Flash Alert: Wednesday 2nd October

Bitcoin lost the perfect opportunity to regain a footing above the 200-day moving average yesterday, leaving the bulls feeling somewhat disheartened today.

Over the last 24-48 hours we have seen Bitcoin struggle each time it reached the 200-day moving average, with the $8,500 level acting as a resistance barrier, suggesting the rhetoric remains very much skewed to the downside.

The price action we described is illustrated as a bearish harami, apparent on the daily candlestick charts between Monday and Tuesday.

At the time of writing today, BTCUSDT was trading at $8,198 following an earlier intra-day high of $8,330 and low of $8,161.

We note the earlier intra-day high was not too far away from the 7-day EMA of $8,357, suggesting short-term daily moving averages are beginning act as resistance.

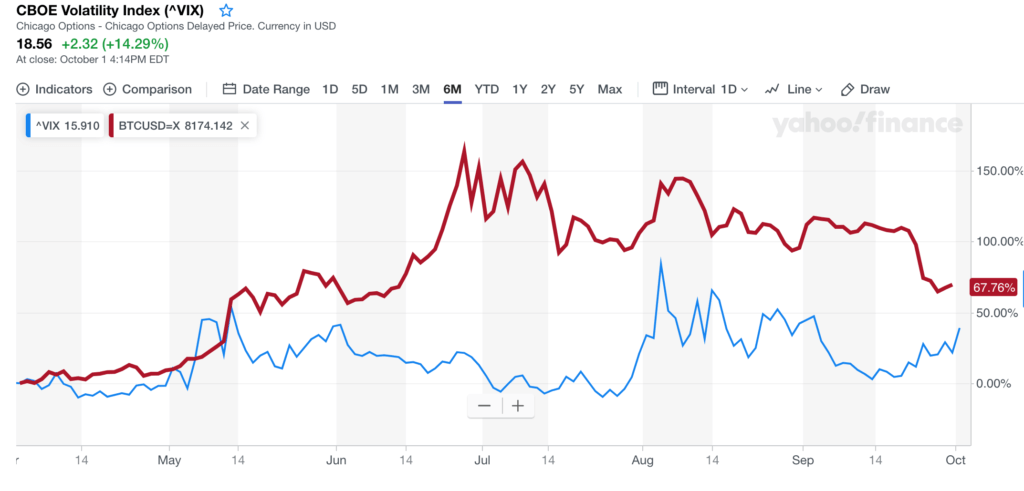

We have also observed an inverse correlation between the Volatility Index (VIX) and the price of Bitcoin, as you may see from the chart below.

The VIX, which is informally referred to as the ‘fear index‘, is a popular measure of the stock market’s expectation of volatility, as implied by S&P 500 index options.

But this observation is interesting because it helps to dispel the notion that Bitcoin is a safe-haven asset. This means we could see more selling pressure hit Bitcoin as profit-taking across stock markets accelerates and general investor sentiment deteriorates.

Based on the price action we are seeing at the moment, we would not be surprised to see BTCUSDT revisit the $8,000 level today.

And at this juncture we also continue to remain bearish on Bitcoin, expecting the price to drop to $7,500 eventually, with the risk of a more pronounced decline to $6,500-$6,200.

As per our previous posts, we reiterate that we will continue to evaluate whether Bitcoin’s recent declines will act as a springboard to help it potentially reach new record highs.

We have documented Bitcoin’s historical price performance pre-and-post halving and are very eager to understand whether BTC will have a similar reaction to the upcoming halving in May 2020.

In the meantime, anyone interested in reading our previous Flash Alerts may do so here as they continue to remain valid and provide a good trail for anyone wanting to catch up with recent price action.

A follow up post to this Flash Alert may be found here.

If you enjoy reading our updates and analysis then start following us on Twitter.

If you’re thinking about trading bitcoin then visit our bitcoin price analysis page. Here we periodically provide interesting bitcoin price insights and analyses that every crypto trader and investor should be aware of.