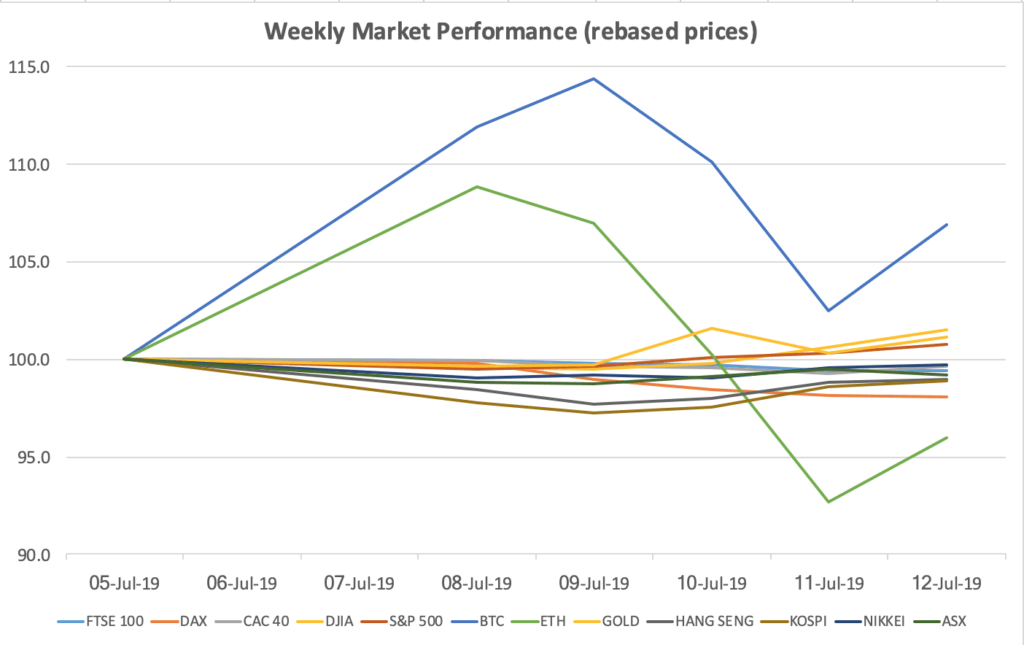

- Bitcoin outperforms stock markets, up 6.9% from a week ago at the time of writing.

- The Dow Jones Industrial Average closed the week at 27,332.03, representing a 1.52% weekly rise.

- Gold was also in positive terrain, closing the week 1.11% higher at $1,417.2 per ounce.

- European and Asian share indices underperformed.

US stock market remains addicted to loose monetary policy!

US stock market sentiment turned positive this week after Federal Reserve Chairman Jerome Powell provided a dovish narrative that signalled the beginning of rate cutting cycle. In a speech on Thursday Powell expressed deep concern about rising trade tensions and reaffirmed his stance to act as ‘appropriate’ to ensure the economic expansion remains intact.

Powell’s dovish speech follows a better-than-expected jobs report, which raised some eye brows. At this juncture the market is attempting to decipher whether the Federal Reserve will cut interest rates by 25 basis points or 50 basis points later this month.

Powell has been under intense pressure by U.S. President to lower interest rates so one must really wonder whether political interference is biasing members of the central bank. Last week President Donald Trump was quoted on CNBC saying “if we had a Fed that would lower interest rates, we’d be like a rocket ship.”

We also must consider the US Presidential Election is around the corner (next year). If President Donald Trump allows a bear market to occur on his watch that could have a devastating blow to his popularity (among existing followers of course) and jeopardise the possibility of being re elected – so naturally it is in President Donald Trump’s interest to ensure stock markets remain buoyant.

The reality is the US stock market has become too dependent on loose monetary policy, which is worrying! As counter intuitive as it may sound, so called ‘trade risks’ and the occasional doom and gloom speech from time to time will most probably keep the market rally alive (on the view that a falling cost of capital will fix corporate America).

Decreasing interest rates and quantitative easing measures had a positive result for markets in the past because it meant companies could borrow money at a lower cost of capital and buy back their own shares. However, in the majority of cases, these actions only create an illusion of rising shareholder value (as a decreasing number of shares in circulation artificially raise earnings and dividends per share). This also means that corporate debt is piling up.

Market participants, including some highly regarded institutional investors, understand these implications very well and are becoming anxious and weary of the current bull market in stocks. These concerns are driving investors back to so called safe-havens such as gold. Certain institutional investors are even considering adding a small exposure to bitcoin, increasingly being perceived as ‘digital gold’, to their portfolios.

Meanwhile, UK, European and Asian stock market indices did not perform near as well as their US counterparts this week, as BREXIT uncertainty and China trade tensions continue to taint sentiment within the respective regions.

Next week we will be seeing a barrage of key earnings from J.P. Morgan, Well Fargo, and Netflix and many other large blue-chip companies. China’s Q2 GDP figures will also be in the spotlight on Monday – so quite an exciting week ahead folks!

If you enjoy reading our updates and analysis then start following us on Twitter now join our new Reddit Community.