Flash Alert: Friday 26th September

We want to be clear about the headline.

Bitcoin is currently NOT in a bear market, although there is a risk it may evolve into one if the price remains below the 200-day moving average for a prolonged period.

The last 24 hours

In our earlier posts we had stated that we cannot discount the possibility of seeing a short-term bounce in the interim period since the RSI is extremely oversold on the daily chart.

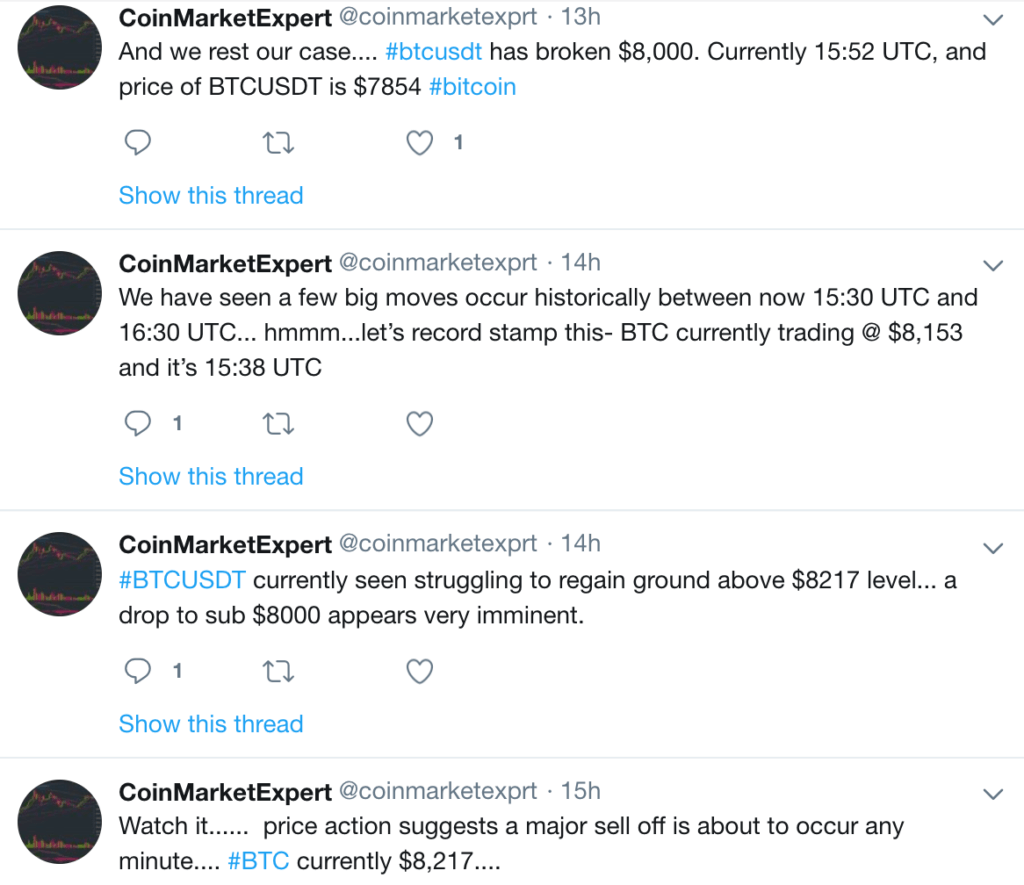

We have been closely monitoring the frail rebound in Bitcoin to understand whether any bounce finds support and therefore we took to Twitter yesterday to let our audience know how the rebound was faring.

We inspected the 15-minute and 30-minute charts and found there was some traction initially, as you may see from the chart below.

However, hours later it all broke down and we reported our observations on both Twitter and Reddit, as we felt it may be valuable for anyone planning to average down or even buy Bitcoin for the first time.

The breakage of intra-day technical levels that we had identified on the charts indicated that sentiment was quickly beginning to stale again.

We did not (and do not) have a crystal ball to know precisely when a big move will be made, although we had picked up on a trend lately; we have been noticing the price of Bitcoin becoming very volatile between 15:30 UTC and 16:30 UTC.

So, after factoring in the technicals and the timing, we made an educated guess that BTCUSDT would drop below the psychological $8,000 level within that timeframe, as you may read from our Twitter feed below. And it did!

As you may imagine, our posts on Reddit were met with many negative reactions from trolls and technical analysis skeptics.

But what we aim to do with these posts is educate our audience by sharing our knowledge and experience of financial market trading and fundamental analysis, which brings us to the next point.

Price and value are not the same thing.

Technical analysis does a great job at capturing market sentiment and price movements. And very often the price of an asset will deviate away from its fundamental value.

However, over the long run, the price of an asset will re-converge with its fundamental value, which is also in a state of constant flux.

This is why we also spend time preparing research posts to understand the driver’s of Bitcoin’s fundamentals:

Making sense of the Bitcoin hash rate: a valuable fundamental indicator for investors

Is the Hash Rate a good predictor of Bitcoin’s Price?

Bitcoin Price Analysis: Pre & Post Halving Event Performance

The conclusion here is that technical and fundamental analysis are both powerful tools that can maximise your ROI. But you must know how and when to apply them, and that requires some experience: which is why we are here to help.

Of course nobody ever gets it 100% right all the time. After all crystal balls haven’t been invented yet!

But if all you do is focus on ‘getting it right‘ you will be doing yourselves a great injustice. Your focus should be on understanding how to manage your own risk properly and to be open to learning from your own mistakes.

So, where is Bitcoin going next?

At the time of writing BTCUSDT was stuck in a trading range of $7,990 – $8,060. So far today, we have seen an intra-day low of $7,912.95 and high of $8,130.

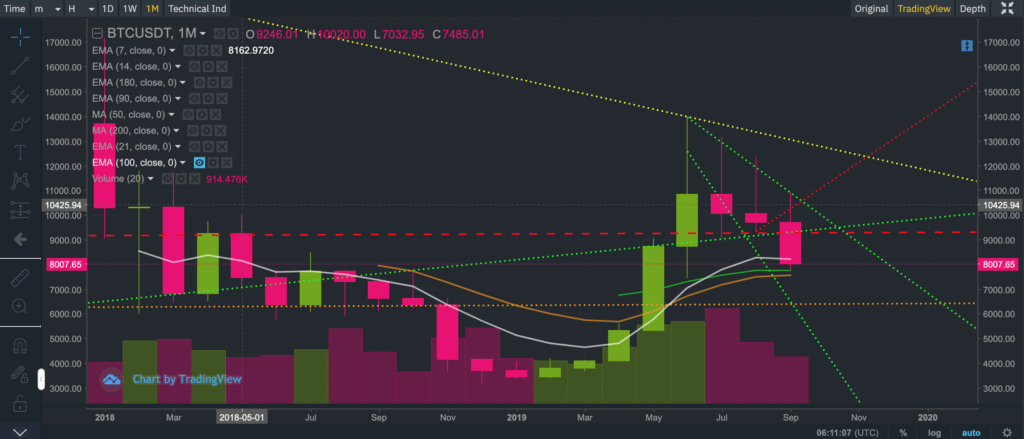

The four-hour chart below clearly shows BTCUSDT struggling to break ground above its short-term moving averages, which suggests the bias for Bitcoin remains to the downside.

But all eyes are on the all important 200-day moving average, currently at $8,353.

If BTCUSDT fails to recover above this level we will most likely see further selling pressure. So unless there is a dramatic change in the tide, we do not discount the possibility of seeing BTCUSDT fall further to $7,500.

If $7,500 fails, we may see BTCUSDT slide further to $6,500 – $6,200. The monthly chart below illustrates these levels better.

Whilst we remain bearish on Bitcoin in the short term, we believe the declines we are witnessing at the moment may very well act as a springboard to help Bitcoin reach new record highs.

This is of course our current hypothesis and we will be re-evaluating this view every step of the way, so stay tuned!

In the meantime, anyone interested in reading our previous Flash Alerts may do so here as they continue to remain valid and provide a good trail for anyone wanting to catch up with recent price action.

A follow up post to this Flash Alert may be found here.

If you enjoy reading our updates and analysis then start following us on Twitter.

If you’re thinking about trading bitcoin then visit our bitcoin price analysis page. Here we periodically provide interesting bitcoin price insights and analyses that every crypto trader and investor should be aware of.