Here you can compare stablecoin savings accounts and the platforms offering the most attractive annualized rates of return to help you maximise your passive income generation.

If you’re new to stablecoin investing, then read our extensive guide below to better understand the risks.

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

Best USDT Interest rate [Latest]

| Crypto Lending Platform | USDT Interest Rate (Annualised Return) | Sign up |

|---|---|---|

Nexo | 10.00%-12.00% APR | Start Saving |

Youhodler | 10.70% APR | Start Saving |

Best USDC Interest rate [Latest]

| Crypto Lending Platform | USDC Interest Rate (Annualised Return) | Sign up |

|---|---|---|

Nexo | 10.00%-12.00% APR | Start Saving |

Youhodler | 10.30% APR | Start Saving |

Best BUSD Interest rate [Latest]

| Crypto Platform | BUSD Interest Rate (Annualised Return) | Sign up |

|---|---|---|

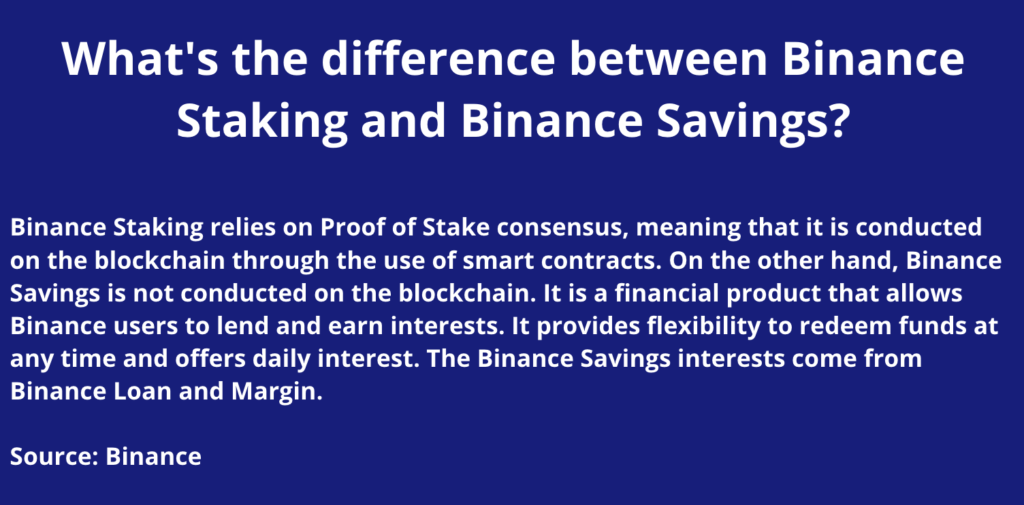

Binance | <13.33% APR | Start Saving |

Youhodler | 9.00% APR | Start Saving |

Bitrue | 4.00% APR | Start Saving |

The table below provides a full comparison!

Compare Stablecoin Interest Rates [Latest]

Updated: January 2023

Table Disclaimer

⚠️ The data and information in our tables are updated periodically and should be used for indicative purposes only. The source data, terms and information in our tables may change without notice so please check directly with the relevant platform first before making any decisions.

💡 Annual Percentage Rate (APR) and Annual Percentage Yield (APY) are commonly used terms that are used express annualised returns. APR simply measures the annualised return without reinvesting the interest (no compounding) whereas APY measures the annualised return after reinvesting the interest (compounding).

Stablecoin Interest Rates on Hodlnaut

Stablecoin Interest Rates on Hodlnaut

⚠️ On 8th August 2022, Hodlnaut announced that it halted withdrawals and token swaps on its platform due to market conditions.

Hodlnaut is a Singapore-based lending platform that is backed by Antler, a global venture capital firm that invests in early-stage companies.

✔️ Available worldwide, including the United States.

✔️ Attractive APR of up to 7.00% on USDT and USDC stablecoins.

✔️ Offers a competitive interest rate on bitcoin savings.

✔️ Deposit as little as $1 to start earning passive income.

✔️ Interest on deposits is calculated daily although paid out weekly (every Monday).

✔️ No lock-up, which means you may withdraw anytime.

USDT & USDC Stablecoin Return Tiers

| Tier | Amount Deposited | APR | APY |

|---|---|---|---|

| 1 | Up to 100,000 | 7.00% | 7.25% |

| 2 | 100,000 – 400,000 | 5.10% | 5.23% |

| 3 | 400,000 – 1,000,000 | 0.50% | 0.50% |

| 4 | Above 1,000,000 | 0.10% | 0.10% |

As you can see, you will receive a flat rate of 7.00% per year up to $100,000 in USDT or USDC. If you decide to deposit more stablecoins, the rate decreases.

Anyone opening a Hodlnaut account can receive a US$30 signup bonus.

The following conditions must be fulfilled in order to receive the bonus:

✔️ Sign up with the referrer’s unique referral link and complete KYC verification.

✔️ Deposit US$1000 or more in any of Hodlnaut’s supported assets.

✔️ The qualifying deposit must be done in a single transaction and from an external wallet.

✔️ The qualifying deposit must be completed within one week of an optional test deposit.

✔️ Maintain a minimum US$1000 account balance for 31 consecutive days.

Read our full Hodlnaut review to learn more about the platform as well as the most recent reduction in withdrawal fees and the new tiered interest rate system!

Stablecoin Interest Rates on Youhodler

Stablecoin Interest Rates on Youhodler

✔️ High-security standards

✔️ Crime Insurance

✔️ Attractive APRs/APYs on crypto savings accounts

✔️ Excellent Trustpilot rating

✔️ Unique trading strategy tools to amplify returns

Youhodler is a European crypto lender, and one of our favorites because they have a wide choice of crypto savings accounts, providing the advantage of diversification, whilst also paying an attractive APR of up to 10.70% on stablecoins.

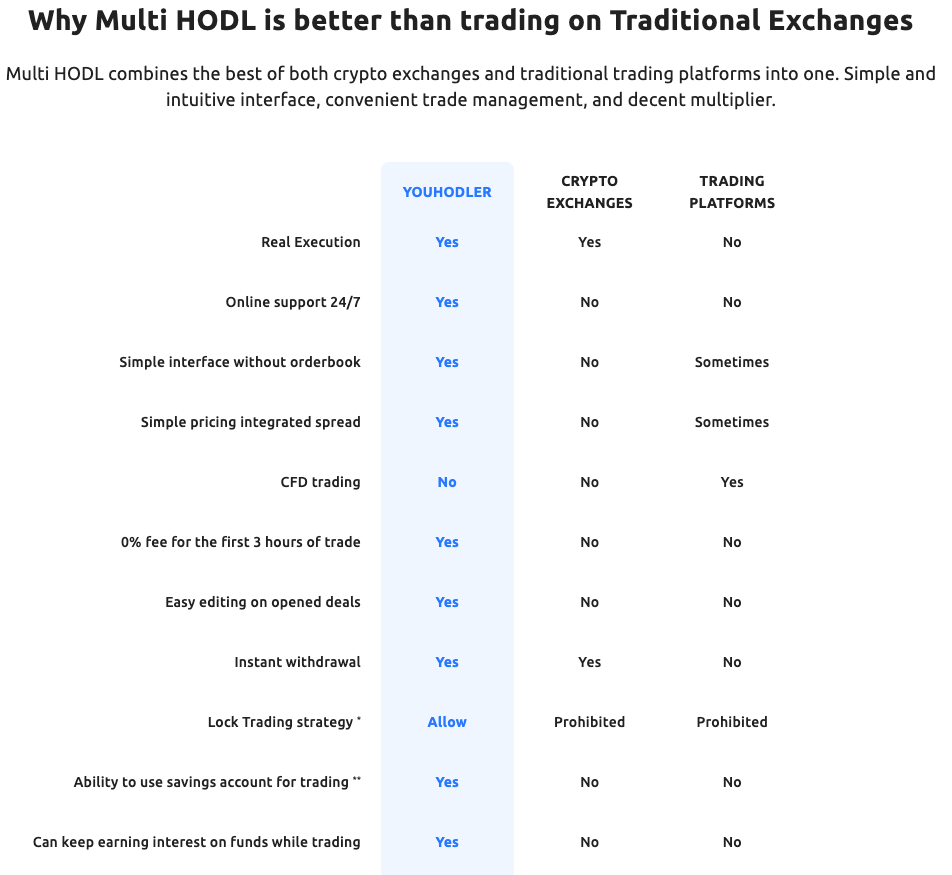

The Youhodler platform also has a unique Multi HODL function that allows users to devise highly attractive crypto trading strategies.

In August 2021 Ledger Vault, the global leader in security and infrastructure solutions for critical digital assets and blockchain applications, entered into an agreement with YouHodler to protect YouHodler’s customers and their digital assets.

This means Youhodler customers benefit from the Ledger Vault’s pooled customized crime insurance program that insures crypto-assets for up to $150 million. This initiative is also led by the prestigious Arch UK Lloyds of London syndicate. The insurance covers different risks, including the risk of employee theft caused by collusion as well as third-party theft of private keys/master seed in the event of a physical breach of hardware security.

Stablecoins, what are they? and what are the risks?

A stablecoin savings account resembles a regular savings account in many ways except it comes with a much higher yield – at least for the moment.

But anything with a higher return will intrinsically carry a higher level of risk. Some diversification and good common sense may help you attain a very decent return by holding stablecoins but you should drum it into your head that they are not risk free.

Stablecoins are digital units of value that rely on stabilisation mechanisms to maintain a stable value relative to one or several official fiat currencies or other assets (including commodities such as gold as well as other crypto-assets too).

These stabilisation mechanisms consist of reserve assets against which stablecoin holdings can be redeemed, known as collateralised stablecoins, and algorithms that match supply and demand to maintain a stable value, known as algorithmic stablecoins.

How stablecoins have evolved over time

Since the value of stablecoins is engineered to be ‘stable’ they were originally used as a relatively safe “parking space” during volatile periods and as a bridge to trade crypto-assets.

Stablecoins are also used as a form of payment via crypto debit cards, although growth has been kept somewhat under check due to scalability and efficiency issues associated with underlying blockchains (e.g. blockchain congestion) and partially also because of stringent KYC and AML requirements.

However, one of the biggest game changers for stablecoins was the rise of decentralised finance (DeFi) applications, which added new uses to stablecoins – such as providing liquidity to decentralised exchanges and centralised crypto lenders.

The current crypto winter has shown us that these new uses may have been overexploited and misused, especially by certain centralised crypto lenders, which are now bankrupt or currently on the brink of bankruptcy.

During the crypto bull market many centralised crypto lenders raised APRs on various stablecoins to unsustainable levels in order to attract more investors. The greater amount of crypto investors parked into these accounts, the more they could lend to speculators.

As a matter of fact, it was not uncommon to find APRs as high as 22% on USDT during the peak of the crypto bull market! Now that we are back in a crypto winter, risk management is high on everyone’s agenda again, and the average APRs on popular stablecoins have fallen to an average rate of approximately 7%-8%.

With central banks from around the world now ramping up interest rates to tame rising inflation, there may be pressure on stablecoin APRs to rise again in order to remain attractive against their underlying fiat counterparts.

These pressures also coincide with a period of rising global economic and financial uncertainty as well as the imminent introduction of central bank digital currencies (CBDCs) as well as tightening crypto regulation.

Recent developments have shown us that stablecoins are anything but stable, as exemplified by the crash of TerraUSD (at one point in time – the most popular algorithmic stablecoin) and the temporary de-pegging of USDT (the most widely used collateralised stablecoin).

Amid a general downturn in the crypto-asset markets, TerraUSD completely lost its peg to the US dollar on 9th May 2022 and consequently crashed to a price below USD 10 cents. Meanwhile, the price of Tether (USDT) came under pressure on 12 May, with the largest stablecoin temporarily losing its peg.

These developments and observations indicate that you should be extremely cautious about the crypto platforms to trust but also to remove the notion that stablecoins are risk free – because they are not!

We also recommend you read our stablecoin guide to familiarise yourself with the different types of stablecoins.

💡 Incorporate the high-interest income generated from stablecoin savings accounts into your crypto trading strategy. Click here to learn how a hedge fund manager may utilise high-yielding stablecoins savings rates to offset potential losses in risky crypto assets.

Stablecoin risks

No bankruptcy protection

![]() As you may already know, deposits made to bank accounts are protected by federal deposit insurance (usually insuring up to a certain amount) so if the bank that you hold your fiat money fails, all or (a proportion) of your funds will be returned to you. You will not have the same level of protection and insurance when parking funds in unregulated cryptocurrency platforms.

As you may already know, deposits made to bank accounts are protected by federal deposit insurance (usually insuring up to a certain amount) so if the bank that you hold your fiat money fails, all or (a proportion) of your funds will be returned to you. You will not have the same level of protection and insurance when parking funds in unregulated cryptocurrency platforms.

Hacks and scams

![]() Cryptocurrency platforms have been prone to major hacks and scams while many do not have any insurance policies in place to protect your funds. So, of course, you must recognise all of these risks if you plan to tie up a proportion of your wealth in a cryptocurrency exchange or wallet for a prolonged period of time.

Cryptocurrency platforms have been prone to major hacks and scams while many do not have any insurance policies in place to protect your funds. So, of course, you must recognise all of these risks if you plan to tie up a proportion of your wealth in a cryptocurrency exchange or wallet for a prolonged period of time.

Counterparty Risk

![]() Counterparty risk is also important to understand. Platforms offering crypto savings products are able to pay savers a proportion of the interest they earn from lenders. If many borrowers default on their crypto loans then that could result in bankruptcy and crypto savers losing all of their assets (e.g. crypto lender Celsius Network recently filed for Chapter 11 bankruptcy following a liquidity crisis.) The level of distress would very much depend on the risk management procedures in place at different platforms – so always choose your platforms wisely and consider diversifying by holding a portion of your crypto assets across various platforms that you trust.

Counterparty risk is also important to understand. Platforms offering crypto savings products are able to pay savers a proportion of the interest they earn from lenders. If many borrowers default on their crypto loans then that could result in bankruptcy and crypto savers losing all of their assets (e.g. crypto lender Celsius Network recently filed for Chapter 11 bankruptcy following a liquidity crisis.) The level of distress would very much depend on the risk management procedures in place at different platforms – so always choose your platforms wisely and consider diversifying by holding a portion of your crypto assets across various platforms that you trust.

🔎 Interested in seeing the savings rates for the wider market? Visit our crypto savings account page to compare rates on the entire savings market or if you’re looking for a more focused analysis on Bitcoin then visit our bitcoin interest rate page.

🔎 Are you searching for higher-yielding accounts? Visit our crypto staking and yield farming pages!

Stablecoin Savings Calendar

Here you get the latest stablecoin savings news and announcements from trusted providers – all in one place!

| Dates | Recent and Upcoming Crypto Savings Announcements |

|---|---|

| 8th August 2022 | ⚠️ Hodlnaut halts withdrawals and token swaps today due to market conditions! |

| 18th April 2022 | ⚠️ Hodlnaut interest rate changes! The max APR and APY on most of its existing stablecoin assets have been lowered with the exception of UST, which was recently added with an APY of 13.86%. |

| 15th April 2022 | 🔥 TerraUSD (UST) stablecoin introduced on Binance Locked Staking with an APY of up to 25%! |

| 31st March 2022 | BUSD APYs are raised to 13.33% on Binance DeFi Staking. |

| 16th March 2022 | USDT and BUSD APYs are raised to 10% on Binance Flexible Savings. |

| 4th February 2022 | USDT, USDC and DAI stablecoins with excellent annualised yields of 12% are available on AQRU. |

| 18th October 2021 | USDT and USDC 7-day locked savings for first time users raised from 50% to 88%! Promo ends on 18th November 2021. |

| 22nd September 2021 | True USD (TUSD) 14-day locked featured savings product launches on Huobi with an APY of 100%! Eligiblity is on a first-come-first-serve basis. |

| 16th September 2021 | USDT fixed earnings deposit of up to 5.88% APY launches on Huobi Earn. |

| 6th September 2021 | USDC fixed deposit of up to 5.12% is rolled out on Huobi Earn. |

| 11th August 2021 | Ledger Vault, the global leader in security and infrastructure solutions for critical digital assets and blockchain applications, enters into an agreement with YouHodler to protect YouHodler's customers and their digital assets. |

| 4th August 2021 | Hodlnaut introduces tiered APR system today with opportunity to earn an annualized interest rate (APR) of up to 12% on USDT and USDC stablecoins and 8% on DAI. |

| 3rd August 2021 | Hodlnaut reduces withdrawal fees on USDT, USDC and DAI stablecoins among others. |

| 2nd August 2021 | Tether (USDT) and USD Coin (USDC) staking is now available on AscendEX with APRs of 8% respectively. |