Flash Alert: Monday 30th September

We continue to reiterate – never try to catch a falling knife.

The charts currently suggest that bearishness will continue to intensify, so if you’re HODLING or trading – do so cautiously. Risk management is pivotal!

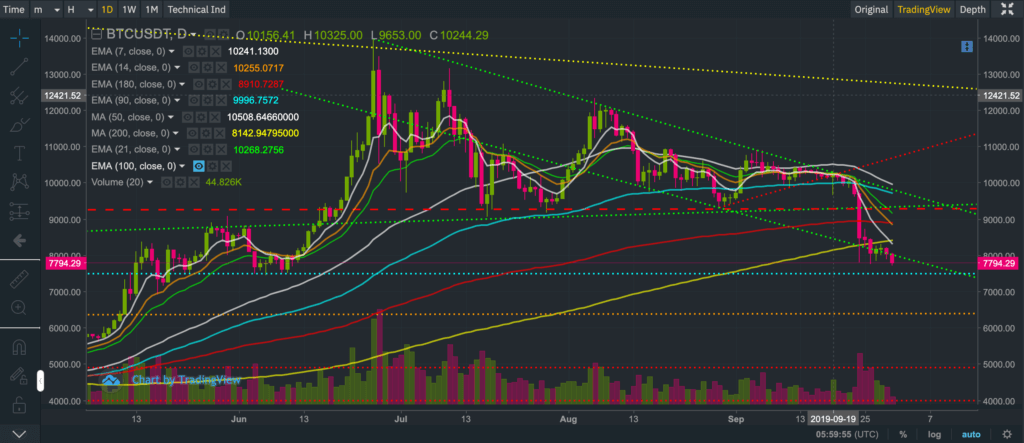

BTCUSDT has continued to drift further away from its 200-day moving average, currently $8,415.

At the time of writing BTCUSDT was trading around the $7,790 mark following an earlier intra-day low of $7,710 and high of $8,056.

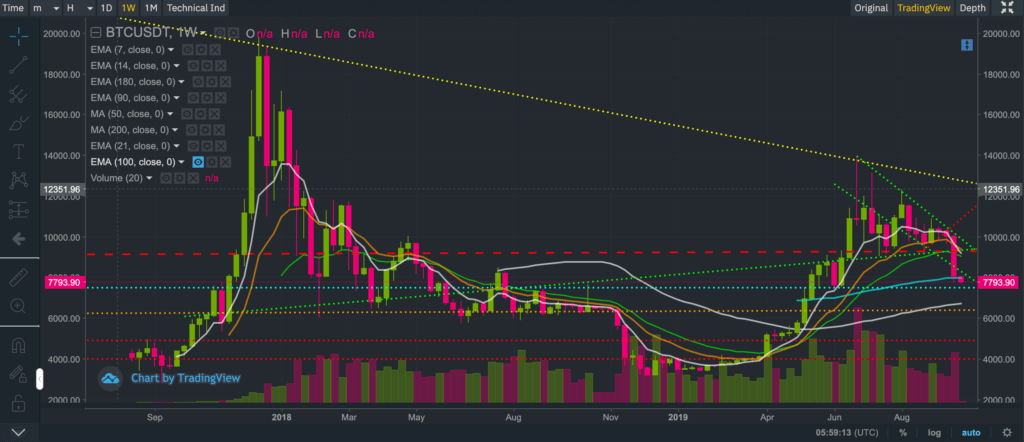

The monthly chart (above) speaks volumes in terms of bearish momentum and illustrates just how important the $7,500 level is for Bitcoin. If Bitcoin closes below this key support level, then more pronounced declines are very likely to ensue.

The weekly chart (below) is even more bearish for Bitcoin , suggesting $6,200-$6,500 are even more likely short-term scenarios.

The daily chart (below) suggests $7,500 is in easy reach, now even more than ever of course. There’s even the potential of seeing $6,200-$6,500, if $7,500 is violated.

The hourly-chart (below) indicates that sentiment is currently bearish, and intensifying.

Barring any possible short-term rebound, we remain very bearish on the overall price trajectory of Bitcoin in the short term.

We are, nonetheless, evaluating whether the declines we are witnessing at the moment will act as a springboard to help Bitcoin reach new record highs, keeping in mind historical price performance pre-and-post halving.

We reiterate this is of course a hypothesis for the time being and will be re-evaluating this view, so do stay tuned.

In the meantime, anyone interested in reading our previous Flash Alerts may do so here as they continue to remain valid and provide a good trail for anyone wanting to catch up with recent price action.

A follow up post to this Flash Alert may be found here.

If you enjoy reading our updates and analysis then start following us on Twitter.

If you’re thinking about trading bitcoin then visit our bitcoin price analysis page. Here we periodically provide interesting bitcoin price insights and analyses that every crypto trader and investor should be aware of.