BitMax rolled out a new service in June, giving users the opportunity to start copying the trades of other traders on its platform.

So what’s all this copy trading stuff all about? and what should you look out for when considering which trader to follow?

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

At CoinMarketExpert we decided to divide this post into four sections:

What is Copy Trading?

What are the benefits of BitMax Copy Trading?

What are the risks of Copy Trading?

Considerations when selecting the best traders to copy

Crypto Copy Trading: What is copy trading?

Copy Trading, as the name implies, refers to the process of copying the trades of other investors and traders (people and robots included).

Your goal is simply reduced to identifying successful traders, who have the best track record of making money over a prolonged period of time.

Copy Trading has something for everyone and is generally useful for all types of participants. Let’s explain:

Experienced investors and traders may copy trade to add some diversity to their existing portfolios ( as there is very little point in copying traders who share your trading style and risk profile).

The less experienced investor or trader may engage in copy trading to educate themselves about the strategies other successful traders are deploying to generate returns. Copy trading is probably one of the best ways to learn about real-trading because it exposes you to real-time strategies and results.

Therefore, copy trading can be a great educational and benchmarking tool, but it can also add some diversification benefits to your portfolio.

What are the benefits of BitMax Copy Trading?

The BitMax Copy Trading service has a lot of useful features that allow its users to view traders’ historic trading performance as well as their risk profile.

In addition to some great features, which we will get to in a moment, BitMax also offers up to 5,000 USDT “Bonus Credit” for qualified traders – as an incentive to attract traders and diversity to the platform. So head over to BitMax if you think you fit the bill!

If that wasn’t already enough, traders will also benefit from:

- Monthly subscription fees from users;

- Referral bonuses;

- Opportunity to share 1,000,000 USDT super reward pool;

- VIP fee discounts;

- and more bonus credits every month.

For users of the copy trading service, the benefits are plentiful as well:

- Copy experienced traders that have a successful track record of generating returns across various market conditions;

- Automated order placements;

- Low latency processing fees;

- Free trial periods;

- Reliable system with some great features.

Copy Trading with Fixed Amount

According to BitMax, users can copy trades with a fixed amount, regardless of whether the trader’s order amount is higher. In other words, a user can set a fixed amount of 100 USDT in their account and not have to worry about the size of trades that are executed by the trader they are copying.

Imagine depositing 100 USDT into your account and then having to copy a 1000 USDT trade placed by the trader you’re copying! Well, you don’t have to worry about this happening because BitMax won’t allow the order to go through. Users with an insufficient balance in their accounts will simply NOT be able to initiate the copying trade.

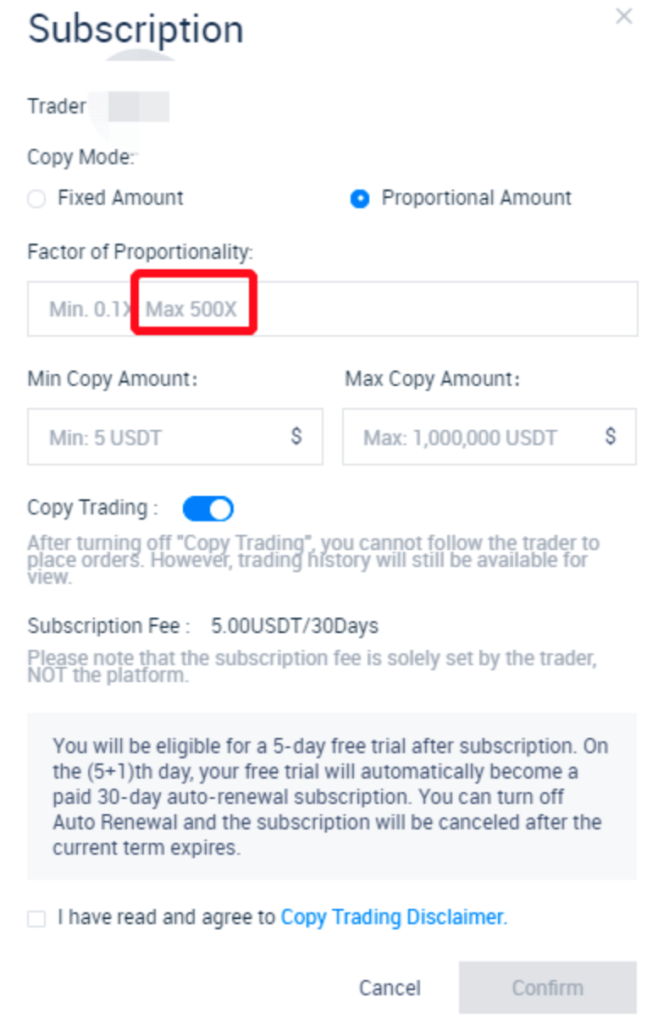

Copy with Proportional Amount

According to BitMax, users have the option to copy a proportional amount ranging between 0.1X and 500X! This means that copy trades can be equal to the [Trader’s Order Amount*Pre-set Factor of Proportion].

Users may also set a minimum or maximum copy amount for each trade. If the user sets a min/max amount and then place an order with the amount lower / higher than that, the pre-set min/max amount will be used. For example, if you set the factor of proportion to 2x, the minimum copy amount would be 20 USDT and the maximum copy amount would be 100 USDT. Users with insufficient balance will NOT be able to initiate the copy trading.

What are the risks of Copy Trading?

Copy Trading, in general, can be an attractive way to earn passive income, although nothing is risk-free. Naturally, risks are involved when copy trading as past results are not a guarantee of future returns!

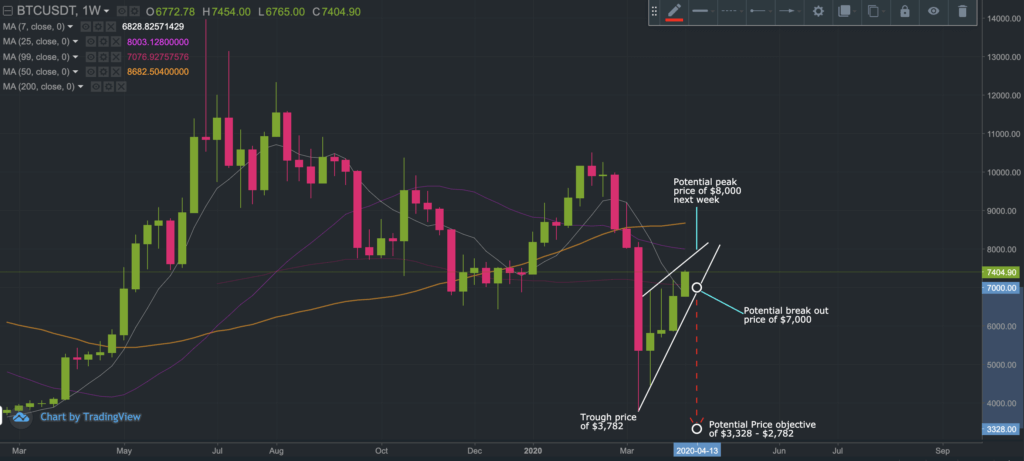

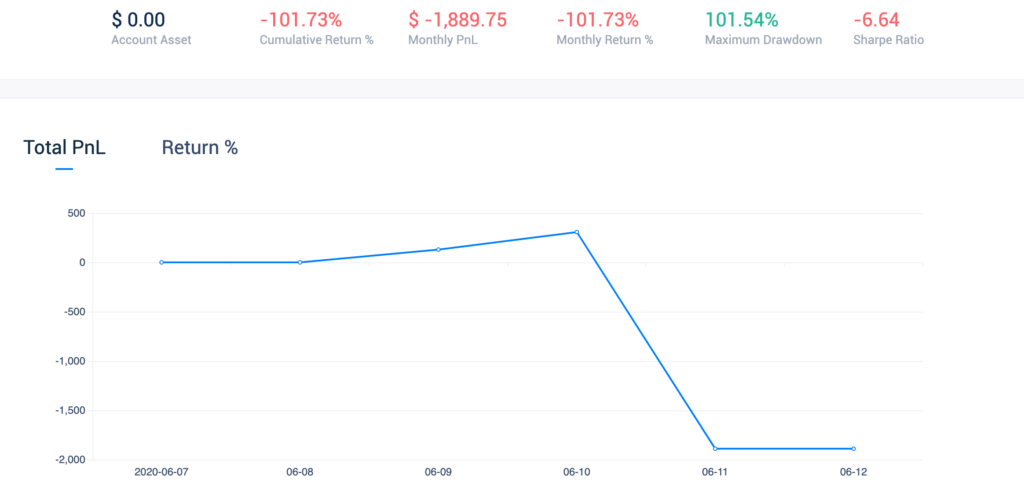

For example, the portfolio performance below is of a BitMax trader who was initially producing a small and steady return before losing it all!

In the meantime, anyone interested in learning more about the BitMax Copy Trading service should head over to their website and read through their Copy Trading Guide.

Considerations on how to select the best Copy Traders

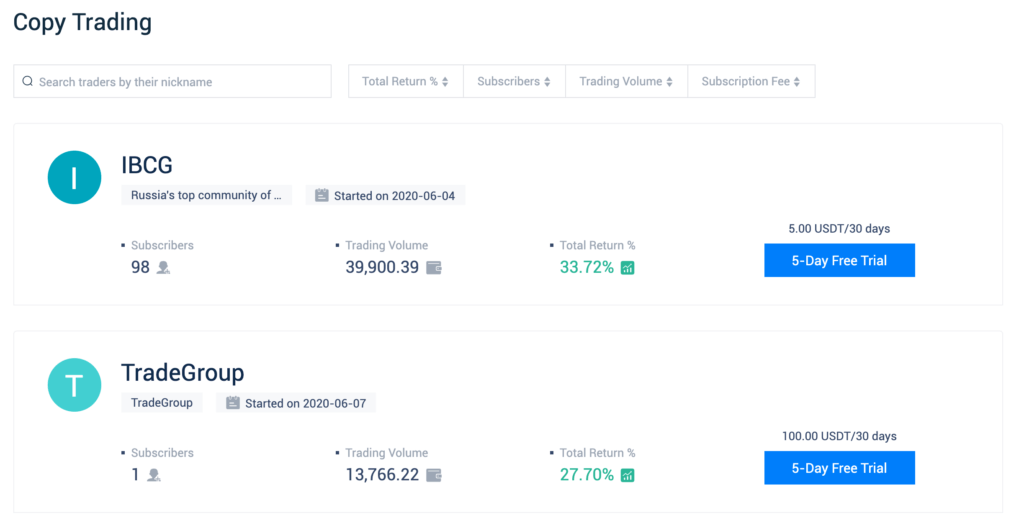

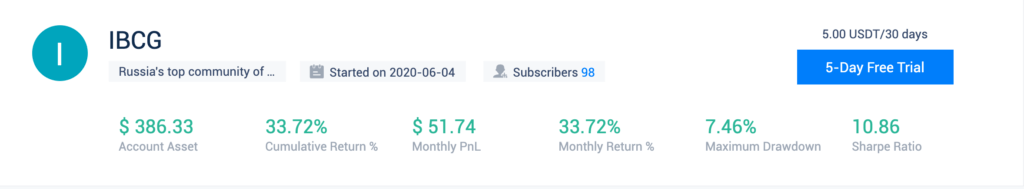

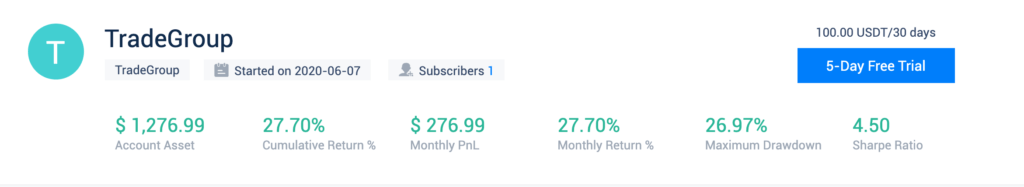

BitMax platform allows users to sort between the best and worst performers. Doing so on BitMax currently reveals that IBCG and TradeGroup are among the best performers with a total return of 33.72% and 27.7% respectively.

Interestingly, when you click on the profiles, you may find additional information such as a Sharpe Ratio, which represents a risk-adjusted return.

Let’s take a step back, the Sharpe Ratio measures the risk/reward profile. It represents the excess return that is achieved divided by the volatility (risk) taken, as calculated by the standard deviation. Therefore, all else equal, Sharpe Ratios are used to reflect a trader’s competence in managing risk-return. A higher Sharpe Ratio is considered better.

However, the Sharpe Ratio is not a perfect risk metric since standard deviations assume that returns are normally distributed, which is not the case!

Despite this drawback, Sharpe Ratios are still relatively popular and simple to understand. Let’s look at the performance of the two traders above.

At the time of writing, IBCG had a Sharpe Ratio of 10.86.

Whilst TradeGroup had a Sharpe Ratio of 4.50.

According to the Sharpe Ratios presented above, for every unit of risk taken, IBCG has so far managed to generate a higher level of return than TradeGroup. In other words, IBCG is getting more ‘bang for its buck‘ in relation to the level of risk taken. This means that we may want to consider copy trading IBCG as opposed to TradeGroup.

Nonetheless, as stated earlier, past performance is not indicative of future performance. A trader with a consistently high Sharpe Ratio could make mistakes and risk losing it all.

Copy trading is of course risky but at least you now understand that returns should NOT be viewed in isolation but rather in relation to the level of risk that has been taken.

We hope you found this article to be educational and for those who are interested in this passive method of crypto trading, good luck.