Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Bitcoin Price Analysis: Tuesday 12th May 2020

What happened after our Bitcoin update on 4th May?

At the time of writing today, the price of BTCUSDT was trading at $8,852, down from an earlier high of $8,978. These levels are practically unchanged from last week.

Since our previous commentary, we have seen the price of BTCUSDT rally to an intra-day high of $10,067 before retreating back to $8,117 by Sunday 10th May. Then on the halving day, we saw the price of BTCUSDT gyrate between $9,168 and $8,200.

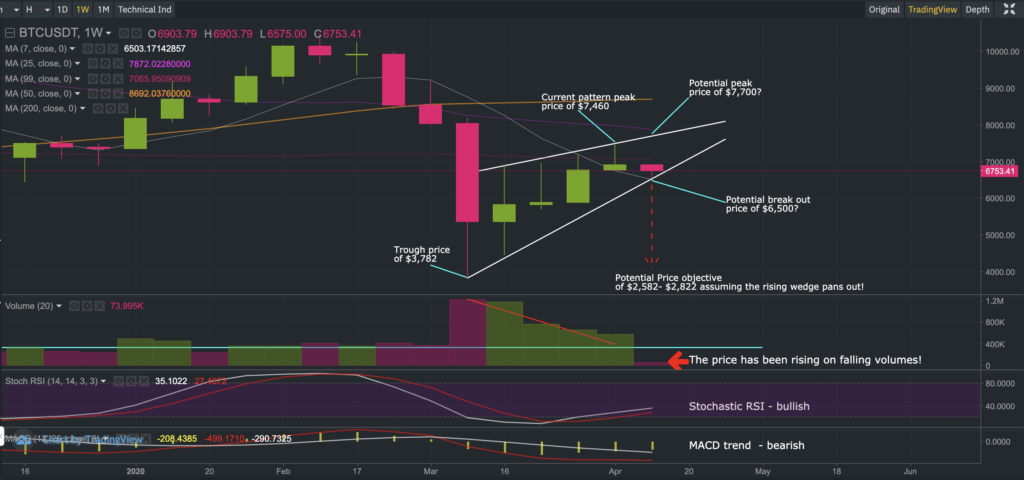

In our commentary last week we noted that the recent price trend appeared to be entering a bullish cycle although at the same time were not convinced that general ‘interest‘ trends towards Bitcoin, as seen on Google Trends, were as strong as historical levels, which gave us a gut-wrenching feeling that something may not entirely right about the current post-halving period.

So where do we stand from here?

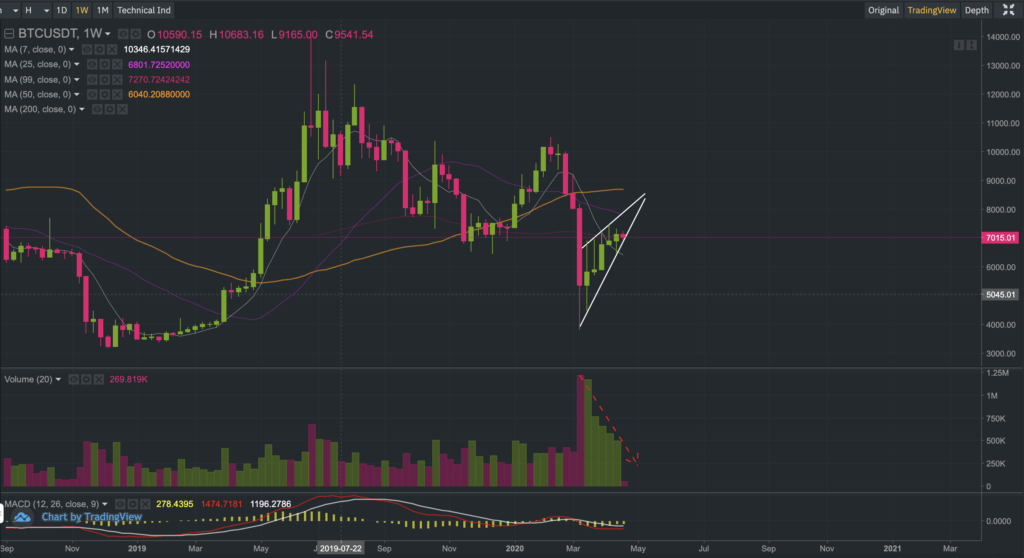

The MACD on the weekly charts has generally been a good momentum indicator for Bitcoin. The bullish crossover could suggest that sentiment and price may continue to recover to higher levels.

According to the chart (above), it may be possible for Bitcoin to recover to around $11,500 and then from that point, anything can happen!

Bullish case: Our log price analysis conducted many months ago had indicated that the price of Bitcoin could potentially reach a range of $22,000 to $162,754 post-halving. However, that assumes historical price patterns for Bitcoin will be repetitive.

The halving of Bitcoin’s block rewards implies there will be less BTC supply entering the market, and given a steady level of demand, the price of Bitcoin should continue to rise. Whilst we do not dispute the laws of supply and demand, we believe it is healthy to maintain a skeptical mindset.

Our report Bitcoin Price Analysis: Pre & Post Halving Event Performance raises some interesting points around the Bitcoin inflation rate fallacy and the law of diminishing returns, which alludes to the possibility of seeing lower post-halving returns over time. For example, after the 2012 halving, we observed the price of Bitcoin rising by approximately 8,818% over a 12-month period whereas in the 2016 halving we saw the price of Bitcoin rising by 285% over a 12-month period. Could the law of diminishing returns repeat itself again?

Historical post-halving periods have been extraordinarily bullish on the price of Bitcoin and this is fuelling a lot of hype in the media. But could it be different this time?

We want to point out that Bitcoin has entered a new era where margin and futures trading has been increasingly dominating markets. With this trend gaining traction there is a risk of incentivizing another type of bad behavior, especially among certain market participants who may be tempted to occasionally unhedge their books and to create market distortions during high-sentiment periods for the purpose of maximizing their bottom line. If any such distortions become recurring (and let’s face it, the industry is not as regulated as the fiat space yet), then historical price patterns will risk breaking down.

Bearish case: the chart (above) depicts a bearish scenario whereby Bitcoin is unable to breach $11,500 and ends up falling all the way back to $3,200. Whilst seemingly improbable, this scenario cannot be discounted either.

Of course, we do not have a crystal ball. The observations made above are extreme and speculative although we hope it forces our readers to be more skeptical and think more carefully about risk management.

We hope this commentary has given you some food for thought. As always, trade safely, and at your own risk.

We dedicate our time to making our commentaries educational and insightful so that you can obtain different angles that improve your decision making, so please do show us some love by following us on Twitter and/or Reddit and sharing our commentaries.

The next Bitcoin commentary will be published on Monday 18th May 2020.

Develop your understanding of trading with our free educational guide that walks you through the five rules you need to master before trading crypto.