| Key Points: | Buy Bitcoin: | |

|---|---|---|

| ⭐ One of the best crypto exchanges in the market right now! ⭐ High on security and safety (SAFU, 2FA, etc..). ⭐ Largest selection of cryptos to trade. ⭐ Ability to buy crypto with fiat. | |

| | ⭐ leading social trading platform, trusted by millions of users from more than 140 countries. ⭐ Wide variety of trading options (crypto, stocks, ETFs, forex, commodities, etc...) ⭐ Copy the trades of top performing traders and portfolios! ⭐ 0% commissions on all stocks! | |

| ⭐ Legitimate crypto exchange and trading platform. ⭐ Low trading and exchange fees. ⭐ Free practice demo account with 50,000 USDT. ⭐ Make your first deposit and receive a 25 USDT Welcome Bonus. | |

| Disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not an indication of future results. Cryptoassets are volatile instruments that can fluctuate widely and therefore are not appropriate for all investors. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework. eToro USA LLC does not offer CFDs. eToro USA LLC makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. This publication has been prepared by our partner utilizing publicly available non-entity specific information about eToro. | ||

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Background

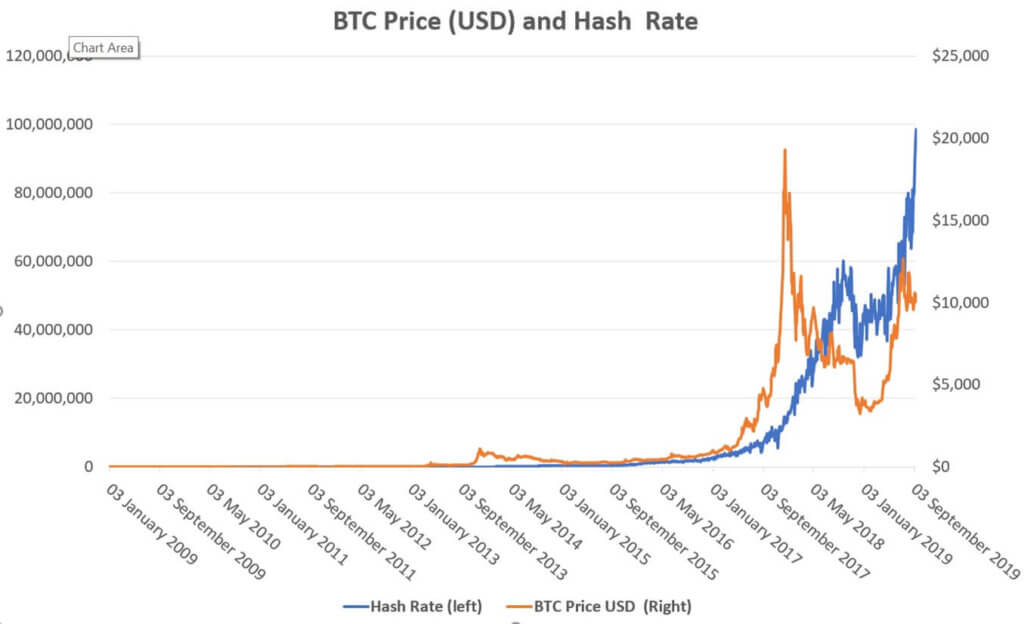

Our previous post Is the hash rate a good predictor of Bitcoin’s price observed that a relationship exists between the price of Bitcoin and its hash rate.

We tested our observation using a regression model in order to confirm whether a statistically significant relationship does indeed exist.

The model regressed the price of Bitcoin with its hash rate, with the former as a dependent variable and the latter as an independent variable. The result indicated that a more statistically significant relationship exists when the hash rate is lagged by 9 months. This could imply the market is impounding the future hash rate value into Bitcoin’s current price.

Whilst it is likely that Bitcoin’s hash rate will be much higher in 9 months time, we wanted to understand whether currently the price of Bitcoin is pricing in (at the very least) a hash rate of circa 90 million.

We found the price of Bitcoin, applying a 90 million hash rate, could be potentially valued at $14,791.

We had also mentioned in our report that correlations do not always equate to causation.

However, this posts attempts to explore two sides of the coin in more detail. This is where it becomes more interesting!

So let’s take a step back and address the concerns of those skeptics out there.

What does the hash rate have to do with the price of Bitcoin?

There has been growing debate over whether the hash rate follows the price of Bitcoin or whether the price follows the hash rate. So we decided to drill down on this issue .

But firstly, let’s break it down to first principle by addressing the following question.

What does the hash rate really represent?

Miners serve an important function on the Bitcoin blockchain. As you may already know, miners that manage to create a block on the Bitcoin blockchain are rewarded with the transaction fees plus the block rewards, currently 12.5 BTC.

So it stands to reason that as the price of Bitcoin rises, more miners will be incentivised to join the network in order to receive their 12.5 BTC’s. That is of course conditional on the price of electricity remaining constant or at least not rising at the same rate as the price of Bitcoin.

Let’s not forget that miners have very high operating costs so net profit margins are important.

But as the competition heats up, it becomes more difficult for miners using existing equipment to find new blocks.

So as the difficulty rate rises, costs increase as well since finding new blocks requires a lot of guess work and computational power. And in turn these conditions provide an incentive for miners to invest into faster equipment that allows them to make more computations per second in order to stand a better chance of solving these complex puzzles faster.

So the key takeaways here are:

1. The hash rate is a representation of the computational speed for completing an operation on the Bitcoin blockchain.

2. Achieving a higher hash rate is better because it raises the opportunity for a miner to find the next block and receive the reward plus the transaction fees.

3. The mining reward, difficulty rate and hash rate are all interdependent. As more miners join the network, the difficulty rate rises, which means costs rise as well, and that phenomenon in turn incentivises miners to invest into more powerful processors to speed up the number of complex computations they can make to successfully identify new blocks. These conditions raise the hash rate.

4. As more miners join the Bitcoin network to approve transactions and create new Bitcoins, the more secure the network becomes.

5. The rise in the hash power of the network, due to more competition and investment in faster and efficient equipment, the greater the number of miners there would have to be in order to commit a 51% attack. Without miners, the network would be extremely vulnerable and risky.

So what are the fundamental drivers of the rising hash rate currently?

Both difficulty and the hash rates have risen to new record levels recently due to:

1. Relatively cheaper electricity rates available in China (at this time of the year, the price of hydro power tends to fall). For those of you who may be unaware, China is home to some of the world’s largest Bitcoin and cryptocurrency mining farms.

2. The release of new ASICs (Application-Specific Integrated Circuits) that increase processing and computational power.

So to sum it all up for you, as electricity costs become relatively cheaper in China due to seasonality. And as the price of Bitcoin rises, an increasing number of older miners start to become profitable again. And as competition heats up, there is an incentive for miners to buy newer, more efficient and more powerful machines so they can mine as many Bitcoins as possible before the next halving in May 2020.

So now that you know what the hash rate represents and understand the driving forces behind it, you may be asking the following question.

How does the hash rate influence the price of Bitcoin?

As described above, the rising price of Bitcoin stimulates the conditions to increase the hash rate – not the other way around.

That relationship may be clearly seen in the chart below, which shows the price of Bitcoin acting as a leading indicator to the hash rate on many occasions.

Does that mean the regression analysis is wrong?

Let’s put it this way. If demand for premium priced smartphones is rising, then wouldn’t you expect the company producing those smartphones to be fundamentally stronger at the end of the year (all else equal)? And wouldn’t you also expect improving fundamentals to be reflected in the share price?

Well, our analysis is simply attempting to capture that relationship since the hash rate is an important mining fundamental that reflects the health of the Bitcoin network.

The model we have developed is trying say that if in the past the fundamentals of Bitcoin was X and the price was Y, then shouldn’t the price of Bitcoin be Y now given the state of its fundamentals?

When institutional investors analyse investments they need to understand the state of the underlying fundamentals to establish how much capital to allocate for a given level of perceived risk.

Bitcoin’s fundamentals are supported as long as the network is becoming more secure and as long as more miners continue to invest in faster equipment. And after all, why would miners continue to invest in expensive equipment and processors if they thought Bitcoin does not have a future?

Why is the 9 month hash rate significant?

That’s what our regression analysis indicated..

Market expectations

After all, it is not uncommon for market participants in traditional capital markets to price future expectations as far as 6-12 months ahead. Therefore we see no reason why the same rationale cannot be applied to Bitcoin.

When investors apply relative valuation techniques to equities they compare the current share price to the company’s forward fundamentals (typically over the next 12 months).

The forward Price/Earnings ratio and the forward EV/EBITDA are popular valuation multiples used by fundamental analysts to determine whether a stock may be undervalued or overvalued from a historical perspective as well as against a peer group.

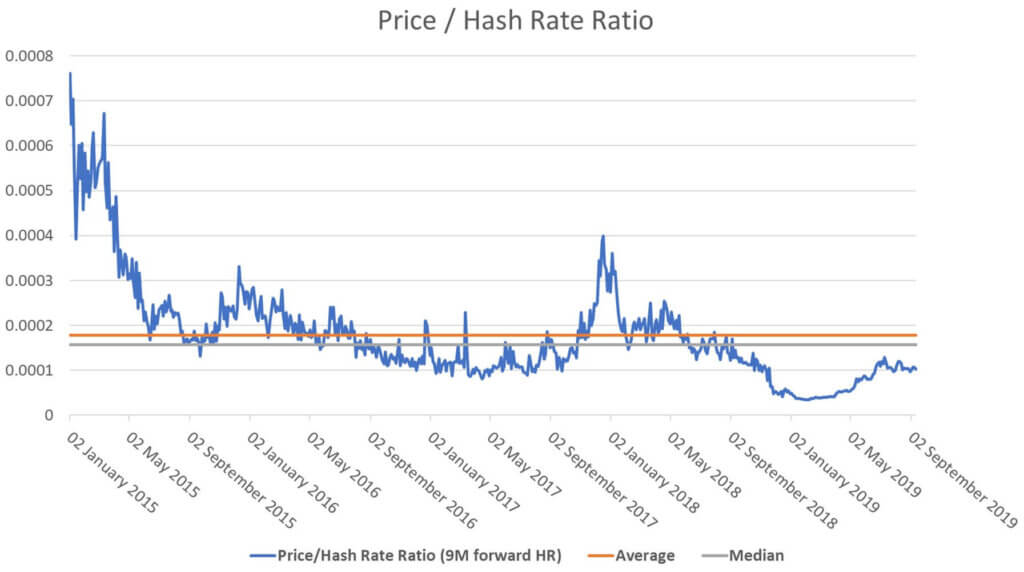

So what would a Forward Price-to-Hash Rate Ratio for Bitcoin look like?

Forward Price to Hash Rate Ratio

It’s actually really interesting to note that since January 2015, the forward price to hash rate ratio has exhibited a mean reverting tendency around a median P/H ratio of 0.0018x and arithmetic average of 0.0016x. This could suggest the price of Bitcoin could be undervalued.

We have chosen to observe this ratio from January 2015 because we wanted to eliminate prior price bubbles and much of the previous distortions.

Also the market was more illiquid in the past and we felt that four years of data is sufficient enough to make a meaningful observation.

We note that during periods of irrationality, particularly during bubbles and busts, statistical models and fundamentals tend to break down as powerful emotions such as greed and fear create conditions whereby the value and price of an asset temporary diverge before re-converging when the market returns to a stable condition

Market inefficiencies

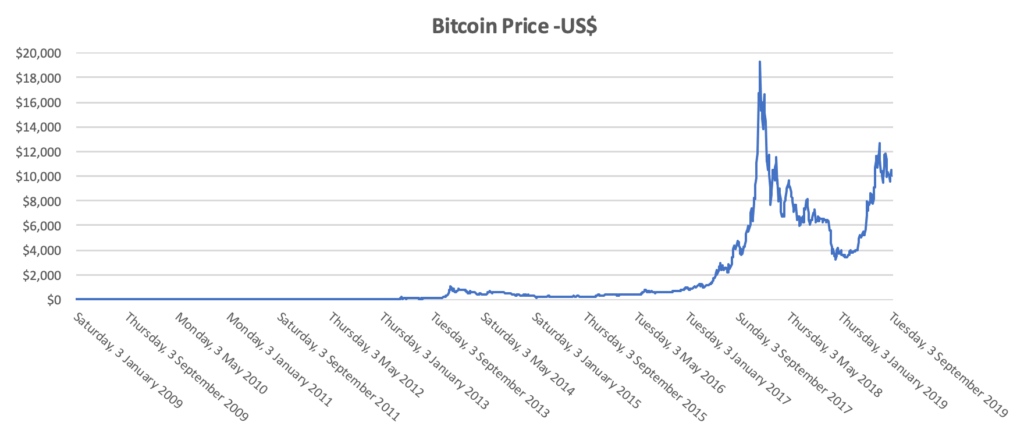

The chart below shows the price of Bitcoin since inception, and although it is not very visible, Bitcoin has gone through many bubbles and busts.

Depending on how you may define a bubble, Bitcoin has gone through at least 4 major bubbles and busts over the past decade, and perhaps a few more if you lower the threshold to account for gains that were less than 1000%.

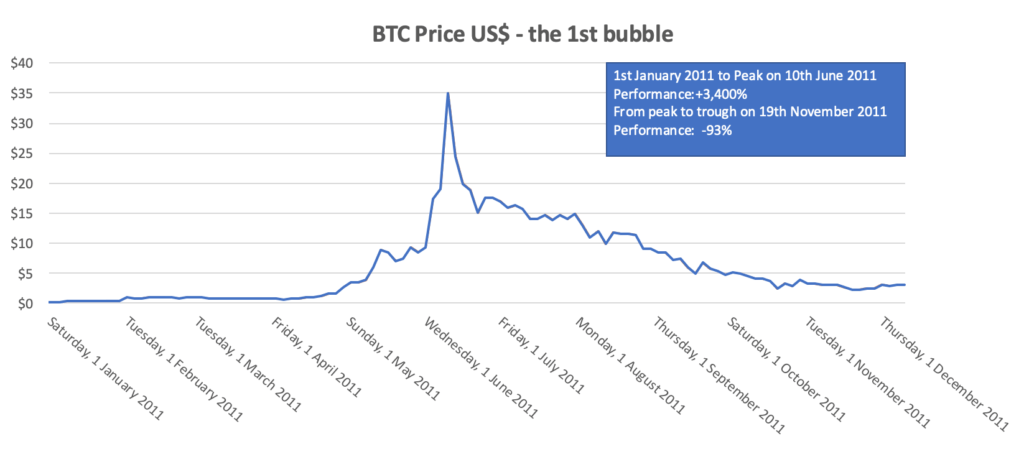

The first major bubble occurred in 2011, when the price of Bitcoin shot up from almost nothing to $35, resulting in a stratospheric rise of 3,400% (or slightly higher depending from where you are measuring the base) before crashing 93%.

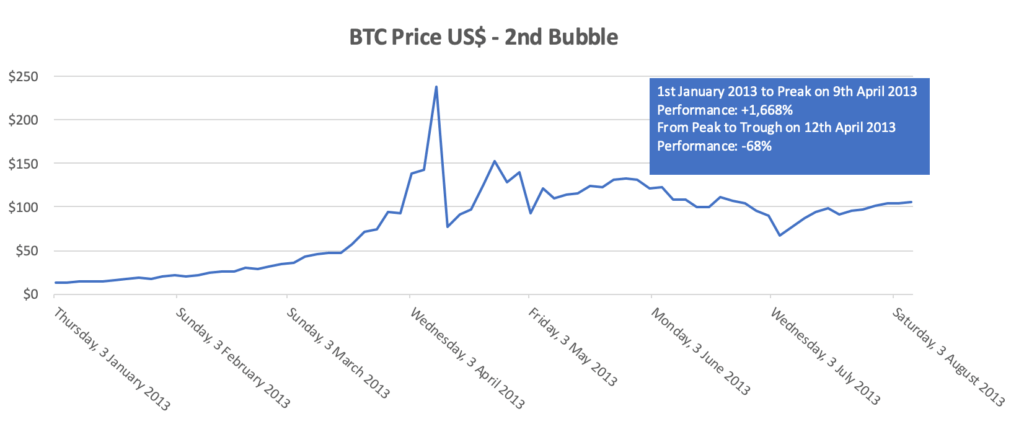

The second bubble occurred in 2013, when Bitcoin soared 1,668% to $238-$240 before crashing 68%.

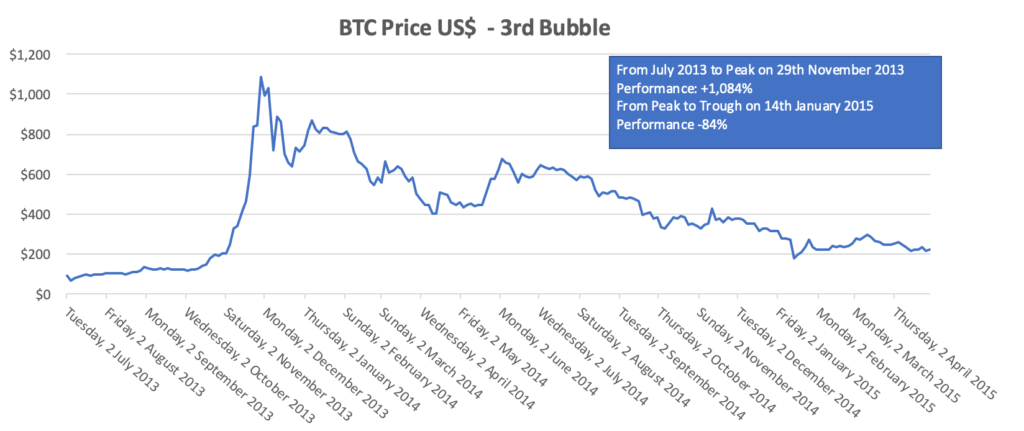

The third bubble occurred shortly after the second, with the price of Bitcoin spiking 1,084% before retreating 84%.

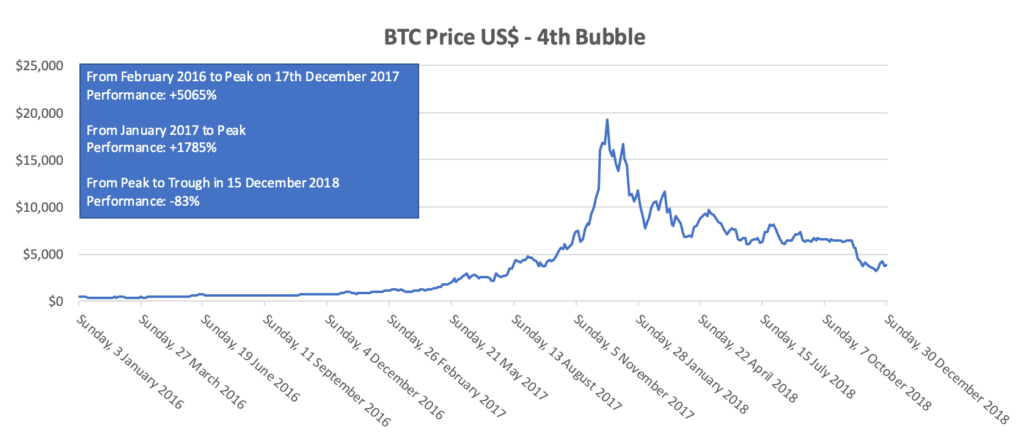

The fourth bubble that occurred in 2017 saw the price of Bitcoin spike over 5,000% (or 1,800% depending from where you take the base).

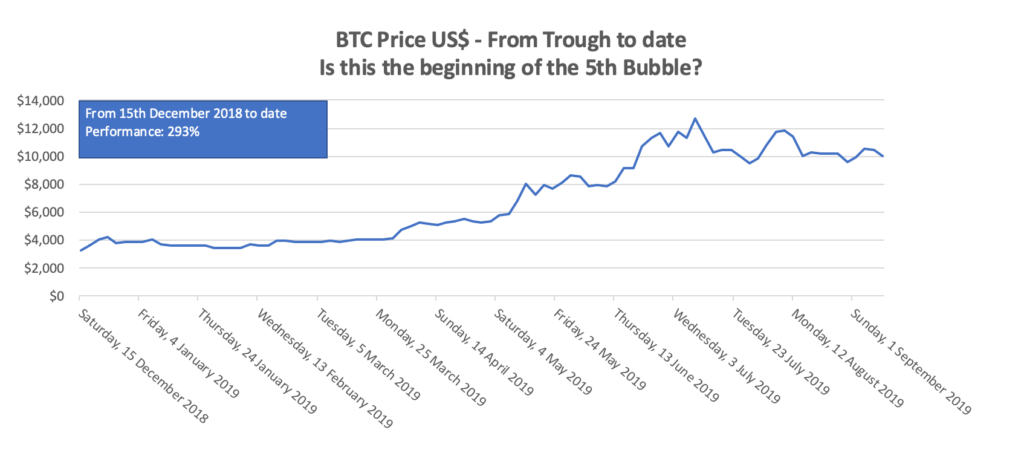

And between December 2018 to date, the price of Bitcoin is up by 293%.

The bubbles and busts that Bitcoin has gone through in the past, especially during the early years are a byproduct of market inefficiencies.

However, as regulators have been increasingly looking into this space, and as more institutional investors enter the market, Bitcoin is obtaining deeper liquidity as well as improved price transparency and discovery. All of these factors are contributing to an overall improvement in market efficiency.

What does the forward 9-month hash rate foretell?

We have modelled Bitcoin’s price (yellow line) based on our regression model that uses the 9-month forward hash rate and then compared it with the actual USD price of Bitcoin (orange line).

The chart below interestingly provides evidence of a reversion occurring between the actual price of Bitcoin and the modelled price of Bitcoin. We may clearly observe the actual price of Bitcoin (orange line) moving towards the modelled price of Bitcoin (yellow line) on multiple occasions since 2015.

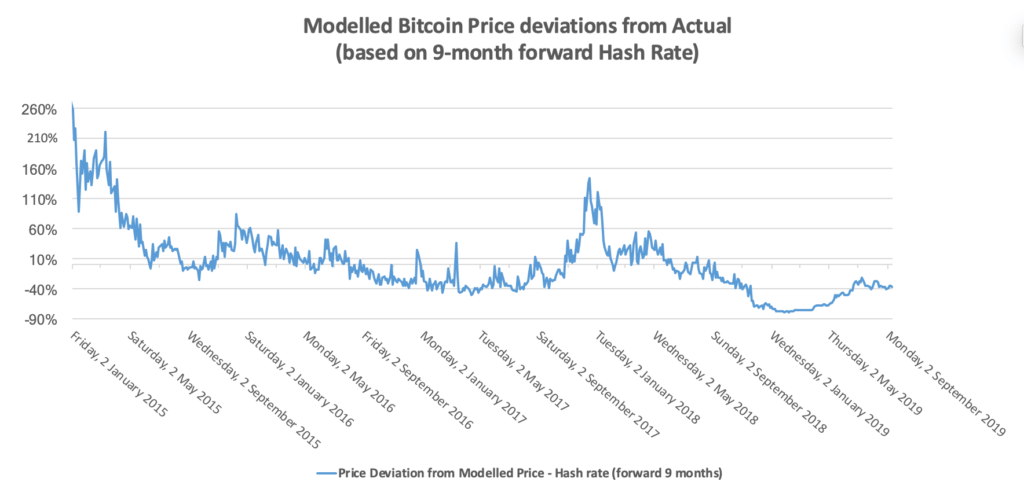

Meanwhile, the chart below shows the percentage difference between the modelled price of Bitcoin and its actual price. For example, in January 2015 the actual price of Bitcoin was between 100% and 200% above the modelled price of Bitcoin (based on the regression model we developed). However, in less than a year the price had moved back to 0%, with some periodic over and undershooting.

The same level of reversion is apparent throughout the entire period, suggesting the modelled price may carry some weight in predicting the fair value of Bitcoin.

Assuming the model still holds, it would appear the price of Bitcoin remains at least 60% undervalued based on the current hash rate of 100 million. Based on the model we have developed the fair value of Bitcoin would equate to $16,432 (or higher if the hash rate is above 100 million in 9 months time). We have placed a calculator below so you may have a go at simulating a hypothetical Bitcoin price (based on a changing hash rate value).

Where to Buy Bitcoin?

| Key Points: | Buy Bitcoin: | |

|---|---|---|

| ⭐ One of the best crypto exchanges in the market right now! ⭐ High on security and safety (SAFU, 2FA, etc..). ⭐ Largest selection of cryptos to trade. ⭐ Ability to buy crypto with fiat. | |

| | ⭐ leading social trading platform, trusted by millions of users from more than 140 countries. ⭐ Wide variety of trading options (crypto, stocks, ETFs, forex, commodities, etc...) ⭐ Copy the trades of top performing traders and portfolios! ⭐ 0% commissions on all stocks! | |

| ⭐ Legitimate crypto exchange and trading platform. ⭐ Low trading and exchange fees. ⭐ Free practice demo account with 50,000 USDT. ⭐ Make your first deposit and receive a 25 USDT Welcome Bonus. | |

| Disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not an indication of future results. Cryptoassets are volatile instruments that can fluctuate widely and therefore are not appropriate for all investors. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework. eToro USA LLC does not offer CFDs. eToro USA LLC makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. This publication has been prepared by our partner utilizing publicly available non-entity specific information about eToro. | ||

If you enjoyed reading this post, you may also want to read our previous research article Is the hash rate a good predictor of Bitcoin’s price.

If you enjoy reading our updates and analysis then start following us on Twitter now join our new Reddit Community.