Flash Alert: Thursday 25th September

Bitcoin has had a scolding over the last 48 hours although support appears to be emerging at the 200-day moving average, currently at $8,333.

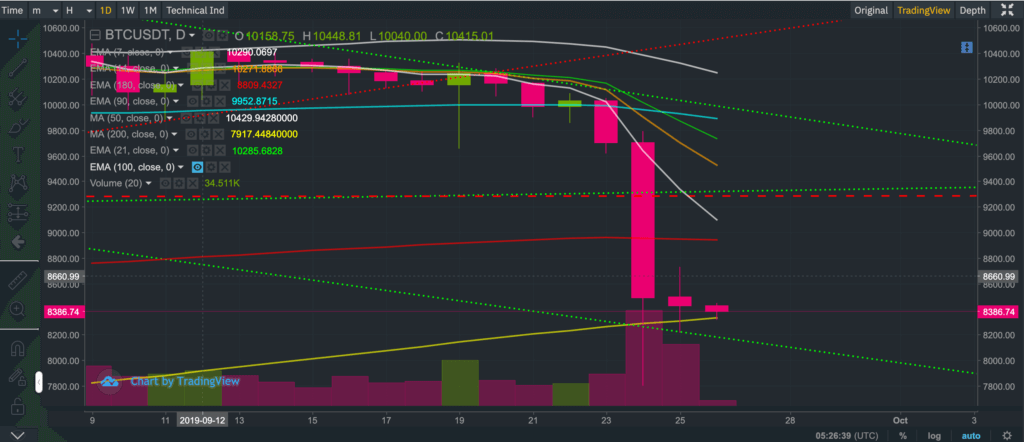

The chart below shows just how well prices are currently remaining supported above the 200-day simple moving average (yellow line) for the time being.

At the time of writing BTCUSDT was trading between $8,384-$8,386, following an earlier intra-day low of $8,317.47 and high of $8,444.3.

In our post yesterday we had mentioned that we cannot discount the possibility of seeing a short-term bounce in the interim period since the RSI is extremely oversold on the daily chart.

Whilst we believe the reasoning remains valid, the 15-minute and hourly charts suggest the BTCUSDT is really struggling to maintain ground. This suggests there is a big risk of seeing BTCUSDT dragged below 200-day simple moving average.

For the time being, we also continue to reiterate our bearish view regarding the trajectory of Bitcoin, and therefore would not be surprised to see the price decline further to $7,500 followed by a further knock to $6,200 – $6,500 levels if support at the $7,500 level is violated.

We also enjoyed reading the most recent Bitcoin analysis produced by Fundstrat, which indicates Bitcoin is mostly driven by retail investors. Contrary to popular belief they also found that the price of Bitcoin does not behave as a safe-haven. A detailed article is available on CCN, here.

Elsewhere in today’s news, an interesting analysis produced by Arcane Research suggests the price of Bitcoin is being manipulated ahead of CME futures contract settlement. You may read this article on Forbes. Further details are here.

We personally agree that until now Bitcoin has been mostly driven by the retail market although it would be interesting to continue following up on this observation since the market for Bitcoin continues to open up to institutional investors.

Furthermore, we have been backtesting models for Bitcoin and gold and have not identified any statistically significant evidence to suggest that correlations between Bitcoin and gold (traditionally perceived as a safe-haven) are strengthening over time.

Therefore, the analysis produced by Fundstrat helps to confirm our observations as well. We will nonetheless continue to monitor the market to understand whether Bitcoin’s safe haven properties are strengthening over time.

In the meantime, anyone interested in reading our previous Flash Alerts may do so here as they continue to remain valid and provide a good trail for anyone wanting to catch up with recent price action.

A follow up post to this Flash Alert may be found here.

If you enjoy reading our updates and analysis then start following us on Twitter.

If you’re thinking about trading bitcoin then visit our bitcoin price analysis page. Here we periodically provide interesting bitcoin price insights and analyses that every crypto trader and investor should be aware of.