With Bitcoin’s hash rate approaching 90 million tera hashes per second, we thought it would be interesting to explore whether there is a correlation between the price of BTC in US dollars and its tera hashes.

| Key Points: | Buy Bitcoin: | |

|---|---|---|

| ⭐ One of the best crypto exchanges in the market right now! ⭐ High on security and safety (SAFU, 2FA, etc..). ⭐ Largest selection of cryptos to trade. ⭐ Ability to buy crypto with fiat. | |

| | ⭐ leading social trading platform, trusted by millions of users from more than 140 countries. ⭐ Wide variety of trading options (crypto, stocks, ETFs, forex, commodities, etc...) ⭐ Copy the trades of top performing traders and portfolios! ⭐ 0% commissions on all stocks! | |

| ⭐ Legitimate crypto exchange and trading platform. ⭐ Low trading and exchange fees. ⭐ Free practice demo account with 50,000 USDT. ⭐ Make your first deposit and receive a 25 USDT Welcome Bonus. | |

| Disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not an indication of future results. Cryptoassets are volatile instruments that can fluctuate widely and therefore are not appropriate for all investors. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework. eToro USA LLC does not offer CFDs. eToro USA LLC makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. This publication has been prepared by our partner utilizing publicly available non-entity specific information about eToro. | ||

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

What we found was actually very interesting from a fundamental perspective.

But lets very briefly run over the basics for those who are unfamiliar with a ‘hash rate’.

What is a hash rate?

During the Bitcoin mining process, blocks of verified transactions must be “hashed” before they can be included into the ever growing blockchain. The hash rate measures the number of times the network can solve a complex algorithm per second and it is therefore considered to be a general measure of the processing power of the Bitcoin network.

Is there a correlation between the price of Bitcoin and its Hash Rate?

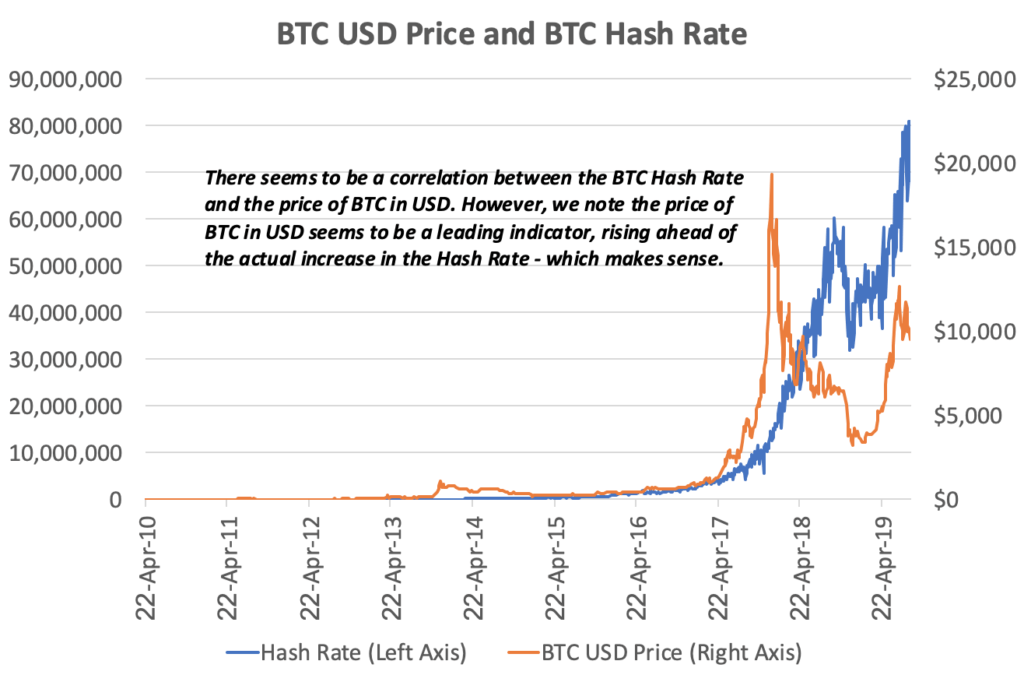

We have crunched the numbers for you and by looking at the chart below, we can see a correlation may indeed exist between the hash rate and the price of Bitcoin.

We are generally weary of these types of analyses since correlations do not not always equate to causation. Although we will take this observation with a pinch of salt, we felt it was refreshing to conduct fundamental analysis on Bitcoin to provide a rough indication of its intrinsic value.

From the chart above, we observe the price of Bitcoin acting as a leading indicator to its hash rate, in other words the market seems to be pricing in the anticipated rise of the network’s hash rate ahead of time. This makes sense because it is after all expectations that move markets.

How long is the lag between the price and the hash rate?

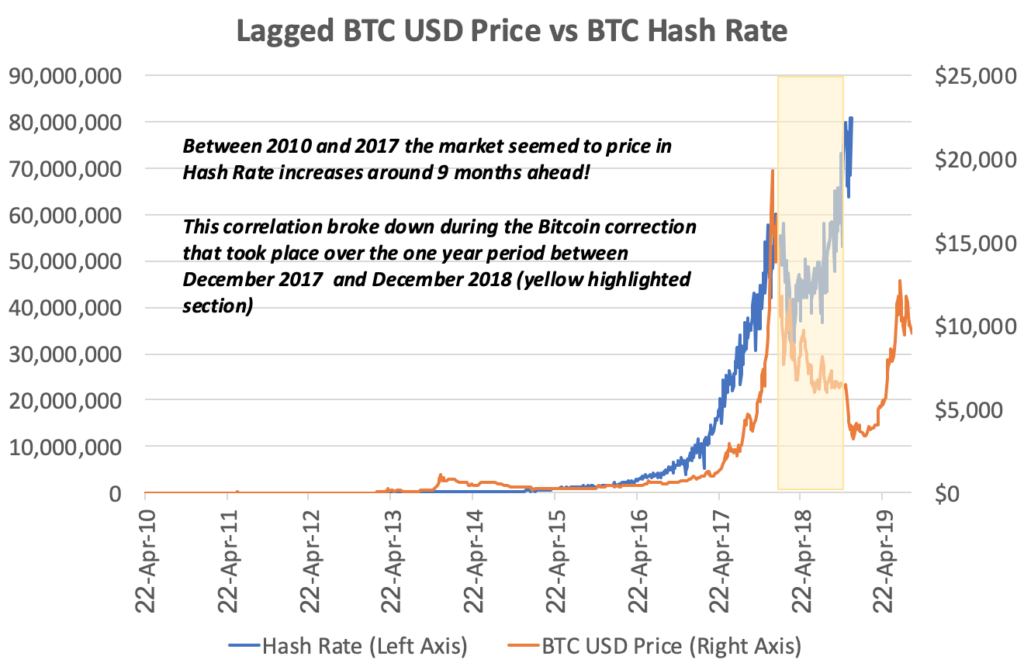

Based on the chart below, it would appear to have been around 9 months! The market is consistently evolving so the time lags may have changed.

We note there was a period when the correlation broke down – and that happened during Bitcoin’s price correction, which started around December 2017. During correction periods, markets go into ‘panic selling mode’ and therefore tend to disregard all fundamentals.

What should the hypothetical price of Bitcoin be based on 90 million tera hashes?

Again, we reiterate the correlation does not always equate to causation. What we hope to achieve is a rough indication of whether Bitcoin may be really undervalued.

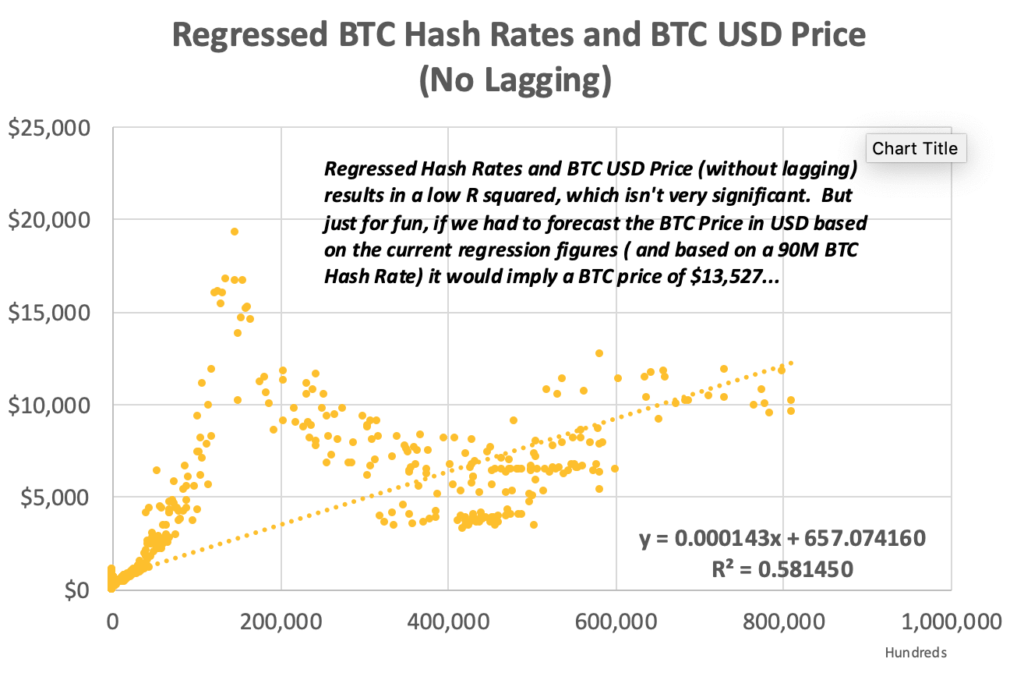

Our first chart does not take into consideration any lagging, and we regress the price of Bitcoin in USD with its hash rate. As expected, the result is not very significant at all although based on this calculation, we obtain a hypothetical Bitcoin price of $13,537.

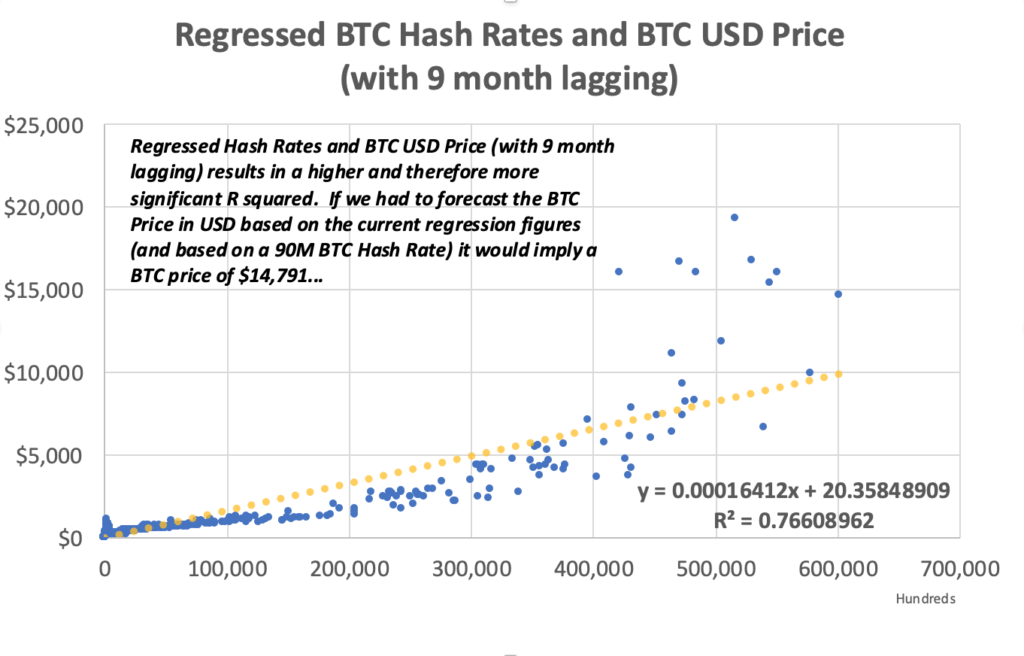

When we regress the BTC Hash Rates with the BTC price in USD (with a 9 month lag), we obtain a more statistically significant result. Based on these figures, we derive a hypothetical Bitcoin price of $14,791

As at the time of writing, the price of Bitcoin was trading at $10,300 on Binance. This compares with a regression result of $13,527 – $14,791 and suggests that Bitcoin may currently be between 31% – 44% undervalued. We have placed a calculator below so you may have a go at simulating a hypothetical Bitcoin price (based on a changing hash rate value).

Where to Buy Bitcoin?

| Key Points: | Buy Bitcoin: | |

|---|---|---|

| ⭐ One of the best crypto exchanges in the market right now! ⭐ High on security and safety (SAFU, 2FA, etc..). ⭐ Largest selection of cryptos to trade. ⭐ Ability to buy crypto with fiat. | |

| | ⭐ leading social trading platform, trusted by millions of users from more than 140 countries. ⭐ Wide variety of trading options (crypto, stocks, ETFs, forex, commodities, etc...) ⭐ Copy the trades of top performing traders and portfolios! ⭐ 0% commissions on all stocks! | |

| ⭐ Legitimate crypto exchange and trading platform. ⭐ Low trading and exchange fees. ⭐ Free practice demo account with 50,000 USDT. ⭐ Make your first deposit and receive a 25 USDT Welcome Bonus. | |

| Disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not an indication of future results. Cryptoassets are volatile instruments that can fluctuate widely and therefore are not appropriate for all investors. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework. eToro USA LLC does not offer CFDs. eToro USA LLC makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. This publication has been prepared by our partner utilizing publicly available non-entity specific information about eToro. | ||

If you enjoyed this article, then you may want to read Making sense of the Bitcoin hash rate: a valuable fundamental indicator for investors for a continuation and more in-depth analysis.

If you enjoy reading our updates and analysis then start following us on Twitter now join our new Reddit Community.