All the ingredients for an epic bitcoin supercycle are in the making.

1/ The bitcoin halving event is around the corner, in April 2024;

2/ bitcoin supply conditions are tight as more bitcoins are being stored off-exchange and;

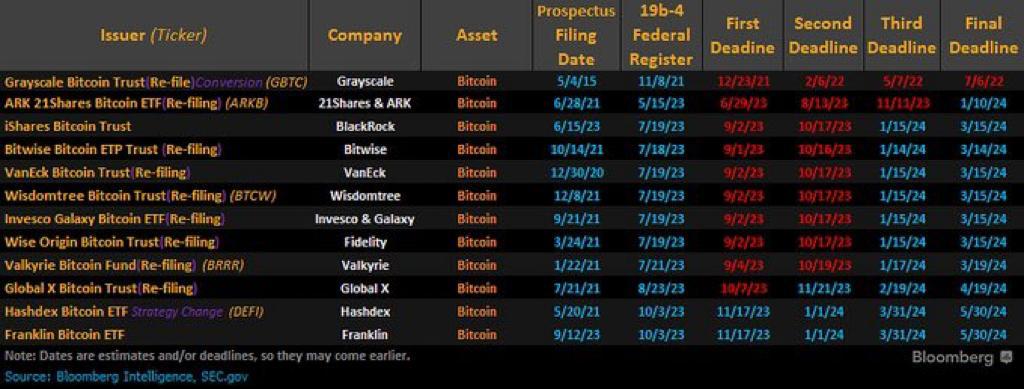

3/ several spot Bitcoin ETFs are pending approval next year by large names such as BlackRock, Fidelity, Invesco, Wisdomtree, Franklin Templeton, Bitwise and many more.

The verdict for BlackRock’s spot Bitcoin ETF is expected as early as January 2024 and the implications are indeed transformational because it redefines bitcoin as a legitimate asset class among institutional investors, which opens up opportunities for pension funds, endowments, and insurance companies to diversify their portfolios and take an allocation in bitcoin. It’s a complete game changer – in a positive way of course – and the anticipation has fuelled a mini-price boom in crypto recently.

Over the past year, the market value of bitcoin has surged 177%. At the time of writing the price of bitcoin was hovering around $43,000, and many have been wondering whether a major correction is underway following the recent price increase.

1/ While markets are pricing in a 90% probability of a spot Bitcoin ETF approval, there is no guarantee that the SEC will grant such approval;

2/ and even if these spot Bitcoin ETFs are approved, how do we know there won’t be a classical “buy on the rumor, sell on the news” price correction following a formal announcement?;

3/ and besides, historically there has ALWAYS been a bitcoin price correction of as much as 50% around the halving event!

You may be thinking about following sound risk management principles and taking profits now, as the balance of probabilities is tilted more towards a short-term correction. But what if it is different this time?

We are in one of the most important transitional periods for Bitcoin and it is not uncommon for market cycles to break or change over time (ever heard of how Long Term Capital Management, Amaranth and Archegos Capital Management ended up when their arbitrage strategies broke down?).

The following sections explore historical bitcoin price trends to extract key data and information that may lie ahead to help us navigate these uncertain times better.

Note – This article has been tailored to cater to both novice and experienced cryptocurrency investors. Feel free to skip over sections that are already familiar to you. Even seasoned investors may find valuable insights within the following sections!

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk.

Bitcoin Halving Price Cycles: Observations About Previous Cycles & Where We Are In The Current Cycle?

Although there are unique catalysts that could make this cycle very different from previous cycles, analysing recurring trends that have consistently emerged will help us consider risk management aspects more carefully.

Bitcoin halving is a major event!

To state the obvious, the bitcoin halving is a major pre-programmed event that occurs approximately every four years. The next one is expected to occur sometime in April 2024. The exact date depends on the network’s hashrate.

During the halving event, the block reward that miners receive to validate and add new blocks to the Bitcoin blockchain, ensuring the network’s security and integrity, is reduced by half – hence the term ‘halving‘. This is a built-in feature of the Bitcoin protocol that is designed to slow down the issuance of new BTC, which increases its scarcity and reduces its inflation (because the total number of bitcoins that will ever exist is capped at 21 million).

The table below shows the previous halving dates as well as the upcoming one.

| Halving Date | Block Reward |

|---|---|

| November 28, 2012 | 50 BTC |

| July 9, 2016 | 12.5 BTC |

| May 11, 2020 | 6.25 BTC |

| April 2024 (estimated) | 3.125 BTC |

The halving event is a bullish catalyst for BTC , as it reduces the supply of new coins entering the market, so all else equal, from a simple economic perspective, the same level of demand (or more) stands to push prices higher.

As we approach the forthcoming Bitcoin halving, I have analysed the charts below, illustrating bitcoin’s log price trends across the three previous halving cycles to attain potential insights into what may be ahead. Although each cycle exhibits a strong resemblance, it’s crucial to remember that past performance is not necessarily indicative of future outcomes.

Currently, the price of bitcoin is primarily driven by anticipation of the Securities and Exchange Commission (SEC) approving several American spot Bitcoin Exchange Traded Funds (ETFs) that would directly hold bitcoin. For those who are not familiar with the concept, ETFs represent baskets of securities that track an underlying index or market sector. They are traded on exchanges like stocks, providing accessibility and liquidity for investors.

The key takeaway, at least for me, is that the introduction of spot Bitcoin ETFs represents a growing acceptance of bitcoin as a legitimate asset class among institutional investors. This opens up new opportunities for pension funds, endowments, and insurance companies to diversify their portfolios and take an allocation in bitcoin!

This is a unique aspect that sets the current market cycle apart from previous ones. However, despite the drivers of this cycle being different, I think it is still prudent to analyse the available historical data to help us from a risk management perspective.

Current Market Phase: Accumulation and Rangebound Movement

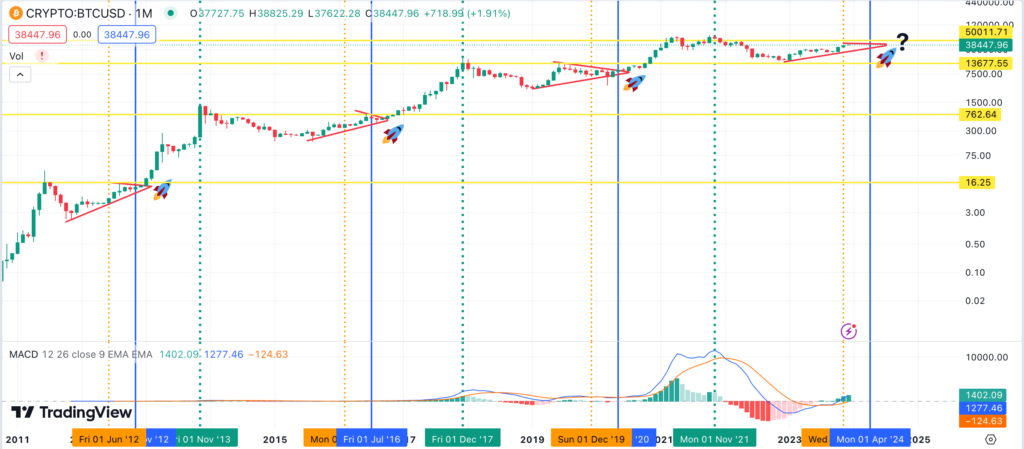

Chart A, below, clearly indicates that the bitcoin ‘bull market cycle’ has already started.

The orange dotted line in Chart A, below, represents the approximate point of the current cycle within the broader trend. It is clear that currently we are in a recovery/accumulation phase, characterised by a gradual rise in price and a consolidation of trading activity. During this phase expect volatility to remain a persistent factor.

Assuming historical trends continue to play out, the price of bitcoin is likely to rise between $45,000 and $50,000 region before correcting by around 40% to 50% to anywhere between $23,000 (worst case) and $30,000 (base case).

I have seen a few analysts point out that the price of bitcoin could fall as low as $10,000 although I personally believe that is highly unlikely and if it did happen it would be considered to be black swan event, which is extremely difficult if not impossible to predict with precision.

Chart A: Bitcoin Price Cycles

Expect a 40%-50% Bitcoin Price Correction Around the Halving Event

As mentioned above, Chart A clearly shows the price of bitcoin historically experiencing a correction 40% to 50% around the halving event period, particularly following a significant price surge.

So the next question is, when would we expect such a correction to take place?

Historical cycles suggest that a temporary although sharp correction could occur either 1-2 months before the halving event (so in February or March 2024) or sometime between the halving month and the following month (so in April or May 2024). However, the price of bitcoin has risen around 177% from a year ago. Given the price surge, it wouldn’t be surprising at all to see a 40%-50% price correction occur sooner (perhaps in December 2023 or January 2024?). The first spot Bitcoin ETF approval is expected to be announced in the first or second week of January 2024 and a “buy on the rumor, sell on the news” type reaction can’t be ruled out either.

Any sharp price corrections that occur around the timeframes mentioned above will act as a catalyst that will add fuel to the ‘Bitcoin Supercycle’!

Bitcoin Halvings as Bullish Catalysts

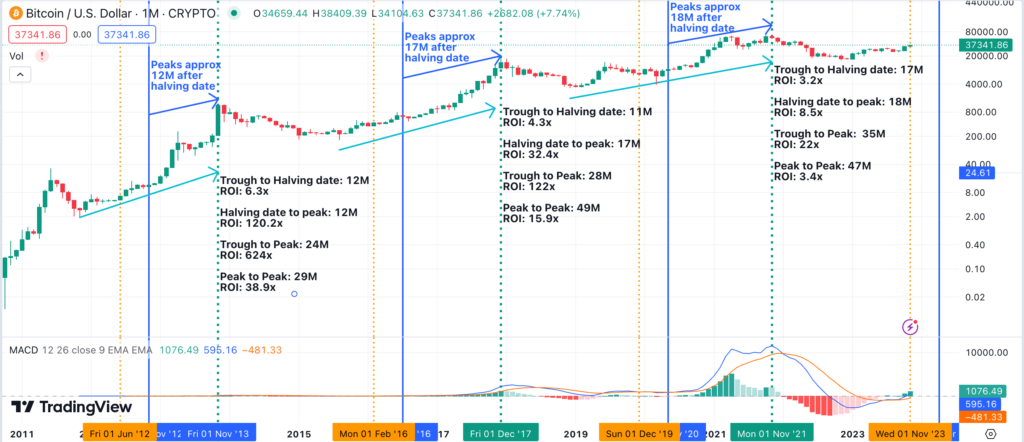

Chart B demonstrates that historical bitcoin halvings have played a pivotal role in propelling the price to new heights. Previous halvings were followed by full-blown bull runs, and there’s no indication that this pattern will change (even in the unlikely scenario that we are rug-pulled by SEC Chairman Gary Gensler and there’s no ETF approval!!!).

Chart B: Bitcoin Price Trends, Pre- and Post-Halving Patterns

Bitcoin Supercycle Peak

Analysing historical trends and considering the current market dynamics, it’s entirely possible that we can see the price of bitcoin reach a cycle peak sometime between September and October 2025.

While my previous analysis, based on the Bitcoin log chart, predicted a peak price of $162,754, that forecast did not materialise during the previous cycle. I will be more conservative this time around. However, the potential for even higher price levels, perhaps even surpassing $162,754, can’t be entirely ruled out as the next bull run unfolds. Certain investors, as shown in the table below, expect the price of bitcoin to reach a peak of $500,000!

The table below shows different bitcoin price forecasts for the post-halving bull run together with my notes and observations.

| Contributor and date | BTC Price Peak Forecasts | My notes |

|---|---|---|

| JPMorgan Chase (May 2023) | N/B | I wasn’t able to identify any bitcoin price forecasts for 2024 or 2025 from JPMorgan. However, in May 2023, when the price of bitcoin was only trading at $26,512, strategists at JPMorgan issued a $45,000 fair value price target. At the time, the bank strategist stated that the price of bitcoin should be fairly valued at $45,000 given a gold price of $2,000 an ounce. This is an interesting, observation suggesting that institutional investors are indeed beginning to view bitcoin as ‘digital gold’. Applying the same logic, I was able to derive a fair value price of $46,000 (rounded) for bitcoin today, which is only 2.8% higher than the recent price of $44,747. Does this suggest that we are not too far away from what could be hypothetically construed to be the ‘halving peak’ price? Does this suggest that the 40%-50% bitcoin price correction that has historically taken place around the halving event is about to start soon? (or has it already started?) In the meantime, I would like to point out that Jamie Dimon’s recent statement about shutting down Bitcoin if he were running the government seems hugely contradictory since internal actions at the bank demonstrate a growing recognition of Bitcoin’s potential and the bank’s willingness to embrace blockchain technology. |

| Goldman Sachs (Jan 2022) | $100,000 | Goldman Sachs has been tight-lipped about its bitcoin price forecast for 2024 and 2025. The earliest price prediction of $100,000 dates back to January 2022, when Goldman analysts stated they expect bitcoin to take more market share from gold as the ‘store of value’ market heats up. |

| Standard Chartered (Jul 2023) | $120,000 | Bank analysts expect the price of bitcoin to rise to $120,000 (up from an earlier forecast of $100,000) by end of 2024 citing supply shortage. I did not come across any forecasts for 2025. |

| Bernstein (Oct 2023) | $150,000 | Bank analysts expect the price of bitcoin to rise to $150,000 by mid 2025, stating that ETF approval would shift up to 10% of Bitcoin’s circulating supply toward ETFs. |

| Deutsche Bank | N/B | I was not able to identify any recent BTC price forecasts from Deutsche Bank. However, I found an interesting article indicating that Deutsche Bank considers Bitcoin to be akin to digital gold. |

| Skybridge Capital (Dec 2023) | $250,000-$500,000 | In a recent interview, Skybridge founder Anthony Scaramucci said he expects the spot Bitcoin ETF to come the first or possibly the second week of January 2024. “Even if ETF doesn’t happen, it won’t matter”, he says. He sees “bitcoin as a store of value”, effectively “digital gold”. Scaramucci says if “bitcoin gets the moniker of digital gold, BTC should trade at a market cap of $10 trillion to $12 trillion” [quick math – that’s equivalent to $510,000 – $610,000 per BTC in today’s terms!!!]. Scaramucci appears confident that BTC will reach $100,000 during this cycle and says that “Tim Draper and Kathie Wood, who studied BTC closely, see this as a $250,000 to $500,000 coin”. Scaramucci acknowledges that BTC is highly volatile but recommends people hold BTC over the long term, adding that bitcoin is still very early in the adoption cycle and that he sees it as part of the future since it is a mechanism for the unbanked. Full interview here. |

| Cryptonary | $110,000-$145,000 | Combination of technical analysis, fundamental analysis, and sentiment analysis. |

| Benjamin Cowen | $100,000 | Cowen explores the Bitcoin Logarithmic Regression Rainbow. He states that each market cycle top has been two-and-a-half logarithmic regression bands below the previous one. Interestingly, he points out that two-and-a half bands below the previous high of $69,000 is at the $45,000-$46,000 level! This is an interesting observation that yet again confirms that the price of bitcoin may be close to a short-term peak. Cowen explains that as the bands move out in time, BTC could actually peak somewhere slightly above $100,000 assuming that the cycle ends in late 2025. Cowen says, “The issue right now is that two-and-a-half log lines down from where this peak was, puts you at this logarithmic regression trend line, which currently is only at around $45,000 to $46,000… Now, that might sound somewhat disheartening to hear, but you also have to remember that normally, we’ve seen these major peaks occur in Q4 of the post-halving year. So, while it is true that two-and-a-half log lines down now is only about $45,000 to $46,000, two-and-a-half log lines down in late 2025 would look a lot different, and we can actually project this out…By late 2025, that would correspond to just north of $100,000…” It is interesting to point out that the $45,000-$46,000 level perfectly aligns with the BTC to gold price model that was described by JPMorgan strategist back in May 2023. Cowen also says that historically sometime before the halving there’s a 40%-50% correction in the price of bitcoin. |

| CoinMarketExpert | $120,000 | I’m being cautious with my price target for bitcoin this time around, setting a minimum peak target of $120,000, representing a 74% increase from its previous peak of circa $69,000. The rise in price is due to two key factors: 1) An expected easing of US monetary policy in 2024-2025, which would boost investor confidence and liquidity, driving up prices for both stocks and cryptocurrencies. 2) An already limited supply of bitcoin, which would shrink even further following the approval and implementation of spot Bitcoin ETFs. Consider that in previous bitcoin price cycles, institutional involvement was minimal. Even so, the market cap of bitcoin had reached an all-time high of $1.28 trillion in November 2021. Additionally, Cowen’s analysis, based on Bitcoin’s logarithmic regression rainbow, suggests a peak bitcoin price of just over $100,000. This assumes that historical trends will continue, with minimal institutional involvement compared to what we can expect after the approval and implementation of spot Bitcoin ETFs. Therefore, a $100,000 price target assumes a ‘classical’ post-halving price trend without ETF approval, placing Bitcoin’s market cap at approximately $2 trillion. Now, let’s examine the asset allocation of US mutual funds. The total asset under management (AUM) of the US mutual fund industry is estimated at around $24 trillion, of which approximately 30% constitutes pure bond funds. This leaves $16.8 trillion of AUM exposed to risk assets. Assuming 80% of this $16.8 trillion allocates a small percentage between 0.5% and 5% to a spot Bitcoin ETF, and taking a conservative 3% average allocation, this would translate into an additional $400 billion flowing into bitcoin. This inflow would boost the minimum market capitalization from $2 trillion to $2.4 trillion, translating to a peak price of $120,000. However, it’s crucial to note that this analysis does not take into consideration fund growth and only considers US funds, so it is also possible for bitcoin to easily overshoot this target. |

| CryptoCon | $130,000-$145,000 | Combination of technical analysis, fundamental analysis, and sentiment analysis. |

| BTC Peak Price Range (2025) | $100,000 – $500,000 | |

| Average BTC Peak Price (2025) | $124,000 (rounded) excluding outliers. |

Disclaimer

It’s important to note that these predictions might be wrong, and they do not constitute financial advice. The cryptocurrency market is inherently volatile and unpredictable, and even the most experienced analysts can be wrong. The timing of the next bull market is uncertain. Investors should carefully consider their goals, risk tolerance, and market conditions before making any decisions. Investors should also conduct their own thorough research and exercise caution before making any investment decisions.

Bitcoin Supply Crunch & Approval of Several Bitcoin ETFs

While some of the price estimates provided above might seem exceptionally high, it is not entirely implausible. Numerous compelling factors are beginning to converge, including the already restricted Bitcoin supply, the impending halving event, and the potential approval of several Bitcoin ETFs. This confluence could very well pave the way for a compelling Bitcoin supply crunch that ignites a Supercycle!

According to an interesting article on Glassnode, Bitcoin’s supply is increasingly becoming tight due to:

- Investors storing more bitcoin off-exchange: Over the past few years, there has been a trend of investors storing more bitcoin in cold storage, which means that it is not available for trading on exchanges. This is making the available supply of bitcoin smaller, which is also putting upward pressure on prices (when prices rise).

- Miners issuing less new bitcoin: over time less new bitcoin has been entering the market, due to previous halvings, which is placing upward pressure on prices (when prices rise).

- A maturing bitcoin market: As the market matures, it seems fewer participants are willing to part with their bitcoin. This is because they believe bitcoin will continue to appreciate in value over the long term. This is making the available supply of bitcoin even smaller, which exerts even more upward pressure on prices (when prices rise).

Here’s a compendium of the potential implications:

- Higher prices, when prices rise. As the available supply of bitcoin decreases, prices will rise by more during bull markets. This could lead to stronger bull markets in the long term (and conversely, stronger bear markets).

- More volatility. With less bitcoin available for trading, the market could become more volatile, resulting in sharp price swings in both directions.

- More institutional interest. As bitcoin’s price rises and the market becomes more stable, institutional investors may become more interested in investing in bitcoin. This could lead to a significant inflow of capital into the market, which could further drive prices up.

Tightening supply conditions, coupled with the impending halving event and the potential approval of several Bitcoin ETFs, create a more volatile market in the short term. However, in the long run, these factors are poised to set the stage for a potential supercycle to unfold. As mentioned earlier, the approval of Bitcoin ETFs would mark the official acceptance of Bitcoin as an established asset class among institutional investors, opening up new avenues for pension funds, endowments, and insurance companies to diversify their portfolios and incorporate bitcoin into their investment strategies.

The Bitcoin network continues to strengthen

Another point worthwhile mentioning is that the Bitcoin network has never been so safe and secure. Blackrock, Invesco, WisdomTree, and many other reputable institutions would not have applied for a Bitcoin ETF if it weren’t!

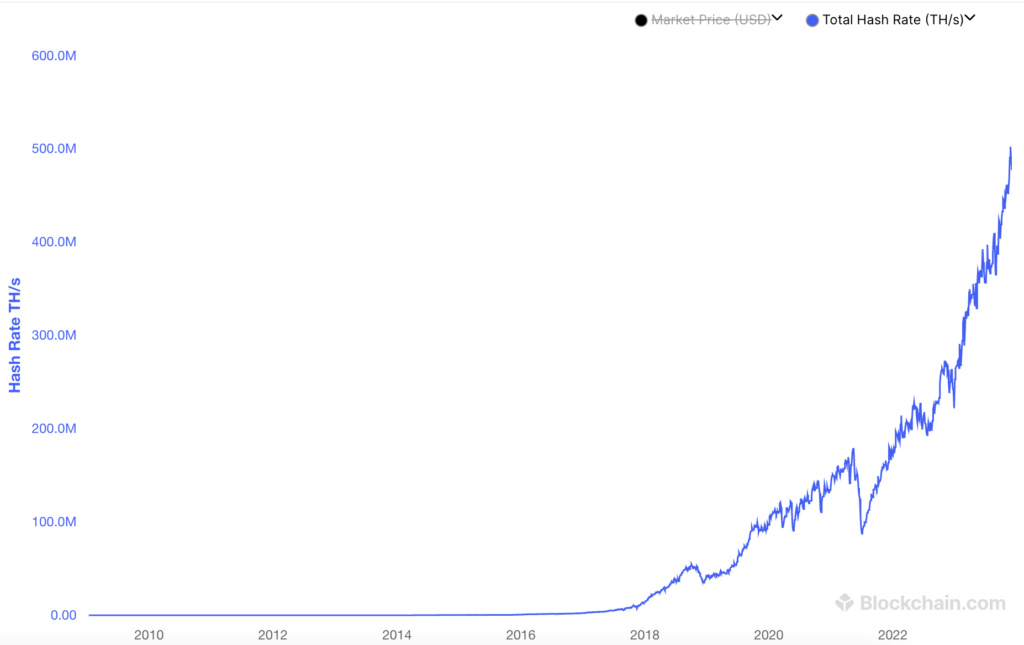

Extensive information about the hash rate is widely available, so I won’t delve too much into this topic. The point I want to make here is that increasing the safety and security of the Bitcoin network is a fundamentally positive development.

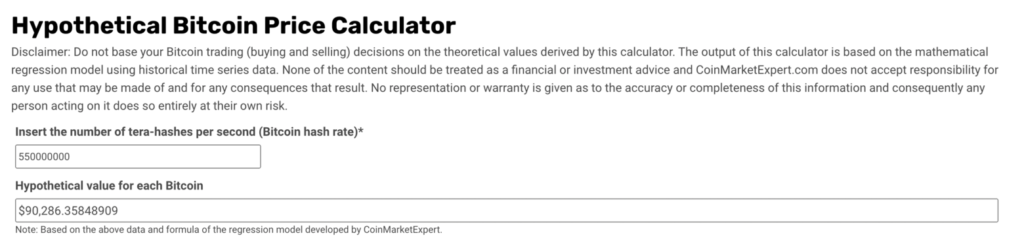

I will also point out that historically, a strong correlation existed between the price of bitcoin and its hash rate, allowing for somewhat rather accurate price forecasting. Whilst this overall correlation has weakened over time, there’s a tendency for it to strengthen around the halving events. If the correlation between the bitcoin price and its hash rate were still valid, the current price of bitcoin would be double, surpassing $90,000 already!

If anything this observation suggests that bitcoin peak price predictions of $100,000 – $120,000 aren’t too fictitious at all.

I developed a hypothetical Bitcoin price calculator some time ago when the correlation between the hash rate and price was still strong, so feel free to head over to that page and experiment with different scenarios.

What will happen to the price of Bitcoin (BTC) following ETF approval?

This warrants a separate article. However, data from Bloomberg Intelligence indicates that 12 applications for spot Bitcoin ETFs currently await approval from the SEC.

While delays are not entirely unexpected, the SEC is expected to decide on some of the pending applications as early as the first or second week of January 2024. There are currently rumours that the first approval will be made public sometime between 9th or 10th January 2024.

So will the spot Bitcoin ETFs affect the underlying price of Bitcoin?

There are differing perspectives. Some seem to believe that the spot Bitcoin ETFs will commence acquiring Bitcoin promptly after approval, while others anticipate a more gradual approach.

The anticipation of price appreciation upon approval suggests that banks may have engaged in pre-emptive buying to capitalise on potential gains. BlackRock, for instance, established a private trust in 2022 with Coinbase as custodian, indicating a strategic move to acquire bitcoin in preparation for the anticipated ETF approval. It’s plausible that other banks have followed suit, accumulating bitcoin in anticipation of increased demand and price appreciation as well.

Meanwhile, JPMorgan analyst Nikolaos Panigirtzoglou predicts that the SEC’s approval of spot Bitcoin ETFs could lead to capital outflow from the Grayscale Bitcoin Trust (GBTC). He estimates that around $2.7 billion could exit GBTC, which could exert downward pressure on bitcoin prices. However, he also notes that the outflow could be mitigated if the money is invested in other bitcoin instruments, such as newly created spot Bitcoin ETFs.

Panigirtzoglou also discusses the impact of the Binance settlement with the US government on the crypto industry. He believes that the settlement is part of an ongoing shift towards regulated crypto entities and instruments. This shift, he argues, could be positive for the crypto ecosystem as it could attract more traditional investors.

Meanwhile, tables 1 and 2, below, show the prices of gold and silver rising between 24% and nearly 300% following respective ETF approvals.

Table 1: Gold price performance pre and post-ETF approval

| ETF Symbol | ETF Name | Approval Date | Creation Method | Gold Price 6 Months Prior | Gold Price 6 Months After | % Chg |

| GLD | SPDR Gold Shares | July 1, 2004 | In-kind creation | $412.62 | $545.11 | 32.11% |

| IAU | iShares Gold Trust | December 9, 2004 | In-kind creation | $471.82 | $585.75 | 24.15% |

| GLDM | SPDR Gold MiniShares Trust | October 10, 2006 | Cash creation | $668.73 | $923.16 | 38.05% |

| SGO | Aberdeen Standard Physical Gold ETF | April 10, 2007 | In-kind creation | $731.67 | $1013.36 | 38.50% |

| SGOL | abrdn Physical Gold Shares ETF | January 3, 2008 | In-kind creation | $946.34 | $1415.28 | 49.55% |

Table 2: Silver price performance pre and post ETF approval

| ETF Symbol | ETF Name | Approval Date | Creation Method | COMEX Silver Price 6 Months Prior | COMEX Silver Price 6 Months After | % Chg |

| SLV | iShares Silver Trust | September 12, 2006 | In-kind creation | $6.51 | $25.87 | 297.39% |

| SIVR | abrdn Physical Silver Shares ETF | June 20, 2007 | In-kind creation | $16.17 | $49.95 | 208.91% |

| AGQ | ProShares Ultra Silver | January 8, 2008 | Cash creation | $50.87 | $74.91 | 47.26% |

| ZSL | ProShares UltraShort Silver | March 4, 2010 | Cash creation | $17.07 | $21.83 | 27.89% |

| PSLV | The Sprott Physical Silver Trust | December 4, 2011 | In-kind creation | $56.51 | $64.95 | 14.94% |

To be fair the past performance of gold and silver ETFs may not be directly attributed to the approval of the ETFs themselves. Instead, the performance may be more closely related to the overall market cycle. However, at the very least this observation provides numerical data to support the notion that the approval of spot Bitcoin ETFs is important for supporting the long-term price appreciation of underlying assets.

So far, I hope you have enjoyed reading my analysis and observations and remember:

1) Be patient and don’t let volatility scare you – RISK MANAGEMENT is always key. It has been an exciting run so far!

2) Personally, I prefer to HODL, especially bitcoin, but don’t be afraid to take profit and realise gains especially in mean reverting alts.

3) Diversify (but don’t over do it). This requires some focus across different sectors such as layer 2 scaling solutions, defi, gaming and maybe even memes. My suggestion is to choose two or three sectors – not more – and to combine that with a mix of large, mid-cap and small-cap cryptos, depending on your level of risk appetite. Understanding the areas to focus on during this cycle will allow you to create alpha and my previous research showed that it is actually possible to develop a crypto portfolio that consistently outperforms bitcoin – so clever diversification (even within crypto) can help achieve relative outperformance (relative to bitcoin)!

4) Learn to do your own research.

5) Follow the money. Understand which sectors VCs are funding. Ultimately a proportion of this funding will go towards marketing and creating sector hype.

6) You don’t have to use leverage to do well in crypto.

Recap of Key Points:

1/ Historically the price of bitcoin has undergone corrections around the halving period. These corrections have occurred either 1-2 months before the halving event (so in February or March 2024) or sometime between the halving month and the following month (so in April or May 2024). Given that the price of bitcoin has risen 177% from a year ago, it wouldn’t be surprising to see a correction occur sooner perhaps as early as now (in December 2023 or January 2024). Afterall, the first spot Bitcoin ETF approval is expected to be announced in early January 2024 and a “buy on the rumor, sell on the news” type reaction is widely anticipated. Despite this, there’s also the risk of a delay, and ,however improbable, there’s also the risk of being rug pulled by the SEC and having no approval. All of these scenarios point to selling pressures potentially being around the corner.

2/ Multiple observations suggest that $45,000 – $50,000 bitcoin price range is a potential sell zone or short-term peak that triggers a 40%-50% correction (and we have already come close to the $45,000 level). A 40%-50% correction could see the price of bitcoin fall anywhere between $23,000 (worst case) and $30,000 (base case), setting the stage for a 4X-5X bitcoin bull run!

3/ Assuming historical trends continue to pan out, the price of bitcoin could reach a cycle peak sometime between September and October 2025. Peak price predictions range from $100,000 – $500,000, with the average in my sample (excluding outliers) coming in at $124,000.

4/ Data suggests that the introduction of ETFs helps to support long-term price appreciation of underlying asset prices.

I hope you have found this to be useful. If you enjoyed reading my research, then please share it on X (formerly Twitter) 😊

Disclaimer: All of the content written on CoinMarketExpert is unbiased and based on objective analysis. The information provided on this page should not be construed as an endorsement of cryptocurrency, a service provider or offering and should neither be considered a solicitation to buy or trade cryptocurrency. Cryptocurrencies carry substantial risk and are not suitable for everyone. No representation or warranty is given as to the accuracy or completeness of this information and consequently, any person acting on it does so entirely at their own risk.