Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Flash Alert: Friday 3rd April

What happened after our Bitcoin update on 10th March?

In the previous commentary, we noted that Bitcoin could be gearing up for a stratospheric rally following a 27% dip that saw the price drop from $10,500 to a low of $7,632.

There were a few reasons to be bullish about Bitcoin at the time. We now know, with the benefit of hindsight, that Bitcoin actually fell further, but the following were the bullish points that we had raised at the time:

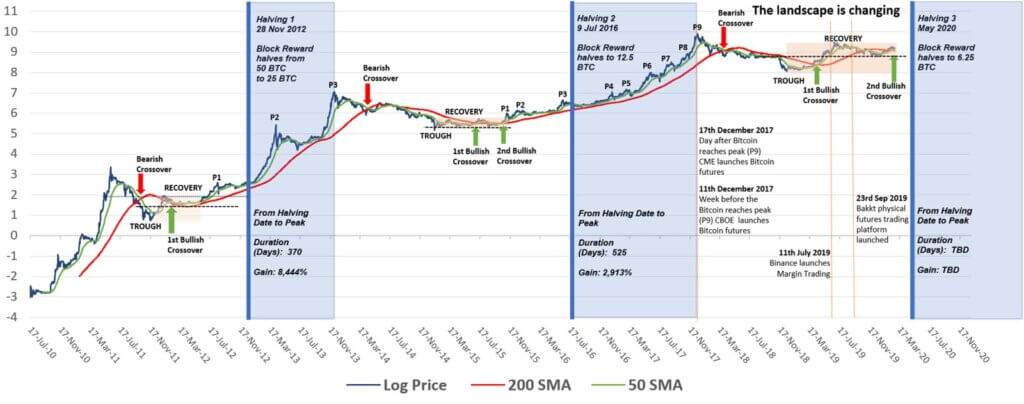

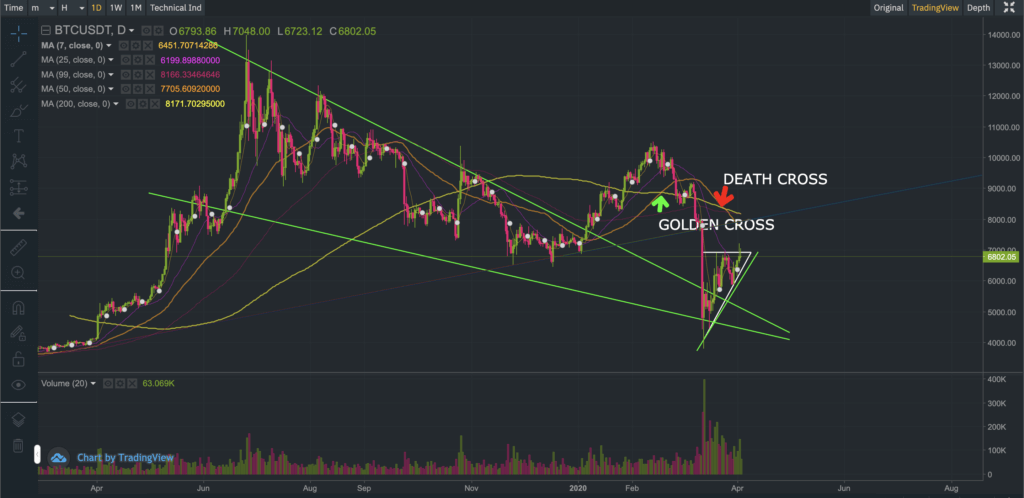

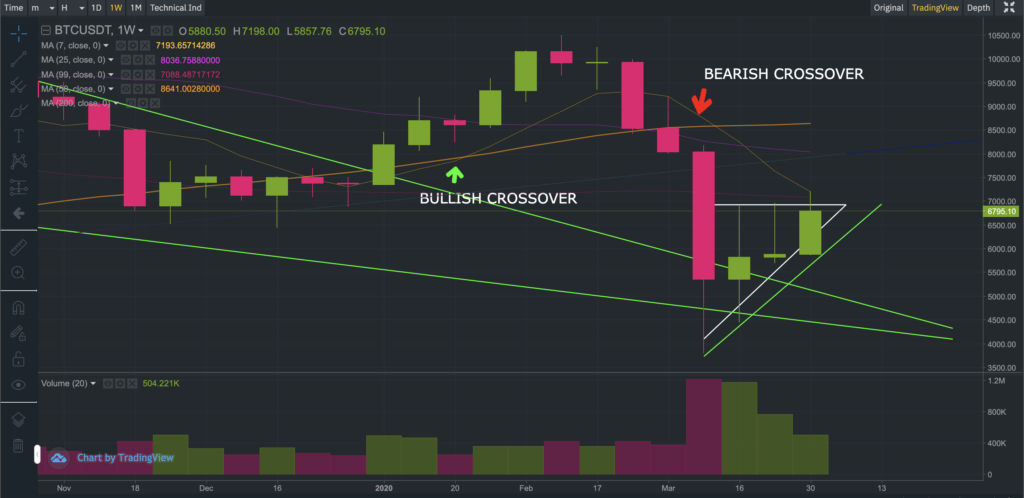

(1) firstly, a golden cross had appeared in mid-February. Golden crosses are generally reliable indicators that tend to occur after a bottoming of the price.

(2) secondly, the price of Bitcoin had fallen to a level that coincided with trend support, as may be seen below.

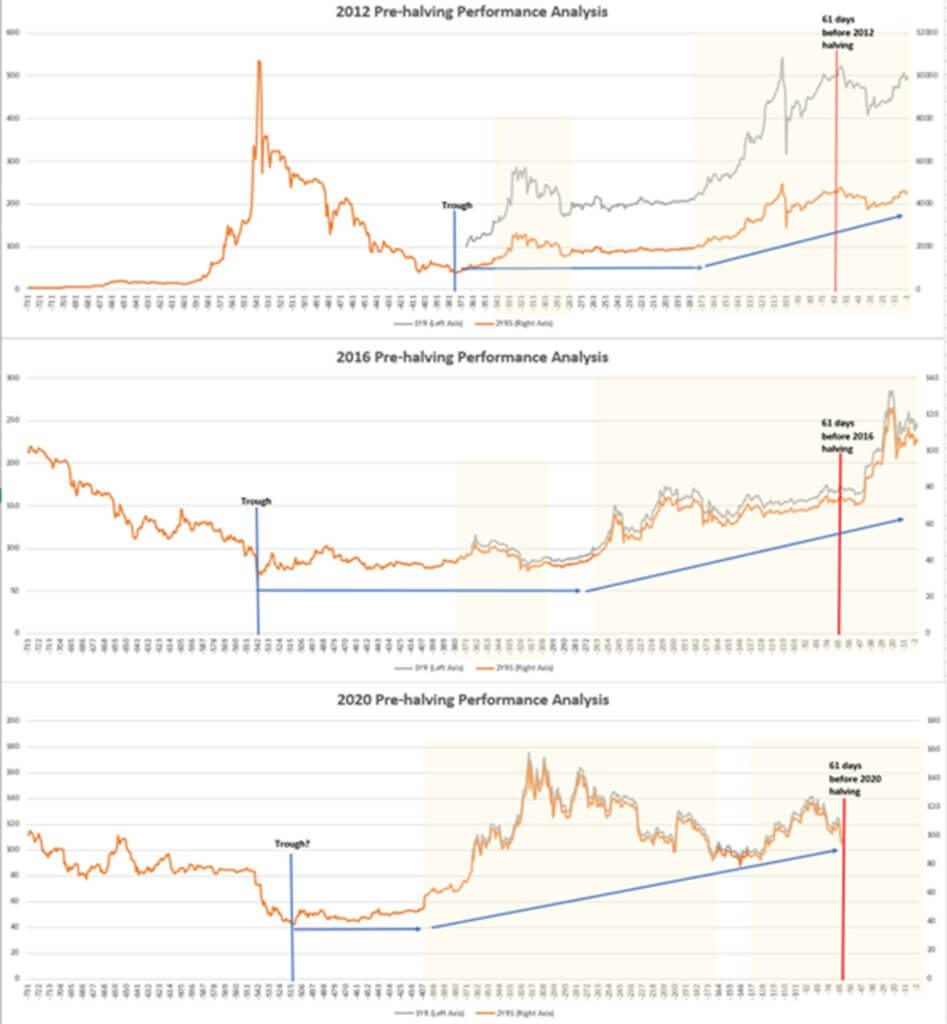

(3) thirdly, it has not been uncommon for Bitcoin to undergo a rough shakeout phase prior to historical halving dates, and when such shakeouts did occur in the past, the price of Bitcoin had never fallen below trend or hit a lower low, as may also be seen below.

Based on the above observations we felt there was an opportunity for Bitcoin to attract additional buyers. But instead of rebounding, the price continued to breakdown and three days later on 13th March, the price of BTCUSDT had plunged a low of $3,782 on Binance.

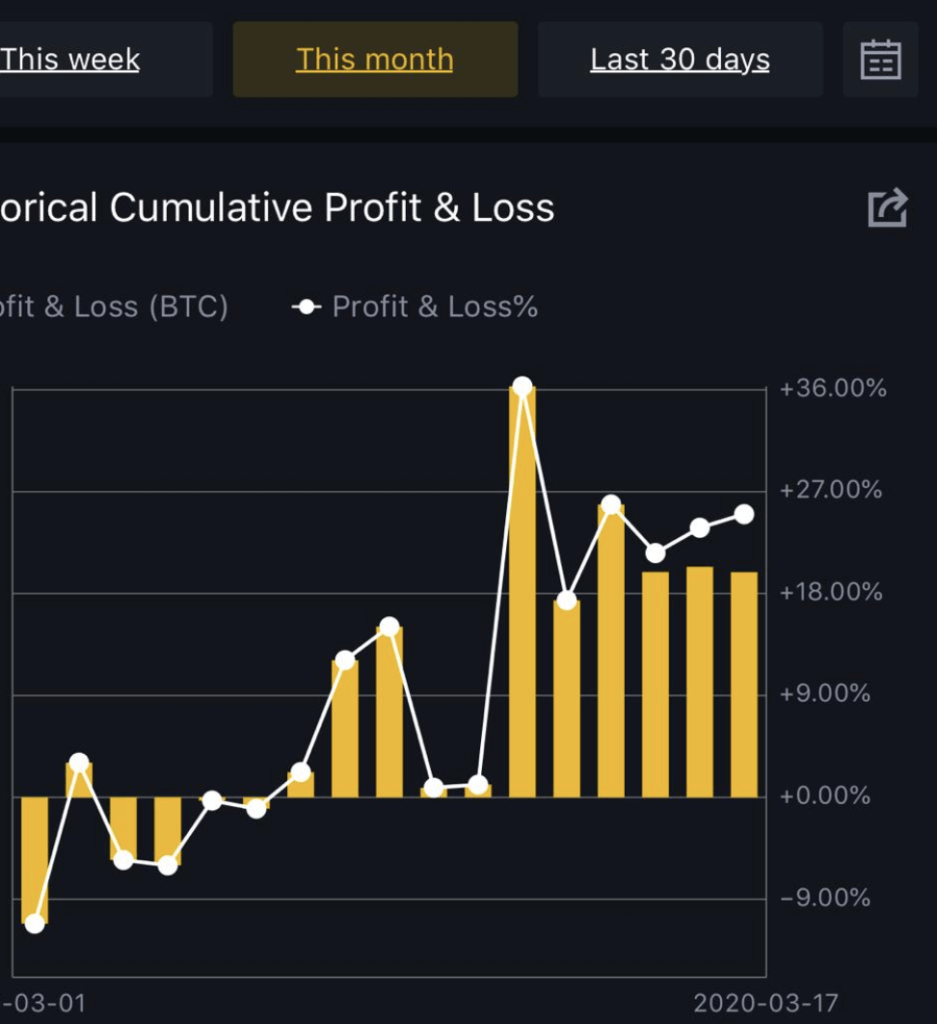

In the absence of any material buy volumes, we had luckily hedged our Bitcoin exposure and exited unscathed with a 26% profit on 17th March, as may be seen by the screenshot below.

We haven’t traded Bitcoin since 17th March due to what we believe has been a major breakdown in historical pre-halving price trends.

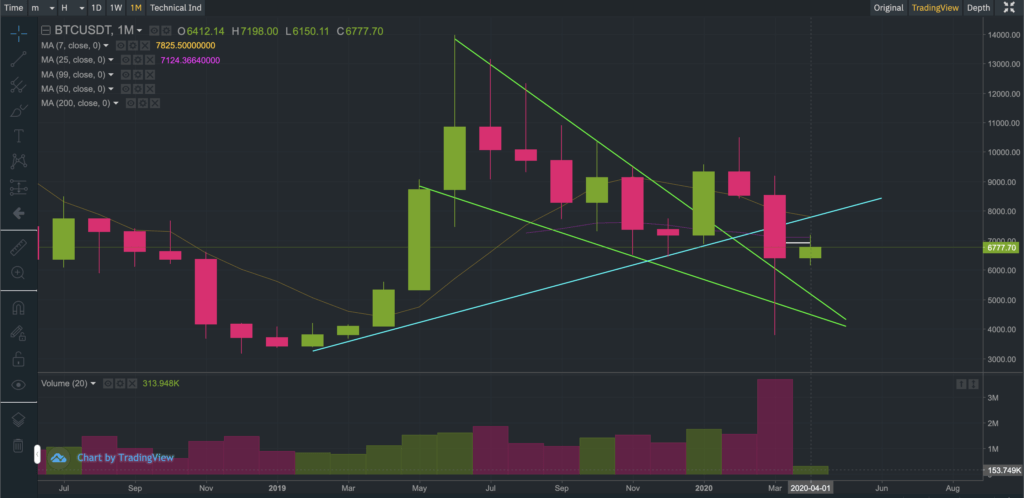

As the first chart in this commentary illustrates, the Bitcoin trading landscape has changed dramatically over the last two years with the introduction of margin, futures and options trading as well as growth in the algorithmic trading space. This means the price of Bitcoin is more prone to exacerbated moves!

So where do we stand from here?

Honestly, it is hard to tell.

If we look at the daily charts, we can clearly see that a death cross has formed (historically, death crosses are followed by a series of lower lows but who knows whether it is different this time as well???….)

We also see an ascending triangle formation, with resistance currently seen around the $7,000 level. We note that ‘buy volumes’ around the $7,000 region have been relatively weak nonetheless.

We note that a close above the $7,200 region could become very bullish for Bitcoin. Let’s also not forget that there is a CME price gap between $8,280-$9,060!

If we look at the weekly charts a similar pattern plays out although we may see resistance at the 7-period moving average of $7,181 (with lower weekly buy volumes).

And last but not least, we may see relatively tiny buy volumes on the monthly chart as well.

We would love to say that we remain bullish on Bitcoin although we cannot genuinely do so at this juncture.

Those of you who have been following us will know that we have been bullish on Bitcoin for a while (and it has been a good ride) but we believe the bias is now bearish – at least for the time being.

In the absence of any positive news flow, we expect the COVID-19 pandemic to raise the level of risk aversion across markets ( with rising unemployment and the perceived risk of becoming unemployed likely to act as a disincentive for new money to flow into risky assets.) This could result in higher price swings/volatility for Bitcoin and on occasion give the impression that Bitcoin is on a solid path to recovery – but until we see stronger buy volumes emerging to support Bitcoin, we will maintain a healthy dose of skepticism.

We prefer to avoid day trading and are looking closely for healthier price trends that are supportive of higher prices to emerge.

We hope you found our Bitcoin commentary interesting and educational. As always, trade safely, and at your own risk.

We dedicate our time to making our commentaries educational and insightful so that you can obtain different angles that improve your decision making, so please do show us some love by following us on Twitter and/or Reddit and sharing our commentaries.

The next Bitcoin commentary will be published on Monday 6th April 2020.

If you’re thinking about trading bitcoin then visit our bitcoin price analysis page. Here we periodically provide interesting bitcoin price insights and analyses that every crypto trader and investor should be aware of.