Over the past week, we have seen Binance and KuCoin both unveil a savings product allowing users to temporarily lock funds in a ‘special’ 14-day USDT account yielding double-digit annualised returns.

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk. See further disclaimer at the bottom of the page.

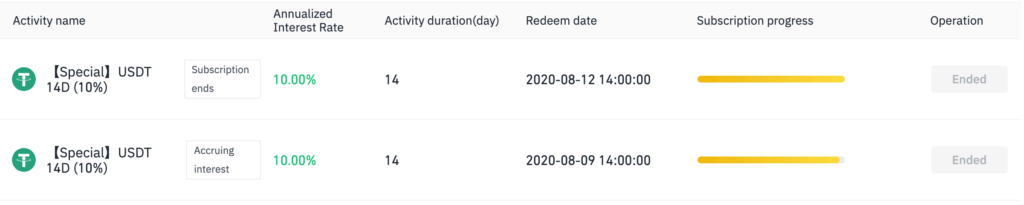

Binance special 14-day USDT Savings Account (10% APR) Oversubscribed!

Anyone who is still interested in participating in the ‘special’ 14-day USDT offer that was unveiled by Binance earlier this week may be a bit too late since the proposition of parking funds in a popular stablecoin that exhibits hardly any daily price fluctuation was too hard to resist.

Since these types of ‘special’ opportunities tend to come with a limited supply, the offerings are very much on a first-come-first-serve basis.

KuCoin rolls out a special 14-day USDT Savings Account with an 18% APR!

Cryptocurrency exchange KuCoin has followed suit with an identical offering although with a materially higher annualised return! I suppose that’s the beauty of rising competition!

KuCoin has unveiled a14-day USDT savings account yielding an APR of 18%, which is currently open although the offer is also on a first-come-first-serve basis.

If 14-days are too long for you, then KuCoin also have a 7-day option yielding an APR of 15%! Not too shabby at all!

Stablecoin savings accounts are becoming increasingly popular, especially amongst those long-sighted crypto investors who prefer to avoid trading and speculation but rather hold and accumulate over the long run.

After all, with interest rates currently in free fall on the back of rising global economic uncertainty, it is not really surprising to see stablecoins savings accounts rise in popularity.

And let’s be frank, long-term returns of the S&P 500 Index have been around 10%-15% (depending on the time horizon) so a stablecoin return of 10%+ is anything but shabby even during good times!

Anyone interested in participating in other forms of passive cryptocurrency investing may also want to consider staking.

CoinMarketExpert compiles staking data from trusted cryptocurrency exchanges and platforms, so why not visit our staking page now to compare the best staking coins.