Binance has made its first step into the world of zero-commission stock trading and investing, with a crypto twist, recognising that a significant portion of its user base also has active fractional stock investment accounts with the likes of Robinhood and Revolut.

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrency investing is unregulated in most countries with no consumer protection. Cryptocurrency investing carries a substantial risk and is not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

On 12th April 2021, Binance announced it will be offering zero-commission, tradable stock tokens, allowing users to trade fractional stocks through its platform.

The announcement explained that stock tokens will be denominated, settled, and collateralized in BUSD, a US-regulated stablecoin that is pegged to the U.S. dollar and issued by Paxos Trust Company.

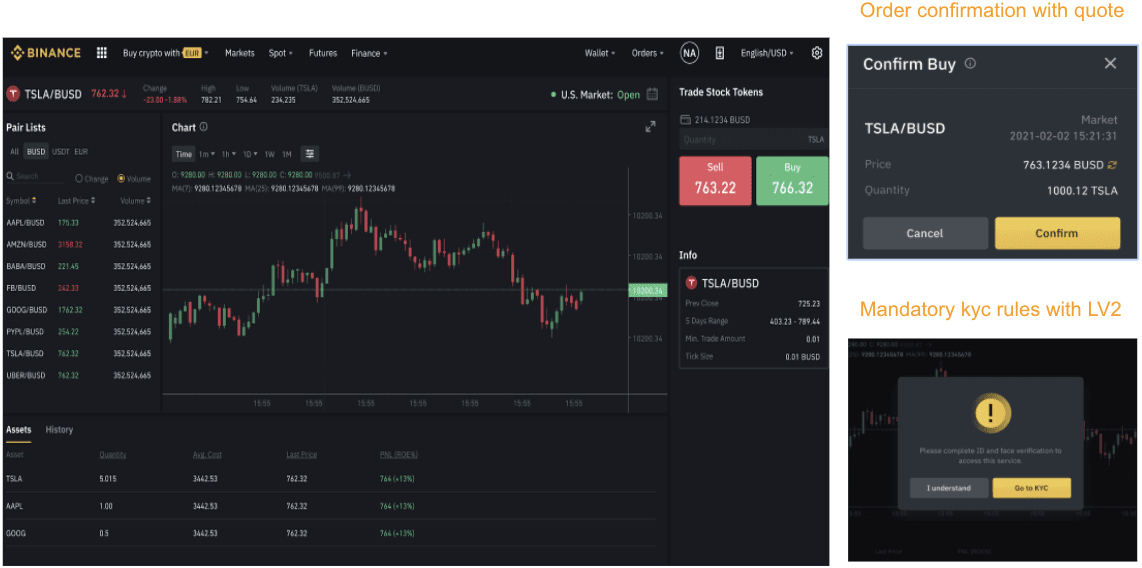

The first tradable stock token will be Tesla (NASDAQ: TSLA), which is currently trading around $700 a share. So instead of purchasing a full, traditional share, for which custody of a physical share certificate is required, Binance users will be able to purchase as little as one one-hundredth of a Tesla share represented by a digital token.

Trading of ‘TSLA/BUSD‘ is scheduled to start today at 1:35 PM (UTC).

It is understood that each digital token will represent one share of equity stock and will be fully backed by a depository portfolio of underlying securities that represents the outstanding tokens. Furthermore, holders of stock tokens qualify for economic returns on the underlying shares, including potential dividends. However, stock tokens are not redeemable for shares.

So, what are the benefits of Tradable Stock Tokens, you may ask?

1. Fractional share investing (through tradable stock tokens) removes barriers to entry for those who want to add high-value shares such as Amazon, Tesla and Google to their portfolio. Now investors can have a piece of Tesla stock (with the same participation rights of owning 1 stock) without the need to fork out $700+ a share.

2. By adding stocks that were previously unattainable (due to a high nominal price per share) investors can now add a greater variety of stocks to their portfolios. This helps to increase portfolio diversification benefits.

3. Fractional shares incentivise investing since idle cash sitting dormant can be invested more effectively in blue-chip investments. And now, Binance has opened up a whole new world for crypto investors to explore.

4. Fractional investing is effectively a way for crypto investors to asset back their cryptocurrency portfolios.

Stock Tokens: Frequently Asked Questions

What are Stock Tokens?

Stock tokens are simply cryptocurrency tokens that are backed by physical shares of publicly traded securities. This helps to explain why the price performance of stock tokens closely mirror the price performance of the underlying publicly-traded securities; a given move in the price of the underlying stock price will result in an identical move in the price of the stock token.

By definition, stock tokens are asset-backed cryptocurrencies (essentially delta-one derivatives) since their value is derived from the underlying price of tradeable securities.

How do Stock Tokens work?

Three parties are involved in this process; in this case Binance and its third-party financial partners CM-Equity AG, a licenced investment firm in Germany, and DAAG Digital Assets AG, a Swiss-based asset tokenisation platform.

Each stock token is fully backed by physical shares that are held by CM-Equity AG, which then entrusts the acquired shares to a third-party brokerage firm for custody. In addition, CM-Equity AG monitors all trading activity for compliance.

Asset backed

Each digital token represents one share of equity stock and is fully backed by a depository portfolio of underlying securities that represents the outstanding tokens.

Fractionalisation

Users will be able to trade fractional tokens, which means that they do not have to purchase 1 whole stock but rather a fraction of 1 token (as little as one one-hundredth of a share). Fractionalizing a highly sought-after asset class of publicly tradable equities into more affordable units enables greater financial participation.

Cash Settled

Stock tokens on Binance are denominated, settled, and collateralized in the BUSD stablecoin, simplifying the calculation of returns.

Since tokens are cash-settled there is no physical redemption of underlying shares. This means users can only sell back their tokens to the market on Binance and receive an equivalent worth in BUSD.

Non-fungiblility

Binance stock tokens are non-fungible, which means stock tokens cannot be swapped for the underlying physical share that is being tracked.

Transferability

Tokens are not transferable to other exchanges. Users can only buy and sell stock tokens on Binance.

Dividend Entitlement

Holders of stock tokens qualify for capital returns on the underlying equity, including potential dividends and stock splits, as they would from holding traditional shares.

Trading hours

Stock tokens follow traditional stock exchange trading hours.

Since Tesla stock is traded on the NASDAQ stock exchange, the trading hours on Binance will mirror the underlying exchange (NYSE/NASDAQ = 9:30 am – 4 pm EST).

There will be no price updates or orders permitted outside of trading hours.

Why trade Stock Tokens instead of shares?

Users can purchase fractional shares of the listed companies with stock tokens (instead of purchasing an entire share), which improves flexibility and opens market access to users who cannot afford to purchase fully paid-up shares.

In addition, Binance does not charge a commission for stock token transactions, offering traders the opportunity to save money on fees.

Token holders are also entitled to dividends and other economic benefits of holding the underlying stock. However, token holders are not entitled to voting rights.

In general, stock tokens are ideal for Binance users who may want to diversify their crypto investment portfolio. It may also be ideal for users who are unable to open a stockbroker account or find the process too cumbersome.

Who can trade Stock Tokens?

Binance users must complete Level 2 KYC, including ID and face verification, to be eligible to trade stock tokens.

For German users, a Level 3 KYC verification is required (proof of address, more advanced identity checks, complete risk assessment, and suitability questionnaire).

Users from Mainland China, Turkey, the U.S, and other restricted jurisdictions are prohibited from trading stock tokens.

How to trade Stock Tokens on Binance?

You may trade stock tokens on Binance in 3 simple steps:

- Make sure to complete Level 2 KYC verification (Level 3 for German users) to be able to trade.

- Deposit BUSD in your “fiat and spot” wallet

- Go to stock tokens page, choose the token you want to trade, and then click “Trade“.