Professional investment assistance can be purchased at a lower cost, with the help of robots. The very first robo-advisor, Betterment, was launched in 2008 and started what is to become a popular investment and wealth management tool, especially among younger consumers. Since then, it is projected that these automated assistants will be handling $830 billion assets under management by 2024.

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

The industry is expecting this number to increase further, especially due to the launch of the first SEC-registered crypto robo-advisor: Makara. Along with Makara, M1 Finance and Wealth Square are other options that are already available for crypto investors. These automated advisors show promising potential in guiding investors through the world of cryptocurrency—and here’s all that you need to know about them.

What are Robo Advisors?

Robo-advisors are digital tools that use computer algorithms to open and manage investment portfolios. These products are great digital substitutes for professional advisors because they are affordable and accessible, especially to investors who are only in the early stages of their wealth accumulation.

Typically, investors have to meet with a financial advisor or a traditional brokerage company before they can open an account and transfer their funds. While this is a more hands-on approach, it can be extremely expensive for beginners. On the other hand, robo-advisors are giving investors a more economic and accessible option for opening their brokerage accounts. It asks clients to answer an online questionnaire regarding their personal details, risk tolerance, and financial goals so that they can create a portfolio that suits the investors’ preferences and needs. Based on these data, robots can generate advice for your investments. Plus, they can also automatically invest and build a portfolio for you.

What are their Pros and Cons for Crypto Investors?

Crypto robo-advisors aim to break numerous limitations that new investors often face. However, they have just been recently established, so users can expect significant limitations. Consider these pros and cons before entrusting your investments with robo-advisors.

PRO: Huge savings

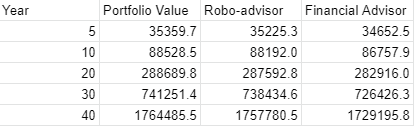

Crypto robo-advisors are definitely less expensive, given that everything is computer-generated. It is estimated that you can get an average return of 0.085% from cryptocurrency, based on the average APR from our analysis of crypto savings rates. Crypto robo-advisors Makara, M1 Finance, and Wealth Square charge an average of 0.38% annually, based on different programs. On the other hand, financial advisors charge an estimate of 2% of your total managed asset value. If you are a 25-year-old investing $5,500 per year, then it is estimated that you can save around $28,584 with robo-advisors as compared to their traditional counterparts in 40 years’ time. Keep in mind that this is computed without the projected inflation rates. You can refer to the table below for more information.

PRO: Increased accessibility

No need to book appointments or spend hours in a meeting! Your robo-advisor can be accessed through your phone, anytime and anywhere. Moreover, these digital services are accessible because they allow you to invest with a low amount. This makes it perfect for beginners who still have limited capital for their investment.

PRO: Increased objectivity

Risk management is a critical skill that crypto traders and investors need to master. Due to cryptocurrency’s volatile nature, beginners may feel discouraged or nervous when the stakes go up. These emotions drive some people to sell their assets or make risky decisions, especially when they are not properly guided. The increased objectivity of robo-advisors helps minimize risks by giving a more rational approach to the risks and calculation. This will help beginners manage the emotions or impulses that can be detrimental to their crypto portfolio.

CON: Insufficient services

This digital service comes at a low price because it is only programmed to provide educational information and to rebalance your portfolio for optimal returns. Though it can minimize the risks caused by emotions, it cannot prepare or save you from the other hazards of buying cryptocurrency. A professional financial advisor can help you navigate through price manipulations, the interface of crypto exchanges, and security issues, on top of the other tasks that robo-advisors offer. These professionals charge a higher fee because they can provide a wider range of services for clients.

CON: Algorithm constraints

While these digital advisors promise to educate and help crypto investors, it can be quite limited because it only relies on an algorithm. Most of all, robo-advisors may offer results based on past data, which is a very limited predictor of future performance. These advisors can be a great way to get started with crypto investments, but as your life gets more complex, you may need an experienced advisor to get the most out of your money.

CON: Limited assets

Crypto robo-advisors handle the buying, selling, and storing of cryptocurrency assets on limited platforms. For instance, Makara is powered through Gemini, so their selection of assets is limited to what Gemini can offer. For now, it only offers six investment baskets, which includes equal-weighted allocations to cryptocurrencies, risk-weighted exposures to assets, and single asset baskets for Bitcoin and Ethereum.

Due to cryptocurrency’s increasing popularity, numerous people are signing up for crypto robo-advisors. However, many users are hoping that these applications can expand their selection of assets and offer options to call human financial advisors in the future. For more news about cryptocurrency, check our articles here.