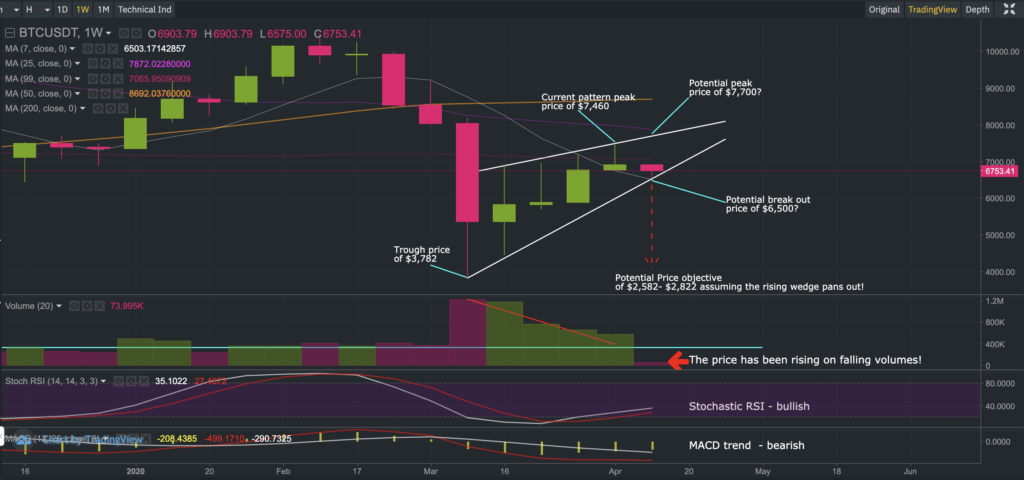

The price of Bitcoin has been recovering since March 2020, although the trend now appears to be breaking down following multiple rejections close to the $10,000 level.

Bitcoin has a tendency to whipsaw around so it’s difficult to ascertain whether the recent price decline is temporary. So far we can say that sellers appear to have the upper hand at the moment although the price is still holding above the 7-day simple moving average.

Failing to maintain support above the 7-day simple moving average could see Bitcoin fall further to test $8,000 (where the 200-day moving average currently resides). If this scenario pans out, we will be looking to see if the $8K holds up or not, as failing to do so could result in steeper price declines!

Hash rate continues to soften

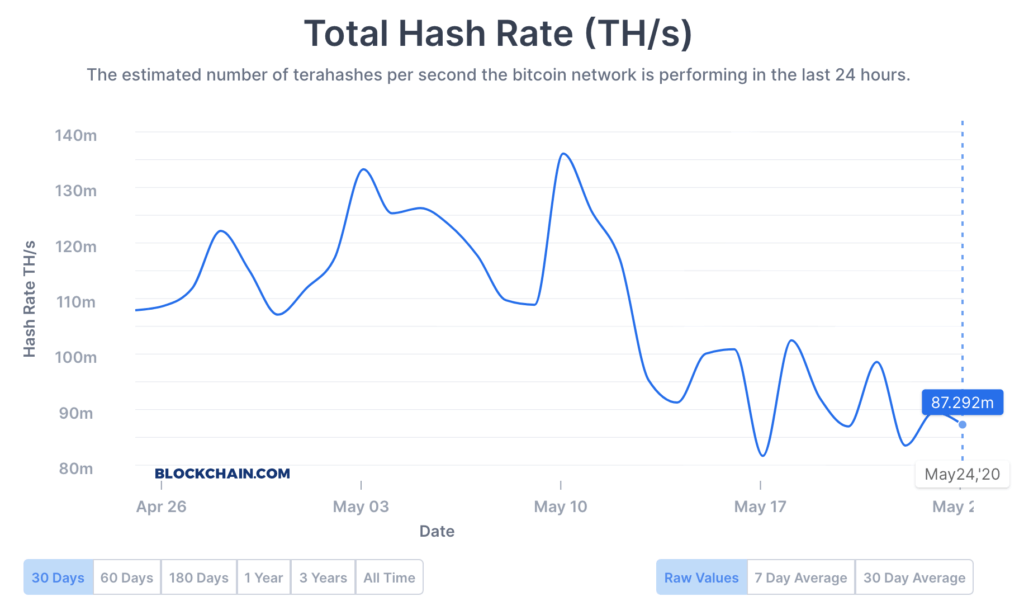

For what it is worth, we also note the Bitcoin hash rate has continued to soften since our previous update last week.

Our earlier research suggests there is a correlation between the price of Bitcoin and its hash rate. The hash rate has a tendency of being very volatile although from the chart above it is not too difficult to see that the overall trend has seen a rather steep decline.

We do not know whether the hash rate will continue to fall although it is definitely worth keeping an eye on, as it often (but not always) seems to act as a leading indicator of the price.

Meanwhile, separate research conducted by our analysts observes that the price of Bitcoin has historically started to find some support (and rise) around 1 month following the halving date. If this historical observation continues to hold than that would imply that we may see a pickup in the price sometime after the first week of June.

We remind our readers that we do not have a crystal ball. The observations provided in this commentary are speculative although we do hope it forces our readers to be more skeptical and thoughtful about risk management.

We hope this commentary has given our readers some food for thought. As always, trade safely, and at your own risk.

The next Bitcoin commentary will be published on Monday 1st June 2020. Follow us on Twitter or Reddit to remain up to date with our latest commentaries.

Develop your understanding of trading with our free educational guide that walks you through the five rules you need to master before trading crypto.